The Power of Automated High-Yield Savings

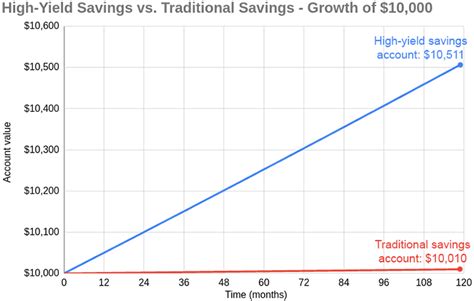

In the quest for financial security and wealth building, one of the most effective strategies is to save consistently. However, consistency can be challenging without a disciplined approach. This is where automation, combined with the power of high-yield savings accounts (HYSAs), becomes an invaluable tool. By setting up a smart, automated system, you can ensure your money is working for you, growing steadily without requiring constant manual intervention.

Automating your savings removes the temptation to spend, turns saving into a habit, and leverages the magic of compound interest. When you pair this with an account that offers significantly higher interest rates than traditional savings accounts, your money not only saves itself but also earns more, accelerating your financial goals.

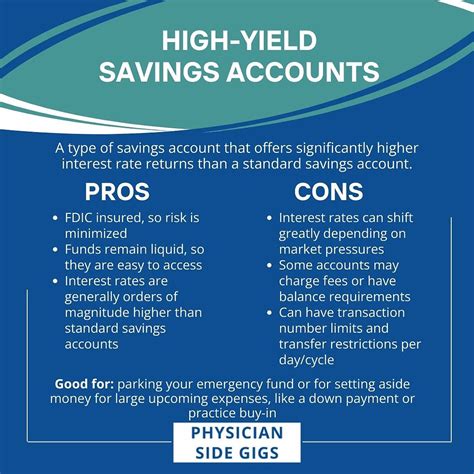

What Makes High-Yield Savings Accounts (HYSAs) Essential?

High-yield savings accounts are specialized savings vehicles typically offered by online banks, credit unions, and some traditional banks. Their defining characteristic is an Annual Percentage Yield (APY) that is substantially higher than the national average for standard savings accounts. While the exact rates fluctuate with the market, HYSAs consistently offer better returns, sometimes by a factor of 10x or more.

Key benefits of HYSAs include:

- Higher Returns: Your money earns more interest, helping it grow faster.

- Liquidity: Funds are still easily accessible, making them ideal for emergency funds or short-term goals.

- FDIC Insurance: Most HYSAs (those at FDIC-insured banks) are protected up to $250,000 per depositor, per institution, ensuring your principal is safe.

- Low Fees: Many online HYSAs come with minimal or no monthly maintenance fees.

Choosing the Best HYSA for Your Setup

Not all HYSAs are created equal. When selecting the right account, consider the following factors to ensure it aligns with your financial needs and automation goals:

- Annual Percentage Yield (APY): This is paramount. Compare rates from various institutions, but also look for consistency. Some banks offer promotional rates that expire.

- Fees and Minimums: Opt for accounts with no monthly service fees and reasonable (or no) minimum balance requirements to earn the advertised APY.

- Accessibility: How easy is it to transfer funds in and out? Look for seamless integration with your primary checking account and quick transfer times.

- FDIC Insurance: Always confirm the bank is FDIC-insured (or NCUA-insured for credit unions) to protect your deposits.

- Online Tools and Mobile App: A user-friendly interface and robust mobile app can make managing your automated savings much easier.

Setting Up Your Automated Savings System

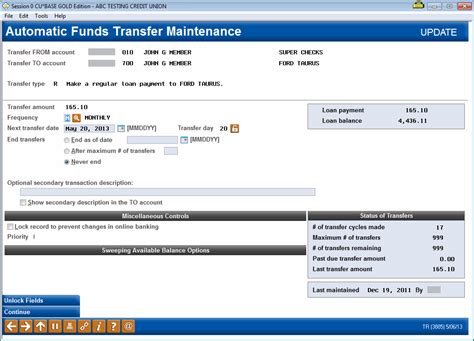

Once you’ve chosen your HYSA, the next critical step is to automate the transfers. This is where the “pay yourself first” principle comes to life.

- Link Accounts: Connect your primary checking account (where your income is deposited) to your new high-yield savings account. This is usually done through your bank’s online portal or mobile app.

- Set Up Recurring Transfers: Determine a fixed amount you want to save each pay period (weekly, bi-weekly, or monthly). Schedule an automatic transfer for this amount to occur on or immediately after your payday. Starting small and gradually increasing the amount is often more sustainable than trying to save too much too soon.

- Consider Multiple Accounts (Optional): For different savings goals (e.g., emergency fund, down payment, vacation), you might open separate HYSAs or utilize sub-accounts if offered by your bank. This provides mental accounting clarity and prevents you from dipping into one goal for another.

By automating this process, you eliminate the decision-making and temptation that often derail manual savings efforts. The money is moved before you even have a chance to miss it.

Optimizing Your Automated High-Yield Setup

To maximize the benefits of your automated HYSA setup, consider these additional strategies:

- The “Round-Up” Feature: Some banks and apps offer a feature that rounds up your debit card purchases to the nearest dollar and transfers the difference to your savings. This is a passive, effortless way to save extra pennies that add up over time.

- Increase Contributions Annually: Just as you might get a raise, consider giving your savings a raise too. Commit to increasing your automated transfer amount by a small percentage each year or whenever you get a pay bump.

- Review and Adjust: Periodically review your savings progress and the performance of your HYSA. Are you meeting your goals? Is there a new HYSA offering a significantly better APY? Don’t hesitate to switch if a better opportunity arises, though consider potential transfer limits or delays.

- Laddering for Larger Goals: For very large, long-term goals, you might consider “laddering” with Certificates of Deposit (CDs) within your high-yield ecosystem once you have a substantial emergency fund. This strategy combines liquidity with even higher interest rates for money you know you won’t need for a specific period.

Conclusion

Automating your savings into a high-yield account is one of the smartest financial moves you can make. It builds discipline, maximizes your earning potential through compound interest, and provides peace of mind knowing your financial future is being proactively built. By carefully choosing the right HYSA and diligently setting up recurring transfers, you can create a robust and effortless system that helps you achieve your financial dreams faster and more efficiently. Start today, and watch your savings grow on autopilot.