For many men, the path to financial freedom can be hindered by the burden of high credit card debt. Societal expectations, consumer culture, and a lack of specific financial guidance can contribute to accumulating balances that stifle wealth-building efforts. However, with focused strategies and a commitment to change, it’s entirely possible to shed debt and accelerate your journey toward lasting financial prosperity.

The Silent Burden: Understanding Credit Card Debt in Men

High-interest credit card debt can feel like a silent burden, eroding your income and preventing you from investing in your future. Often, men might face unique pressures related to providing, maintaining a certain lifestyle, or even taking on debt to support family. Understanding the root causes of your debt is the first step toward effective management. Recognize that credit card interest rates are notoriously high, making minimum payments an expensive, never-ending cycle.

Strategic Debt Elimination: Your Action Plan

Tackling credit card debt requires a clear strategy and unwavering discipline. Here are proven methods to start paying down those balances:

- Prioritize High-Interest Debt: Focus on paying off the card with the highest interest rate first (the “debt avalanche” method) while making minimum payments on others. This saves you the most money in interest over time. Alternatively, some prefer the “debt snowball” method, paying off the smallest balance first for psychological wins.

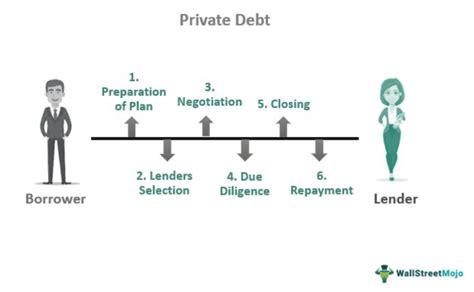

- Consolidate or Transfer Balances: Explore options like a balance transfer credit card with a 0% introductory APR, a personal loan with a lower interest rate, or a home equity line of credit (HELOC) if appropriate. Be cautious with balance transfers; ensure you can pay off the transferred amount before the promotional period ends.

- Create a Strict Budget: Track every dollar coming in and going out. Identify areas where you can cut unnecessary expenses. Every dollar saved can be redirected towards debt repayment.

- Increase Your Income: Look for opportunities to earn more – whether through a side hustle, overtime, selling unused items, or negotiating a raise at your current job. Extra income is your most powerful weapon against debt.

Beyond Debt: Accelerating Your Wealth Building Journey

Once you’ve made significant progress on your debt, or even while you’re tackling it, it’s crucial to pivot towards building wealth. This means making your money work for you.

- Build an Emergency Fund: Before serious investing, aim for at least 3-6 months’ worth of living expenses saved in an easily accessible, high-yield savings account. This protects you from future debt in case of unexpected events.

- Maximize Retirement Contributions: If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s free money. Then, explore Roth IRAs or Traditional IRAs, taking advantage of tax-advantaged growth.

- Invest Broadly and Consistently: Don’t try to pick individual stocks. Instead, invest in diversified low-cost index funds or ETFs that track the broader market. The key is consistency over time, utilizing dollar-cost averaging.

- Educate Yourself: Learn about different investment vehicles, risk tolerance, and long-term financial planning. Knowledge is power when it comes to growing your money.

Cultivating a Wealth-Building Mindset and Habits

Financial success isn’t just about numbers; it’s about mindset and consistent habits. Develop financial literacy, practice delayed gratification, and set clear, achievable financial goals. Regularly review your budget, investment performance, and adjust your strategies as life changes. Automate savings and investments so you pay yourself first before discretionary spending. This discipline is the bedrock of long-term wealth accumulation.

Seeking Expert Guidance and Long-Term Vision

Don’t hesitate to consult with a reputable financial advisor. A professional can help you create a personalized debt repayment plan, optimize your investment strategy, and align your financial decisions with your long-term life goals. They can offer an objective perspective and guide you through complex financial situations, ensuring you stay on track for a secure and prosperous future.

Tackling high credit card debt and building wealth faster is a journey that requires commitment, education, and consistent action. By adopting strategic debt elimination methods, prioritizing smart investments, and cultivating a disciplined financial mindset, men can break free from debt cycles and build a robust foundation for enduring financial independence and prosperity.