The Interconnected Path to Lasting Financial and Fitness Success

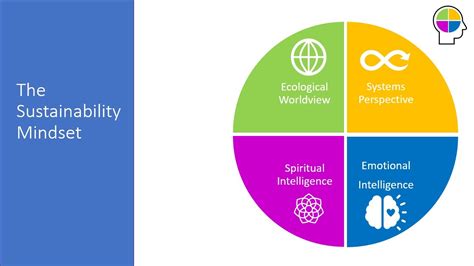

Many people embark on journeys to improve their finances or fitness, only to find their motivation wane and their efforts falter. The secret to not just achieving, but sustaining success in both these critical areas isn’t just about the right diet or investment strategy; it’s profoundly rooted in the mindset you cultivate. A resilient, adaptable, and forward-thinking mindset is the bedrock upon which long-term financial stability and physical well-being are built.

This article will explore the core components of such a mindset, offering practical insights into how you can develop the mental fortitude needed to navigate challenges, stay consistent, and ultimately thrive in both your financial and fitness endeavors.

Understanding the Core Connection Between Mindset, Money, and Muscle

At first glance, finances and fitness might seem like disparate domains. However, they share fundamental psychological underpinnings. Both require delayed gratification, consistent effort, the ability to overcome setbacks, and a clear vision of the future. A scarcity mindset can impact both your financial decisions (e.g., fear of investing) and your fitness goals (e.g., restrictive diets leading to burnout). Conversely, an abundance mindset fosters growth, resilience, and a belief in one’s capacity to improve.

Recognizing this synergy is the first step. When you train your mind to be disciplined in one area, those mental muscles strengthen and can be applied to the other. Building a budget demands the same self-control as sticking to a workout routine. Recovering from an investment loss requires the same mental resilience as bouncing back from an injury.

Pillars of a Financial Success Mindset

1. Long-Term Vision and Delayed Gratification

True financial success isn’t about quick wins; it’s about compounding interest and consistent saving over decades. This requires the ability to defer immediate pleasures for greater future rewards. Cultivate a vision of your financial future – whether it’s early retirement, a secure home, or funding your children’s education – and let that vision guide your daily spending and saving habits.

2. Abundance Mentality

Shift from a mindset of scarcity (“there’s not enough”) to one of abundance (“there are always opportunities”). This encourages smart risk-taking, continuous learning about investments, and a proactive approach to increasing income, rather than just fearing loss.

3. Continuous Learning and Adaptability

The financial world is constantly evolving. A successful mindset embraces learning, whether it’s understanding new investment vehicles, market trends, or personal finance strategies. Be open to adapting your approach when circumstances change, rather than rigidly sticking to outdated methods.

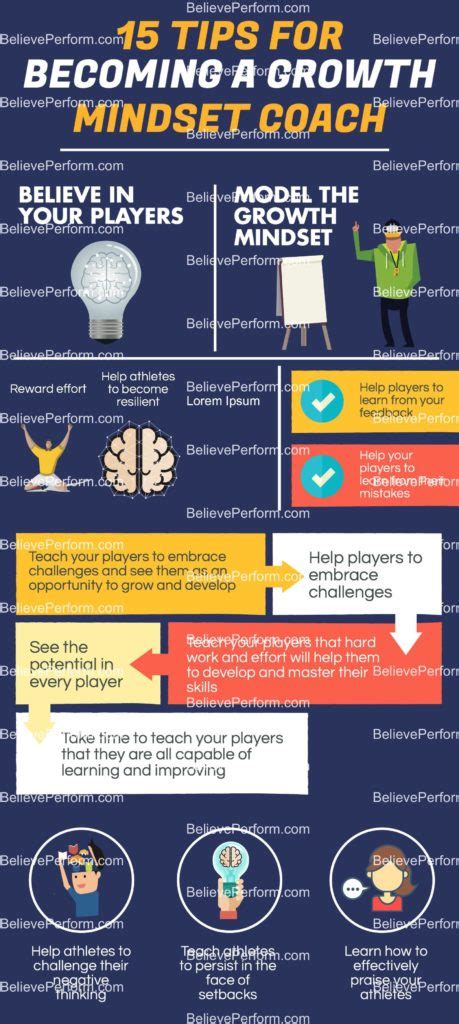

Pillars of a Fitness Success Mindset

1. Process Over Outcome

While goals like losing a certain amount of weight or running a marathon are important, an enduring fitness mindset focuses on the daily process. Celebrate consistency in your workouts, nutritious meal choices, and adequate rest. The outcomes will naturally follow from consistent, positive actions.

2. Self-Compassion and Patience

Fitness journeys are rarely linear. There will be plateaus, setbacks, and days you simply don’t feel like working out. Instead of self-criticism, practice self-compassion. Understand that progress takes time and patience. Learn from missed workouts or dietary slip-ups, adjust, and get back on track without dwelling on perfection.

3. Intrinsic Motivation

While external motivators like looking good or fitting into certain clothes can kickstart a journey, sustained fitness comes from within. Discover what truly fuels your desire to be healthy – perhaps it’s the energy you gain, the stress relief from exercise, or the feeling of strength. Connect with these deeper, intrinsic reasons.

Building Synergistic Habits for Dual Success

To truly embed these mindsets, you need to translate them into actionable habits. Here’s how to create synergy:

- Set SMART Goals: Make your financial and fitness goals Specific, Measurable, Achievable, Relevant, and Time-bound. For example, “Save $500 per month for an emergency fund” and “Walk 10,000 steps daily.”

- Prioritize Consistency: Small, consistent actions yield massive results over time. Just as you wouldn’t expect to get fit from one workout, you won’t build wealth from one good investment. Automate savings and schedule workouts.

- Track Progress Regularly: Monitoring your financial statements and fitness metrics (e.g., steps, strength, body composition) provides objective feedback, reinforces positive behaviors, and helps you adjust when necessary.

- Embrace Accountability: Share your goals with a trusted friend, family member, or join a community. External accountability can be a powerful motivator, especially on days when internal motivation wanes.

- Educate Yourself Continuously: Dedicate time each week to learning about personal finance, nutrition, and exercise science. Knowledge empowers better decision-making and reinforces your mindset.

Conclusion: The Journey of Lifelong Growth

Building a mindset for sustained financial and fitness success is not a destination but an ongoing journey. It requires commitment, self-awareness, and a willingness to evolve. By consciously cultivating qualities like discipline, resilience, patience, and a long-term perspective, you equip yourself with the mental tools to not only achieve your goals but to continuously adapt and thrive through life’s inevitable ups and downs.

Start today by identifying one small mindset shift you can make in your financial approach and one in your fitness routine. Consistent effort in these mental adjustments will pave the way for a life of sustained well-being and prosperity.