The Unsung Hero: Discipline Beyond Fleeting Motivation

It’s a familiar scenario: you start a new fitness regimen or financial savings plan with immense enthusiasm, only for that initial burst of motivation to gradually fade. The gym seems less appealing, the budget feels restrictive, and the temptation to revert to old habits grows stronger. This ebb and flow of motivation is natural. The true secret to long-term success in both fitness and finance isn’t sustained motivation, but rather the unwavering power of discipline.

Discipline acts as your internal autopilot, guiding you towards your goals even when you don’t ‘feel like it.’ It’s the commitment to a chosen path, irrespective of your mood or external circumstances. So, how do you cultivate this crucial trait when your drive is at an all-time low?

Strategies for Fitness Goals When Motivation Wanes

1. Automate Your Habits

Make your workouts non-negotiable. Schedule them in your calendar like important appointments. The less you have to think about ‘if’ you’ll exercise, the more likely you are to just do it. Lay out your workout clothes the night before, prepare your post-workout snack, or find a workout buddy to create accountability.

2. Start Small, Stay Consistent

When motivation is low, don’t aim for an hour-long intense session. Commit to just 15-20 minutes. A short walk, a quick bodyweight circuit, or a gentle stretching session is infinitely better than doing nothing. Consistency, even in small doses, builds momentum and reinforces the habit.

3. Focus on Process, Not Just Outcome

Instead of fixating on weight loss or muscle gain, shift your focus to the act of exercising itself. Celebrate showing up, completing your reps, or simply moving your body. This makes the journey more rewarding and less dependent on immediate results, which can take time to manifest.

Strategies for Finance Goals When Motivation Ebbs

1. Automate Your Savings and Investments

This is arguably the most powerful discipline tool for finance. Set up automatic transfers from your checking account to your savings or investment accounts immediately after payday. If the money isn’t readily available, you’re less likely to spend it.

2. Create a ‘Why’ That Resonates Deeply

Beyond just ‘saving money,’ define what that money represents to you. Is it a down payment on a house, a stress-free retirement, your child’s education, or financial freedom? When motivation drops, revisit this powerful ‘why’ to rekindle your commitment. Keep a picture or a written reminder of your goal where you can see it daily.

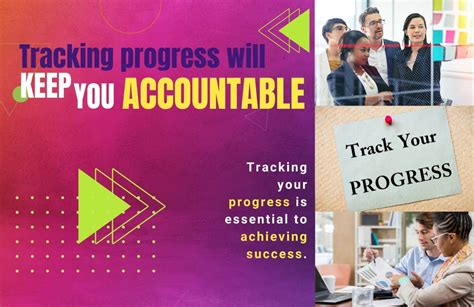

3. Track Your Progress Visibly

Seeing your savings grow or your debt shrink can be incredibly motivating. Use apps, spreadsheets, or even a simple physical chart to track your financial milestones. Visual progress provides tangible proof that your disciplined actions are paying off.

Overarching Principles for Both Fitness and Finance

1. Establish Clear, Realistic Goals

Vague goals lead to vague efforts. Define what you want to achieve with specific, measurable, achievable, relevant, and time-bound (SMART) goals. Break larger goals into smaller, manageable steps. This clarity provides a roadmap when you feel lost.

2. Build Supportive Routines and Environments

Your environment significantly influences your discipline. For fitness, this might mean setting up a home gym, choosing a gym close to work, or having healthy snacks readily available. For finance, it could involve unsubscribing from tempting marketing emails, deleting shopping apps, or setting a weekly budget review time.

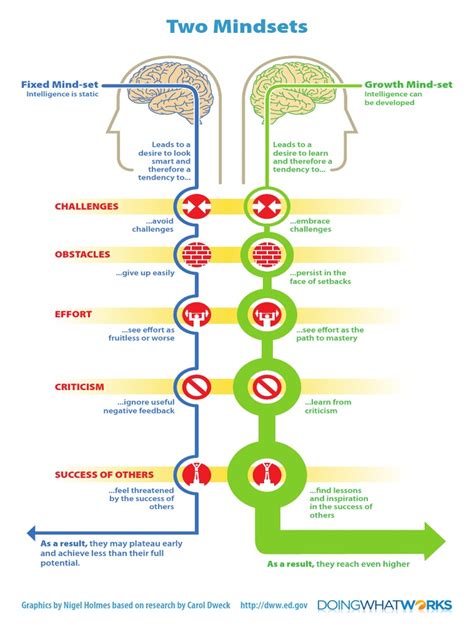

3. Practice Self-Compassion and Forgiveness

You will have off days. You might skip a workout or overspend. The key is not to let one lapse derail your entire effort. Acknowledge the slip, learn from it, and get back on track immediately. Discipline isn’t about perfection; it’s about persistent effort despite imperfections.

4. Find Accountability

Share your goals with a trusted friend, family member, or mentor. Knowing someone is aware of your commitments can provide an extra layer of motivation to stay disciplined, especially when you feel like giving up. Group challenges, personal trainers, or financial advisors can also serve this purpose.

Conclusion: Discipline as Your Lifelong Ally

Motivation is a wonderful spark, but discipline is the fuel that keeps the fire burning, even through the rain. By implementing these strategies – automating tasks, focusing on consistent small steps, tracking progress, and fostering self-compassion – you can build the muscle of discipline. This isn’t just about achieving a specific fitness level or financial milestone; it’s about cultivating a powerful internal strength that will serve you in every aspect of life, transforming fleeting desires into lasting achievements.