Conquering High-Interest Credit Card Debt: Your Path to Financial Freedom

High-interest credit card debt can feel like an insurmountable mountain, constantly growing with each passing month. The steep interest rates can trap individuals in a cycle where minimum payments barely touch the principal, leading to prolonged stress and diminished financial prospects. However, with the right strategy and consistent effort, you can not only pay off these burdensome debts but also establish a stronger financial foundation for the future.

Understanding Your Debt Landscape

Before diving into payoff strategies, it’s crucial to understand the full scope of your debt. Gather all your credit card statements and list them out, noting each card’s outstanding balance, minimum payment, and, most importantly, its annual percentage rate (APR). This clear picture will be your guide, highlighting which debts are costing you the most.

The Debt Avalanche Method: Prioritizing Interest

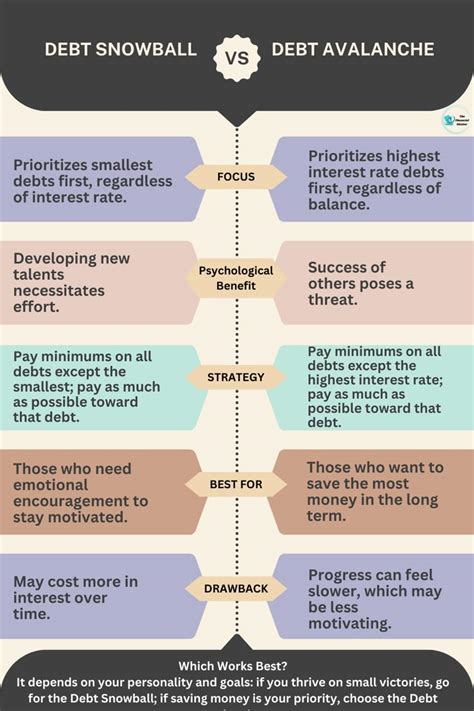

For those who prioritize saving money in the long run, the Debt Avalanche method is often recommended. This strategy focuses on paying off debts with the highest interest rates first, regardless of the balance size. Here’s how it works:

- List all your debts from highest APR to lowest APR.

- Make minimum payments on all cards except the one with the highest APR.

- Put any extra money you have towards the card with the highest APR.

- Once that card is paid off, take the money you were paying on it (minimum payment + extra payment) and apply it to the card with the next highest APR.

The primary advantage of the debt avalanche is that it minimizes the total amount of interest you’ll pay over time, saving you the most money. The downside is that it might take longer to see the first debt completely eliminated, which can be less motivating for some.

The Debt Snowball Method: Prioritizing Momentum

If you need psychological wins to stay motivated, the Debt Snowball method might be a better fit. This strategy focuses on paying off the smallest balance first, regardless of the interest rate. The steps are as follows:

- List all your debts from the smallest outstanding balance to the largest.

- Make minimum payments on all cards except the one with the smallest balance.

- Put any extra money you have towards the card with the smallest balance.

- Once that card is paid off, take the money you were paying on it (minimum payment + extra payment) and apply it to the card with the next smallest balance.

The Debt Snowball’s main benefit is the rapid succession of small victories. Paying off a debt entirely, even if it’s small, provides a significant psychological boost, fueling your motivation to tackle the next one. While you might pay slightly more in interest compared to the avalanche method, the increased adherence to the plan often leads to success.

Complementary Strategies for Faster Payoff

Create a Detailed Budget

Regardless of whether you choose the avalanche or snowball method, a strict budget is indispensable. Track every dollar coming in and going out to identify areas where you can cut expenses and free up more money to put towards your credit card debt.

Avoid New Debt

While aggressively paying down existing high-interest debt, commit to not incurring any new credit card debt. Cut up cards if necessary, or at least keep them out of reach. Focus on living within your means and using cash or a debit card for purchases.

Consider Balance Transfers

If you have a good credit score, you might qualify for a 0% APR balance transfer credit card. This can be a powerful tool, as it gives you a grace period (often 12-18 months) to pay down your balance without accruing interest. Be mindful of balance transfer fees (typically 3-5% of the transferred amount) and ensure you can pay off the balance before the promotional period ends, as deferred interest can be substantial.

Negotiate with Creditors

Sometimes, credit card companies are willing to work with you, especially if you’re experiencing financial hardship. They might offer a lower interest rate, waive a late fee, or even set up a payment plan. It never hurts to call and ask.

Choosing the Right Strategy for You

The “best” strategy is ultimately the one you stick with. If saving the maximum amount of money is your absolute priority and you have the discipline, the Debt Avalanche is mathematically superior. If you need consistent motivation and small wins to keep you going, the Debt Snowball is likely to be more effective. Many people combine elements of both, starting with the snowball to build momentum, then switching to the avalanche once they feel more confident.

Conclusion

High-interest credit card debt can feel overwhelming, but it doesn’t have to be a permanent fixture in your life. By understanding your debt, choosing a payoff strategy that aligns with your personality, and implementing complementary financial habits, you can systematically dismantle your debt and pave the way for a more secure and prosperous financial future. Consistency and commitment are your greatest allies on this journey.