Understanding Your Debt Landscape

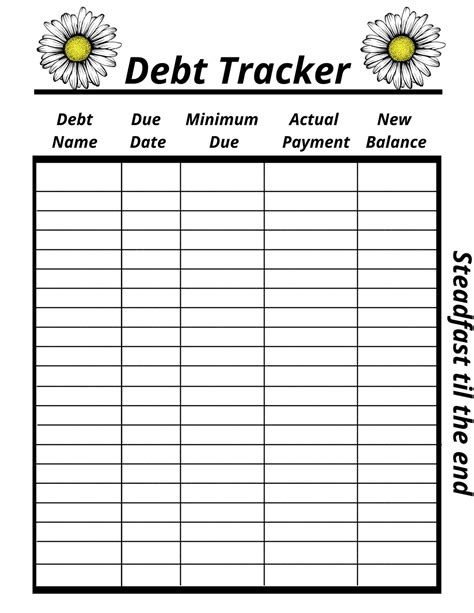

High-interest credit card debt can feel like a financial quicksand, eroding your income with every passing month. The first crucial step in any successful repayment strategy is to gain a crystal-clear understanding of your current financial situation. This means listing every single credit card you owe money on, along with its current balance, minimum payment, and, most importantly, its Annual Percentage Rate (APR).

Organize this information in a spreadsheet or a simple list. Seeing all your debts laid out will not only provide clarity but also highlight which debts are costing you the most in interest, guiding your prioritization efforts. Don’t forget to include any other high-interest debts, such as personal loans, that might compete for your attention.

The Avalanche Method: Attacking High-Interest Debt First

For those who are mathematically inclined and driven by efficiency, the debt avalanche method is often recommended. This strategy prioritizes paying off the credit card with the highest interest rate first, while making minimum payments on all other cards. Once the highest-APR card is paid off, you take the money you were paying on that card (its minimum payment plus any extra funds you were applying) and apply it to the card with the next highest interest rate.

The primary benefit of the avalanche method is that it saves you the most money in interest over the long run. By eliminating the most expensive debt first, you reduce the total amount of interest accrued, leading to a faster overall debt-free date and significant financial savings. This method requires discipline and patience, as it might take longer to see the first debt completely disappear if that debt has a large balance.

The Snowball Method: Building Momentum

In contrast to the avalanche, the debt snowball method focuses on psychological wins to keep you motivated. With this strategy, you prioritize paying off the credit card with the smallest balance first, regardless of its interest rate, while making minimum payments on all other cards. Once the smallest debt is paid off, you “snowball” the payment amount (its minimum payment plus any extra funds) to the next smallest debt.

The power of the snowball method lies in the psychological boost you get from quickly eliminating entire debts. Seeing cards drop off your list can be incredibly motivating and help sustain your commitment to debt repayment, especially if you feel overwhelmed by the total amount owed. While it might cost you slightly more in interest over time compared to the avalanche method, the increased motivation can be invaluable for many individuals.

Key Strategies for Accelerating Repayment

Regardless of whether you choose the avalanche or snowball method, several supporting strategies can significantly accelerate your debt repayment journey.

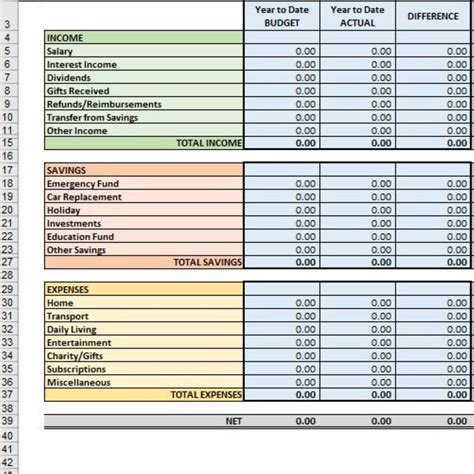

Budgeting and Cutting Expenses

Creating a realistic budget is fundamental. Track your income and expenses to identify areas where you can cut back. Even small savings can be redirected towards your priority credit card. Consider temporary sacrifices like eating out less, canceling unused subscriptions, or finding cheaper alternatives for daily necessities.

Making Extra Payments

Every dollar extra you put towards your principal debt reduces the amount of interest you’ll pay and shortens your repayment timeline. If you receive a bonus, tax refund, or unexpected windfall, resist the urge to splurge and instead direct a significant portion towards your high-interest debt.

Balance Transfers and Debt Consolidation

For those with good credit, a balance transfer credit card with a 0% APR introductory offer can provide a crucial breathing room. This allows you to pay down the principal without accruing interest for a specific period (e.g., 12-18 months). Be mindful of transfer fees and ensure you can pay off the balance before the promotional period ends and the regular, often high, APR kicks in.

Alternatively, a debt consolidation loan can combine multiple high-interest debts into a single loan with a lower interest rate and a fixed payment schedule. This simplifies your payments and can reduce your overall interest cost. However, always compare the total cost and terms carefully before committing.

Negotiating with Creditors

If you’re facing significant hardship, don’t hesitate to contact your credit card companies. They may be willing to offer a lower interest rate, waive late fees, or set up a hardship payment plan, especially if you have a good payment history or can demonstrate financial distress.

Building a Sustainable Plan and Staying Motivated

Prioritizing repayment is just the first step; maintaining momentum is key. Create a detailed plan outlining which card you’re tackling first, how much extra you’ll pay, and your estimated debt-free date. Regularly review your progress, perhaps monthly or quarterly, to stay on track.

Set small, achievable milestones and celebrate them. Paying off your first credit card, or hitting a certain percentage of your total debt, can be incredibly empowering. Visualizing your progress, whether with a physical tracker or an app, can also keep you engaged.

Remember, debt repayment is a marathon, not a sprint. There will be good months and challenging ones. Stay persistent, adapt your budget as needed, and don’t get discouraged by setbacks. The ultimate goal is financial freedom and a healthier relationship with your money.

Conclusion: Your Path to Financial Freedom

Prioritizing high-interest credit card debt repayment is one of the most impactful financial decisions you can make. Whether you choose the interest-saving avalanche method or the psychologically motivating snowball method, consistency and commitment are paramount. By understanding your debts, implementing smart budgeting, exploring consolidation options, and staying disciplined, you can systematically dismantle your high-interest debt and pave your way to a more secure financial future.