In today’s fast-paced world, managing finances can often feel like another chore, especially for men balancing careers, families, and personal aspirations. The good news? You don’t need to be a finance guru to build significant wealth. The key lies in automation – setting up systems that manage your money for you, consistently and efficiently. This approach transforms daunting financial tasks into seamless background operations, freeing up your time and mental energy while propelling you towards your financial goals.

The Power of Automation: A Game Changer for Men

Imagine a financial ecosystem where your savings grow automatically, bills are paid on time without a second thought, and investments compound steadily, all orchestrated with minimal effort on your part. This isn’t a pipe dream; it’s the reality automation offers. For men who value efficiency and results, automating finances is not just a convenience; it’s a strategic imperative for long-term wealth accumulation.

Step-by-Step Guide to Automating Your Finances

Ready to put your money on autopilot? Here’s how you can systematically automate your financial life to build a robust foundation for wealth.

1. Automate Your Savings

This is perhaps the most fundamental step. Set up automatic transfers from your checking account to your savings account immediately after you get paid. Start with a realistic amount, even if it’s small, and gradually increase it. Consider dedicated high-yield savings accounts for different goals like an emergency fund, down payment, or vacation.

2. Set Up Automatic Bill Payments

Eliminate late fees and the stress of remembering due dates. Enroll in automatic bill pay for all your recurring expenses: utilities, rent/mortgage, credit cards, loans, and subscriptions. Most banks and service providers offer this feature, ensuring your payments are always on time, protecting your credit score, and maintaining financial peace of mind.

3. Supercharge Your Investments

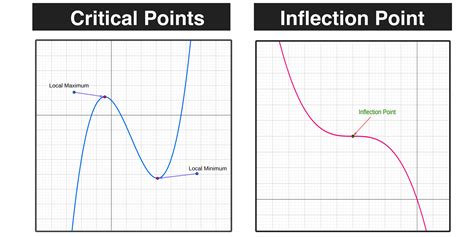

Automated investing is where the real wealth building happens. Configure automatic contributions to your retirement accounts (401(k), IRA) and brokerage accounts. Even small, consistent investments benefit immensely from compounding over time. Many investment platforms allow you to set up recurring transfers and even automate diversified portfolio management.

4. Leverage Budgeting and Tracking Apps

While automation handles the “doing,” intelligent apps can handle the “knowing.” Tools like Mint, YNAB, or Personal Capital can automatically categorize your transactions, track your spending, and provide insights into your financial health. They remove the manual chore of data entry, allowing you to quickly review where your money is going and make informed adjustments to your automated systems.

5. Automate Debt Repayment

If you’re carrying high-interest debt (like credit card balances), automate an accelerated repayment plan. Set up automatic payments that exceed the minimum due. Directing an extra fixed amount each month can significantly reduce the total interest paid and shorten your debt-free timeline, freeing up more capital for wealth building.

The Wealth-Building Benefits of Automation

Beyond the sheer convenience, automating your finances delivers tangible benefits that are crucial for wealth accumulation:

- Consistency: Automation ensures you’re always paying yourself first and investing regularly, regardless of market fluctuations or personal motivation.

- Discipline: It removes the temptation to spend money earmarked for savings or investments, enforcing financial discipline effortlessly.

- Time-Saving: Less time spent on manual money management means more time for career growth, hobbies, and family.

- Compounding Power: Consistent, automated investments allow your money to grow exponentially over time through the magic of compounding interest.

- Reduced Stress: Knowing your financial house is in order provides immense peace of mind.

Embracing financial automation is one of the smartest moves any man can make to secure his financial future. It’s about leveraging technology to create a robust, resilient financial system that works for you, day in and day out. Start small, set up one automation at a time, and watch as your wealth building becomes a predictable, effortless journey.