The Path to Financial Freedom: Budget, Debt, Invest

Many aspire to financial freedom, a state where money works for you, rather than the other way around. However, for most, this journey involves navigating the twin challenges of existing debt and the daunting prospect of starting to invest. The good news is that with a strategic approach to your budget, you can rapidly pay down debt and transition smoothly into building wealth through effective investing. It’s a two-pronged attack that, when executed correctly, can dramatically alter your financial trajectory.

Phase 1: Mastering Your Budget for Maximum Impact

The cornerstone of any successful financial plan is a well-optimized budget. This isn’t about deprivation, but rather about intentionality – directing every dollar towards your goals. Start by gaining absolute clarity on where your money goes.

Track Every Penny

For at least one month, meticulously track every single expense. Use apps, spreadsheets, or even a notebook. This unvarnished look at your spending habits is often eye-opening.

Categorize and Identify Areas for Reduction

Once you have your data, categorize your expenses (housing, food, transportation, entertainment, subscriptions, etc.). Distinguish between essential needs and discretionary wants. Look for areas where you can make significant cuts without severely impacting your quality of life. Even small, consistent reductions in areas like dining out, unused subscriptions, or daily coffees can free up substantial funds over time.

Create a Realistic, Goal-Oriented Budget

Based on your tracking and identified cuts, construct a realistic budget. Allocate specific amounts for each category. Crucially, your budget should prioritize your goals: aggressive debt repayment and future investments. The ‘zero-based budget’ where every dollar has a job, can be particularly effective here.

Phase 2: Accelerating Debt Repayment with Purpose

Once your budget is optimized and freeing up cash, direct that surplus towards your debt. The goal here is speed and efficiency.

Target High-Interest Debt First (Debt Avalanche)

Mathematically, the most efficient way to pay off debt is using the ‘debt avalanche’ method: list all your debts from highest interest rate to lowest. Make minimum payments on all debts except the one with the highest interest rate, and throw every extra dollar from your optimized budget at that debt. Once it’s paid off, roll that payment amount (minimum + extra) into the next highest interest debt. This saves you the most money on interest.

Consider the Debt Snowball for Motivation

Alternatively, the ‘debt snowball’ method prioritizes paying off the smallest debt first, regardless of interest rate. While it costs slightly more in interest, the psychological wins of quickly eliminating smaller debts can provide powerful motivation to keep going. Choose the method that best suits your personality and keeps you engaged.

Avoid New Debt

During this phase, it is paramount to avoid taking on any new debt. Cut up credit cards if necessary, and resist the temptation of ‘buy now, pay later’ schemes that can derail your progress.

Phase 3: Seamlessly Transitioning to Effective Investing

As debt balances dwindle, you’ll feel an incredible sense of liberation. Now, the money you were using for debt repayment can be redirected to building wealth.

Build Your Emergency Fund

Before seriously investing, ensure you have a robust emergency fund. This should cover 3-6 months of essential living expenses, stored in an easily accessible, high-yield savings account. This fund acts as a financial safety net, preventing you from going back into debt if an unexpected expense arises.

Define Your Investment Goals and Risk Tolerance

Are you saving for retirement, a down payment, or early financial independence? Your goals will influence your investment strategy. Understand your risk tolerance – how comfortable are you with market fluctuations? This will guide your asset allocation.

Automate Your Investments

Just as you automated debt payments, automate your investments. Set up recurring transfers from your checking account to your investment accounts (401k, IRA, brokerage). ‘Pay yourself first’ ensures consistency and leverages the power of compounding.

Start with Broadly Diversified, Low-Cost Investments

For most beginners, focusing on broad-market index funds or ETFs is highly effective. These provide instant diversification across hundreds or thousands of companies, have low fees, and historically offer strong returns. Prioritize tax-advantaged accounts like 401(k)s (especially if your employer offers a match – free money!), Roth IRAs, and Traditional IRAs.

Phase 4: Sustaining Momentum and Long-Term Growth

Financial success is a marathon, not a sprint. Consistency is key.

Regularly Review and Adjust Your Budget

Life changes, and so should your budget. Review it quarterly or bi-annually. Adjust as your income increases, expenses shift, or financial goals evolve.

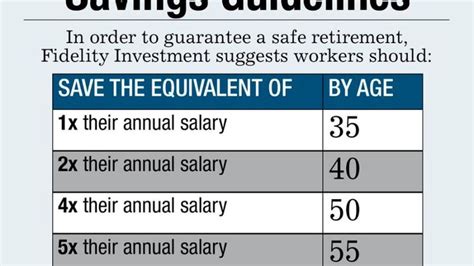

Increase Your Savings Rate

As your income grows, try to increase the percentage of money you save and invest. The more you put away early, the greater the impact of compounding over time.

Educate Yourself Continuously

The world of finance is always evolving. Read books, listen to podcasts, and stay informed about personal finance strategies to continually optimize your approach.

Conclusion: Your Empowered Financial Journey

Optimizing your budget, aggressively paying off debt, and then strategically investing your freed-up capital is a proven roadmap to financial success. It requires discipline, patience, and commitment, but the rewards – reduced stress, increased security, and ultimately, true financial freedom – are immeasurable. Start today, stay consistent, and watch your financial landscape transform.