For many men, taking control of their finances is a crucial step towards building a secure future and demonstrating responsible leadership in their lives. Credit card debt can feel like a heavy burden, hindering progress and creating unnecessary stress. But it doesn’t have to be a permanent fixture. By adopting a proactive, strategic approach, you can accelerate your debt payoff and reclaim your financial power.

Confront the Reality: Know Your Numbers

The first step to crushing credit card debt is to clearly understand the enemy. Gather all your credit card statements. List out each card, its outstanding balance, and most critically, its interest rate. Don’t shy away from the truth – knowing the exact figures is empowering, not discouraging. This data forms the foundation of your attack plan.

Forge a Bulletproof Budget (and Stick to It)

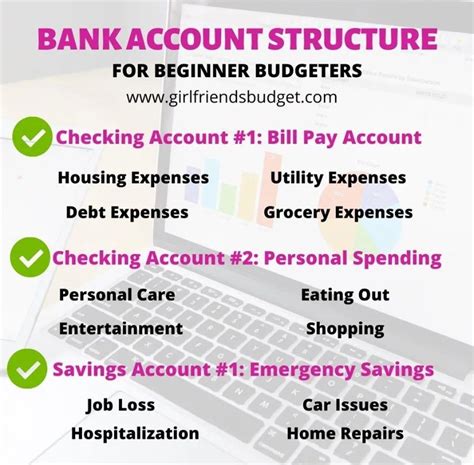

A budget isn’t about deprivation; it’s about intentional spending and allocating your resources where they matter most. Track every dollar coming in and going out for at least a month. Identify “money leaks” – those unnecessary expenses that chip away at your ability to pay down debt. Challenge every discretionary expense: Can you cut back on dining out, subscriptions, or entertainment? Reallocate those savings directly to your credit card payments.

Consider the “envelope system” or robust budgeting apps to keep yourself accountable. This isn’t just about cutting; it’s about redirecting funds towards your ultimate goal of debt freedom.

Choose Your Attack Strategy: Snowball or Avalanche

With your numbers in hand, pick your battle strategy:

- Debt Avalanche: Focus on the card with the highest interest rate first. Pay the minimum on all other cards, and throw every extra dollar at the highest-interest one. Once that’s paid off, roll that payment (plus the minimum from the next card) to the card with the next highest interest rate. This method saves you the most money in interest over time.

- Debt Snowball: List your debts from smallest balance to largest. Pay the minimum on all cards except the smallest one, to which you direct all extra funds. Once that’s paid off, take the money you were paying on it (plus its minimum) and apply it to the next smallest debt. This method provides psychological wins as debts are paid off quickly, keeping motivation high.

Boost Your Income, Even Temporarily

While cutting expenses is crucial, increasing your income can significantly accelerate your debt payoff. Explore options like:

- Side Hustles: Deliver food, drive rideshares, freelance, or offer a skill you possess.

- Selling Unused Items: Declutter your home and sell clothes, electronics, or furniture you no longer need on platforms like eBay, Facebook Marketplace, or local consignment shops.

- Negotiate a Raise: If you’ve been excelling at work, build a case for increased compensation.

- Overtime: If available at your current job, embrace extra hours temporarily.

Commit to channeling 100% of this extra income directly towards your credit card debt.

Negotiate Lower Interest Rates

Many credit card companies are willing to work with customers who demonstrate a commitment to paying off their debt. Call your credit card providers and politely ask for a lower interest rate. Highlight your good payment history (if applicable) and explain your goal. Even a few percentage points off can save you hundreds, even thousands, in interest over your payoff journey.

Automate Payments and Avoid New Debt

Set up automatic payments for at least the minimum amount on all your cards to avoid late fees and missed payments. Better yet, automate your increased payments if possible. Crucially, commit to not accumulating new debt. Consider cutting up or freezing your credit cards (physically or digitally) until you’ve cleared your existing balances. If you must use a card, ensure you can pay the balance in full immediately.

The Road to Freedom

Paying off credit card debt requires discipline, consistency, and a clear vision of financial freedom. It’s not always easy, but the satisfaction of eliminating this burden and gaining full control over your money is immeasurable. By taking these practical steps, men can systematically dismantle their credit card debt, build stronger financial foundations, and secure a more prosperous future.