Laying the Groundwork for Your Financial Future

Embarking on the journey of investing for long-term wealth growth can seem daunting, but with a clear strategy and consistent effort, it’s one of the most powerful ways to secure your financial future. The key isn’t about getting rich quick, but rather about steady, disciplined growth over decades. For beginners, understanding the fundamental principles and practical steps is crucial to building a resilient portfolio.

Define Your Goals and Build Your Savings Foundation

Before you even think about buying your first stock, it’s imperative to establish what you’re investing for. Are you saving for retirement, a down payment on a house, or your children’s education? Clear financial goals will dictate your investment horizon, risk tolerance, and asset allocation strategy. Once your goals are set, the next critical step is to build a robust emergency fund – typically 3-6 months’ worth of living expenses – in a high-yield savings account. This prevents you from having to sell investments prematurely during unexpected life events.

Simultaneously, create a budget that allows you to identify areas where you can save more. The more you can consistently set aside, the greater your compounding returns will be over time. Automating your savings and investment contributions is a powerful habit that ensures you’re always paying yourself first.

Understanding Core Investment Vehicles

For long-term wealth building, you don’t need to be an expert in complex financial instruments. The most effective strategies often involve straightforward, low-cost options:

- Index Funds and ETFs: These are ideal for beginners. Index funds (or Exchange Traded Funds) track a specific market index, like the S&P 500. They offer instant diversification across hundreds or thousands of companies, reducing individual company risk. They are also typically low-cost and passively managed, making them an excellent choice for long-term growth.

- Bonds: Often considered safer than stocks, bonds represent a loan made by an investor to a borrower (typically a corporation or government). They generally offer lower returns but provide stability and income, diversifying a portfolio, especially as you approach retirement.

- Mutual Funds: Similar to ETFs, but often actively managed (which can mean higher fees) and traded only once a day after the market closes. For long-term passive investing, index ETFs are generally preferred due to lower costs and greater flexibility.

Key Principles for Sustained Success

Start Early and Harness Compounding

Time is your greatest ally in investing. The power of compounding interest, where your earnings generate their own earnings, is astounding. Even small, consistent contributions made early in life can grow into substantial wealth over decades. Delaying even a few years can significantly impact your potential returns.

Diversification is Non-Negotiable

Never put all your eggs in one basket. Diversification means spreading your investments across different asset classes (stocks, bonds), industries, company sizes, and geographies. This strategy helps mitigate risk, ensuring that a downturn in one area doesn’t derail your entire portfolio.

Embrace Dollar-Cost Averaging

Instead of trying to “time the market” (which is notoriously difficult, even for professionals), commit to investing a fixed amount of money at regular intervals (e.g., monthly or bi-weekly), regardless of market fluctuations. This practice, known as dollar-cost averaging, allows you to buy more shares when prices are low and fewer when prices are high, averaging out your purchase price over time and reducing the impact of market volatility.

Stay the Course and Avoid Emotional Decisions

Market corrections and downturns are a natural part of investing. Panicking and selling during a downturn often locks in losses and prevents you from benefiting from the inevitable recovery. Long-term investors understand that market volatility is temporary noise; patience and adherence to your initial strategy are paramount.

Practical Steps to Begin Your Investing Journey

- Open a Brokerage Account: Choose a reputable online brokerage firm (e.g., Fidelity, Charles Schwab, Vanguard). Look for low fees, a user-friendly platform, and robust educational resources. Consider opening a tax-advantaged retirement account first, such as a Roth IRA or traditional IRA, to maximize tax benefits.

- Choose Low-Cost Index Funds or ETFs: For most beginners, focusing on broad market index funds (like an S&P 500 fund or a total stock market fund) or diversified bond ETFs is an excellent starting point. They provide broad market exposure with minimal effort and cost.

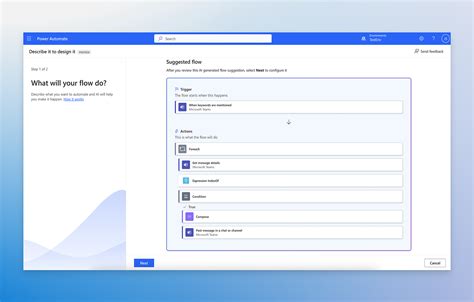

- Automate Your Investments: Set up automatic transfers from your bank account to your investment account on a regular schedule. This reinforces consistency and leverages dollar-cost averaging without requiring constant manual effort.

- Periodically Rebalance Your Portfolio: Over time, the performance of different assets can shift your portfolio’s allocation away from your target. Once a year, review and rebalance your portfolio to bring it back to your desired asset mix.

Consistency and Patience: Your Best Investment Allies

Starting to invest for long-term wealth growth is less about finding a secret formula and more about embracing sound financial principles and consistent action. By defining your goals, understanding basic investment vehicles, leveraging the power of compounding and diversification, and maintaining a disciplined, long-term perspective, you can build substantial wealth over time. The best time to start was yesterday; the second best time is today.