Sticking to a tight budget can feel like an uphill battle, especially when unexpected expenses arise or temptation strikes. However, with the right strategies and a commitment to your financial goals, it’s entirely possible to take control of your money and make every dollar count. This guide will walk you through actionable steps to help you stick to your tight budget month after month.

Understand Your Financial Landscape

Before you can effectively manage your money, you need a clear picture of where it’s currently going. Start by gathering all your financial statements: bank accounts, credit cards, loan statements, and pay stubs. Categorize your expenses into fixed (rent, mortgage, loan payments) and variable (groceries, entertainment, utilities).

Understanding your income sources and their frequency is equally important. Knowing exactly how much money is coming in and when it arrives allows you to plan your spending and saving more accurately.

Create a Realistic and Detailed Budget

Once you have a clear understanding of your income and expenses, it’s time to create your budget. Choose a budgeting method that works for you – whether it’s the 50/30/20 rule, zero-based budgeting, or simply using a spreadsheet or budgeting app. The key is to be realistic. Don’t cut so deep that your budget becomes unsustainable, leading to burnout and failure. Allocate specific amounts for each spending category.

Remember to include categories for essential needs first, then savings, and finally, discretionary spending. Being honest with yourself about your spending habits is crucial here.

Track Every Penny Religiously

A budget is just a plan until you put it into action. The most critical step in sticking to a tight budget is consistently tracking your spending. This means logging every expense, no matter how small. Use a budgeting app, a simple notebook, or a spreadsheet to record your transactions daily. This practice not only helps you stay within your limits but also reveals patterns and areas where you might be overspending without realizing it.

Identify and Cut Unnecessary Expenses

With a clear picture of your spending, you can now identify areas where you can cut back. Look for subscriptions you no longer use, consolidate or cancel streaming services, pack lunches instead of buying out, and reduce impulse buys. Challenge yourself to find cheaper alternatives for regular purchases, like generic brands at the grocery store or free entertainment options.

Consider the “needs versus wants” principle. While some ‘wants’ are important for quality of life, when on a tight budget, prioritizing needs is paramount. Even small cuts can add up significantly over a month.

Embrace Frugal Living as a Lifestyle

Sticking to a tight budget becomes much easier when you adopt a frugal mindset. This doesn’t mean depriving yourself; it means being resourceful and intentional with your money. Cook more meals at home, look for second-hand items, utilize free public resources like libraries, and find ways to extend the life of your possessions. Frugal living is about smart choices that align with your financial goals, not about feeling poor.

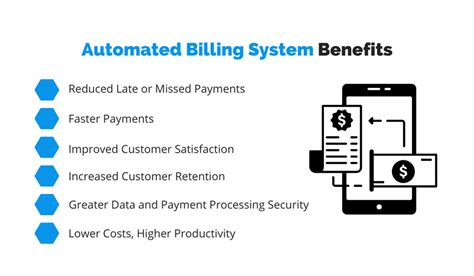

Automate Savings and Bill Payments

One of the most effective strategies for budgeting success is to automate your finances. Set up automatic transfers from your checking account to your savings account each payday. This “pay yourself first” approach ensures that savings are prioritized before you have a chance to spend the money. Similarly, automate bill payments to avoid late fees and manage your cash flow more efficiently.

Even small, consistent savings contribute to long-term financial stability and provide a buffer for unexpected expenses.

Regularly Review and Adjust Your Budget

A budget isn’t a static document; it’s a living tool that needs regular review and adjustment. At least once a month, sit down and compare your actual spending to your budgeted amounts. Identify what worked well and what didn’t. Did you underestimate grocery costs? Did an unexpected expense derail your entertainment budget? Use these insights to refine your budget for the following month. Life changes, and so should your budget.

Stay Motivated and Celebrate Small Wins

Budgeting can be challenging, and there will be times when you feel discouraged. Set small, achievable financial goals and celebrate when you reach them. Whether it’s saving an extra $50, paying off a small debt, or sticking to your grocery budget for the whole month, acknowledging your progress will keep you motivated. Remember your “why” – your long-term financial goals and the freedom that comes with financial control.

Conclusion

Sticking to a tight monthly budget requires discipline, consistency, and a willingness to adapt. By understanding your finances, creating a realistic budget, diligently tracking expenses, cutting unnecessary spending, and embracing a frugal mindset, you can gain control over your money. Regular reviews and a focus on your long-term goals will empower you to build a stronger financial future, one month at a time.