Conquering High-Interest Debt: The First Step to Financial Freedom

For many men, the dream of financial independence often collides with the harsh reality of high-interest debt. Whether it’s credit card balances, personal loans, or other obligations, these debts can act as significant roadblocks, siphoning off hard-earned money and delaying wealth accumulation. The smartest approach isn’t just about paying bills; it’s about strategic elimination and intentional wealth creation.

Understanding the Enemy: The High-Interest Trap

High-interest debt is a wealth killer. It operates like a financial vacuum, pulling more money from your pockets through interest payments than it does from your principal balance. Before you can build wealth, you must neutralize this threat. The first step is to get a clear picture: list all your debts, their outstanding balances, and their interest rates. Knowledge is power, and this inventory will be your roadmap.

Aggressive Debt Crushing Strategies

Once you understand your debt landscape, it’s time to act aggressively. There are two primary strategies for debt repayment:

- The Debt Avalanche Method: This is generally considered the mathematically smartest way. You pay the minimum on all debts except the one with the highest interest rate. You throw every extra dollar at that highest-interest debt until it’s gone. Then, you take the money you were paying on that debt and apply it to the next highest interest rate debt. This method saves you the most money in interest over time.

- The Debt Snowball Method: While not mathematically optimal, this method focuses on psychological wins. You pay the minimum on all debts except the one with the smallest balance. Once that debt is paid off, you take the money you were paying on it and apply it to the next smallest debt. The quick wins can provide motivation, especially if you feel overwhelmed.

For most men aiming for maximum efficiency and long-term wealth, the Debt Avalanche is the superior choice. Complement this with a strict budget, cutting unnecessary expenses to free up more cash for debt repayment.

Building Your Financial Fortress: Beyond Debt

Once high-interest debt is under control or eliminated, the focus shifts squarely to wealth building. This isn’t a single event but a disciplined journey.

1. Establish an Emergency Fund

Before any significant investing, build an emergency fund. Aim for 3-6 months’ worth of essential living expenses saved in an easily accessible, high-yield savings account. This fund acts as a buffer against unforeseen circumstances, preventing you from falling back into debt when life happens.

2. Maximize Income & Savings

Look for ways to increase your income – whether through career advancement, a side hustle, or negotiating a raise. The more you earn, the more you can save and invest. Simultaneously, cultivate a high savings rate. Automate savings to ensure a portion of every paycheck goes directly into your emergency fund or investment accounts.

3. Invest Early and Consistently

Time is your most powerful ally in wealth building, thanks to compound interest. Start investing as early as possible and contribute consistently.

- Employer-Sponsored Plans (401k, 403b): If your employer offers a match, contribute enough to get the full match – it’s free money.

- Individual Retirement Accounts (IRAs): Consider Roth or Traditional IRAs. Roth IRAs offer tax-free withdrawals in retirement, while Traditional IRAs provide upfront tax deductions.

- Taxable Brokerage Accounts: For funds beyond retirement accounts, a standard brokerage account offers flexibility.

Focus on diversified, low-cost index funds or ETFs that track broad markets. Avoid chasing speculative trends; slow and steady wins the race.

Strategic Growth: Diversification and Risk Management

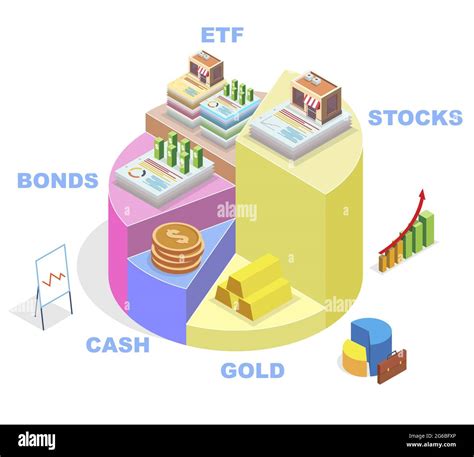

As you accumulate wealth, strategic asset allocation becomes crucial. Diversify across different asset classes (stocks, bonds, real estate) and geographies to mitigate risk. Understand your risk tolerance, but don’t shy away from growth-oriented investments if you have a long time horizon. Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk profile.

The Long Game: Financial Literacy and Avoiding Lifestyle Creep

Building wealth is a marathon, not a sprint. Continuously educate yourself on personal finance and investing. Resist the urge of lifestyle creep – as your income grows, avoid immediately upgrading your spending to match. Instead, direct a significant portion of those raises towards savings and investments. Set clear, measurable financial goals, and revisit them regularly to stay on track.

Conclusion: A Path to Lasting Prosperity

The smartest way for men to crush high-interest debt and build wealth involves a dual approach: aggressive debt elimination using strategies like the Debt Avalanche, followed by disciplined savings, early and consistent investing, and continuous financial education. It requires patience, discipline, and a long-term perspective. By mastering these principles, any man can pave his way to true financial independence and lasting prosperity.