Why Every Man Needs a Robust Emergency Fund

Life throws curveballs, and for men often shouldering significant financial responsibilities—whether it’s supporting a family, maintaining a home, or pursuing career growth—an unexpected event can derail even the most carefully laid plans. An emergency fund isn’t just a good idea; it’s a foundational pillar of financial stability, acting as a crucial buffer against the unforeseen. Think job loss, medical emergencies, car repairs, or sudden home maintenance issues. Without a dedicated fund, these events can force you into debt, liquidate investments prematurely, or severely compromise your long-term financial goals.

Building an emergency fund is a proactive step towards peace of mind, allowing you to navigate crises without panicking or making rash financial decisions. It empowers you to maintain your lifestyle and protect your assets, regardless of what unexpected challenges arise.

How Much Cash Should You Save? The Golden Rule & Personalizing It

The standard advice for an emergency fund is to save three to six months’ worth of essential living expenses. This benchmark provides a solid starting point, offering a decent cushion for most common emergencies. However, ‘essential living expenses’ can vary wildly from person to person, and your personal circumstances should heavily influence your target.

Factors to Consider When Calculating Your Fund Size:

- Job Security: If your job market is volatile or your industry is prone to layoffs, aiming for six months or even more (e.g., 9-12 months) might be prudent.

- Dependents: Supporting a spouse, children, or elderly parents significantly increases your monthly outlay, demanding a larger safety net.

- Health: If you or a family member have pre-existing conditions or high medical deductibles, factor in potential healthcare costs.

- Debt: While an emergency fund shouldn’t be used to pay off consumer debt, having substantial debt can make financial shocks more impactful, perhaps warranting a larger fund.

- Homeownership: Homeowners often face unexpected repair costs (HVAC, roof, plumbing) that renters typically don’t.

- Single vs. Dual Income: A single-income household generally needs a larger fund than a dual-income one, as the loss of that sole income stream is catastrophic.

To pinpoint your exact target, start by meticulously tracking your monthly essential expenses—rent/mortgage, utilities, groceries, transportation, insurance premiums, minimum debt payments, etc. Exclude discretionary spending like dining out or entertainment. Once you have this number, multiply it by 3, 6, 9, or even 12, depending on your comfort level and risk assessment.

Where to Stash Your Emergency Cash Safely: Accessibility Meets Security

The key to storing your emergency fund is a delicate balance between security and accessibility. You need to access it quickly in a crisis, but it also needs to be protected from market volatility and impulsive spending. Here are the top safe havens:

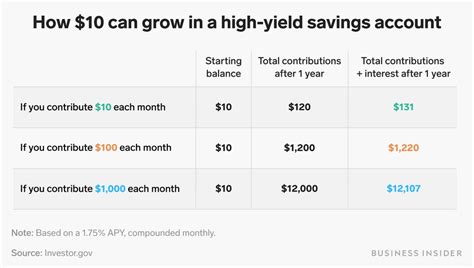

1. High-Yield Savings Accounts (HYSAs)

This is the gold standard for emergency funds. HYSAs are offered by online banks, typically yielding significantly higher interest rates than traditional savings accounts. They are FDIC-insured (up to $250,000 per depositor, per institution), ensuring your principal is safe. They offer immediate access to your funds via electronic transfers, often within 1-3 business days.

2. Money Market Accounts (MMAs)

Similar to HYSAs, MMAs also offer competitive interest rates and FDIC insurance. They might come with check-writing privileges or a debit card, offering slightly more liquidity than a pure savings account, though often with limits on transactions. Compare rates and fees with HYSAs to determine the best fit.

3. Short-Term Certificates of Deposit (CDs) – With Caution

While CDs offer guaranteed interest rates for a fixed term, they lock up your money. If you need to access funds before maturity, you’ll typically pay a penalty. Consider using a CD laddering strategy for a portion of a very large emergency fund (e.g., for 9-12 months of expenses), where CDs mature at staggered intervals, providing periodic access. For the bulk, HYSAs are usually superior for emergency liquidity.

4. Treasury Bills (T-Bills)

Issued by the U.S. Treasury, T-Bills are short-term government securities with maturities ranging from a few days to 52 weeks. They are considered one of the safest investments globally, backed by the full faith and credit of the U.S. government. They are also exempt from state and local taxes. While slightly less liquid than an HYSA (you buy them at auction or on the secondary market), they offer competitive, risk-free returns for those with a very substantial fund looking to diversify its safe storage.

What to Avoid:

- The Stock Market/Volatile Investments: Your emergency fund should never be invested in stocks, cryptocurrencies, or other volatile assets. The risk of losing principal when you need it most is too high.

- Your Checking Account: While highly liquid, keeping your entire emergency fund in your checking account makes it too easy to spend on non-emergencies and often earns minimal interest.

- Illiquid Assets: Real estate, collectibles, or precious metals are not suitable for an emergency fund, as they cannot be quickly converted to cash without potential loss or significant effort.

Maintaining and Growing Your Emergency Fund

Building your emergency fund is not a one-time task; it’s an ongoing commitment. Regularly review your financial situation and adjust your fund’s size as your life changes (new job, marriage, children, home purchase). If you tap into your fund, make it a priority to replenish it as quickly as possible. Automate contributions from your checking account to your chosen savings vehicle to ensure consistent growth without conscious effort.

By diligently building and protecting your emergency fund, you’re not just saving money; you’re investing in your future peace of mind and overall financial resilience.