In an age of instant gratification, the ability to cultivate discipline stands out as a superpower, especially when it comes to long-term goals like fitness and financial security. These two areas, seemingly disparate, are deeply intertwined by the common thread of consistent action, delayed gratification, and a resilient mindset. Building this bedrock of discipline isn’t about rigid self-deprivation; it’s about making conscious choices that align with your future self, day in and day out.

Understanding the Core of Discipline

Discipline isn’t born; it’s built. It’s the commitment to a set of rules and routines, not because you’re forced to, but because you understand the profound benefits they bring. It’s the bridge between goals and accomplishment, enabling you to overcome resistance and stay on track even when motivation wanes. For fitness, this might mean showing up for a workout when you’d rather sleep in. For finances, it could be consistently saving a portion of your income instead of making an impulse purchase. The underlying mechanism is the same: prioritizing long-term rewards over short-term desires.

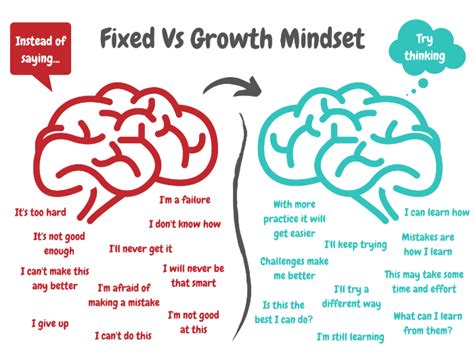

The Pillars of a Disciplined Mindset

1. Clear Goal Setting

You can’t hit a target you can’t see. Define your fitness goals (e.g., run a 5k, lift a certain weight) and financial goals (e.g., save for a down payment, retire by a certain age) with specificity and measurable metrics. Break them down into smaller, actionable steps.

2. Consistency Over Intensity

It’s better to do a little bit consistently than a lot sporadically. Regular, even small, workouts yield better results than occasional extreme sessions. Similarly, consistent saving, no matter how modest, builds wealth far more effectively than irregular large deposits.

3. Self-Awareness and Accountability

Understand your triggers for procrastination or impulse. Recognize your weaknesses and develop strategies to circumvent them. Hold yourself accountable by tracking progress, perhaps with a journal, an app, or a trusted accountability partner.

4. Resilience and Adaptability

There will be setbacks. You’ll miss a workout, or overspend one month. The disciplined mindset doesn’t dwell on failures but learns from them, adjusts, and gets back on track without losing momentum. It’s about bouncing back stronger.

5. Delayed Gratification

This is perhaps the cornerstone of discipline. The ability to forgo immediate pleasure for greater, long-term reward is critical for both physical health and financial prosperity. It’s choosing the healthy meal over fast food, or investing instead of buying the latest gadget.

Applying Discipline to Fitness

Building fitness discipline involves creating a routine and sticking to it. Start small: commit to 15 minutes of activity daily. Schedule your workouts like important appointments. Prepare healthy meals in advance. Track your progress to see how far you’ve come, which acts as a powerful motivator. Focus on building habits that are sustainable, rather than chasing quick fixes that often lead to burnout.

Applying Discipline to Financial Growth

Financial discipline starts with a budget – understanding where your money goes. Automate your savings and investments to remove the temptation to spend. Prioritize debt repayment, especially high-interest debts. Educate yourself on financial literacy to make informed decisions. View every spending choice through the lens of your long-term financial goals, asking if it aligns with the future you envision.

Strategies for Building and Sustaining Discipline

- Start Small: Overwhelm leads to failure. Begin with one small, achievable disciplined action and gradually build upon it.

- Create a Routine: Structure your days. Routines reduce decision fatigue and automate positive behaviors.

- Remove Temptations: Make it harder to make bad choices (e.g., don’t keep unhealthy snacks, unlink credit cards from online shopping sites).

- Find Your ‘Why’: Constantly remind yourself of the deep, personal reasons behind your goals. This intrinsic motivation is far more powerful than external pressure.

- Reward Progress (Wisely): Acknowledge milestones, but choose non-detrimental rewards that don’t undermine your progress.

- Embrace Discomfort: Growth happens outside your comfort zone. Learn to tolerate the initial discomfort that comes with new, disciplined habits.

Conclusion

The disciplined mindset is not a personality trait; it’s a skill that anyone can develop. By applying principles of clear goal setting, consistency, self-awareness, resilience, and delayed gratification, you can systematically build the foundation for enduring success in both your fitness and financial journeys. Embrace the process, celebrate small victories, and commit to the long game – the rewards of a disciplined life are truly boundless.