Understanding the Procrastination Trap

Procrastination is a universal challenge, often a deep-seated resistance to tasks we perceive as difficult, unpleasant, or overwhelming. Whether it’s delaying a workout, putting off budget planning, or postponing an investment decision, the underlying mechanisms are remarkably similar. We tend to prioritize immediate gratification over long-term gains, creating a cycle of guilt and missed opportunities in both our physical well-being and financial stability.

The first step to conquering procrastination isn’t about finding more willpower; it’s about understanding the psychological triggers and adopting a more practical approach. This shift moves us from being paralyzed by the magnitude of a task to taking consistent, manageable action.

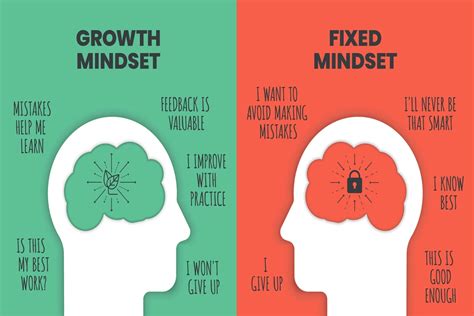

The Core of a Practical Mindset

A practical mindset reorients our focus from the emotional burden of a task to the concrete steps required to complete it. It’s about de-personalizing the challenge and applying systematic thinking to overcome inertia. Here are key components of this mindset:

1. Define Clear, Attainable Goals

Vague aspirations like “get fit” or “save money” are invitations to procrastinate. Instead, define SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals. For fitness, this might be “run 3 miles continuously by the end of next month.” For finance, “save $500 for an emergency fund by December 31st.” Clarity reduces ambiguity, making the path forward seem less daunting.

2. Break It Down: The Power of Micro-Actions

Large tasks are intimidating. A practical mindset advocates for breaking them into the smallest possible actions. Want to start exercising? Your first step might be “put on workout clothes” or “walk for 10 minutes.” For financial planning, it could be “open bank statement” or “track spending for one day.” These micro-actions require minimal effort and build momentum.

3. Implement the “Just Start” Rule

Often, the hardest part is simply beginning. The “Just Start” rule means committing to working on a task for a very short, defined period – say, 5 or 10 minutes. The idea isn’t to finish the task, but to overcome the initial resistance. More often than not, once you start, you’ll find it easier to continue beyond the initial commitment. This works wonders for getting off the couch or opening that budgeting spreadsheet.

4. Build Habits, Not Just Motivation

Motivation is fleeting; habits are enduring. A practical mindset prioritizes building routines that make desired actions automatic. Link new habits to existing ones (habit stacking). For example, “After my morning coffee, I will do 10 squats” or “When I get home from work, I will immediately review my budget for 5 minutes.” Consistency trumps intensity.

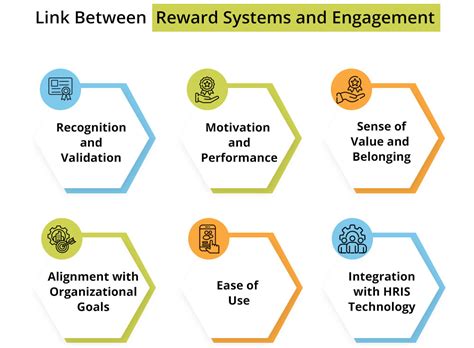

5. Embrace Accountability and Rewards

Share your goals with a friend, family member, or join a community. External accountability can be a powerful motivator. Similarly, integrate small, non-detrimental rewards for milestones achieved. This positive reinforcement strengthens the habit loop and makes the journey more enjoyable. Celebrate completing a week of workouts or hitting a small savings target.

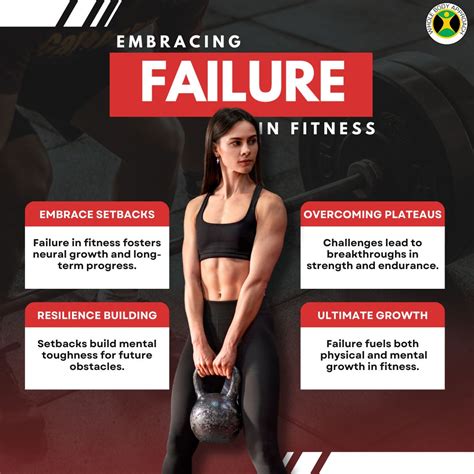

6. Practice Self-Compassion, Not Perfectionism

A practical mindset acknowledges that setbacks are inevitable. Instead of dwelling on missed days or financial slips, practice self-compassion. Understand why it happened, adjust your approach, and get back on track without self-judgment. Perfectionism is a common root of procrastination; aiming for consistent progress is far more effective than striving for an unachievable ideal.

Sustaining Your Momentum

Conquering procrastination is an ongoing process, not a one-time event. Regularly review your goals, adapt your strategies as needed, and continuously reinforce your practical mindset. By shifting from a reactive, emotion-driven response to a proactive, action-oriented approach, you can systematically dismantle the barriers of procrastination and achieve lasting success in both your fitness journey and financial well-being.