The Weight of Expectation: Men as Financial Providers

For centuries, the role of men as primary financial providers has been deeply ingrained in societies across the globe. This deeply rooted expectation isn’t merely a cultural norm; it’s a powerful psychological force that often shapes men’s life decisions, particularly when it comes to their personal long-term investment strategies. The pressure to secure a family’s financial future can lead to unique approaches to risk, goal setting, and the very definition of financial success.

Historical Roots and Modern Realities

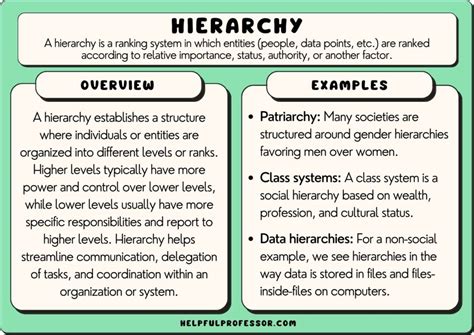

Historically, a man’s ability to provide shelter, food, and security was paramount to his standing within the community and his family. While modern economies have evolved and gender roles are more fluid, the echo of this traditional expectation persists. Many men still feel an intrinsic, often unspoken, responsibility to be the primary breadwinner or at least a significant contributor, ensuring a stable and prosperous life for their partners and children.

Impact on Investment Risk Tolerance

One of the most profound effects of this expectation is on risk tolerance. The pressure to accumulate wealth quickly can push some men towards more aggressive, higher-risk investments, hoping for rapid growth to meet perceived financial obligations like homeownership, children’s education, or early retirement for a spouse. Conversely, the immense fear of failure or of jeopardizing a family’s security can lead others to be overly conservative, favoring low-risk, low-return options, even if it means missing out on significant long-term growth potential. Striking this balance between ambition and caution is a constant struggle.

Shaping Investment Goals and Horizons

Societal expectations also dictate the specific financial goals men prioritize. Investment strategies might heavily skew towards tangible assets that signify provision and stability: a down payment for a house, funding for higher education, or establishing a robust retirement fund for both partners. Less emphasis might be placed on personal ‘dream’ investments, with the focus remaining squarely on family-centric objectives. The long-term investment horizon, while theoretically spanning decades, can feel compressed by the immediate and looming needs associated with supporting a family, potentially leading to decisions that prioritize shorter-term gains over true compounding.

The Burden of Financial Knowledge and Decision-Making

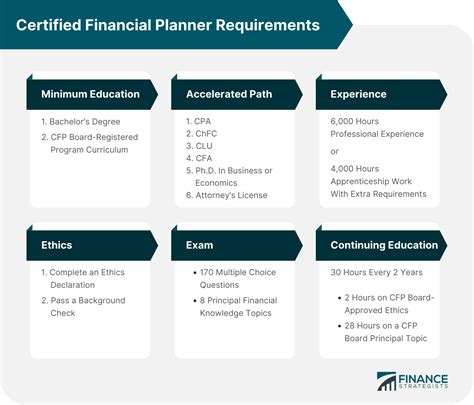

Another subtle but powerful influence is the unspoken expectation that men should naturally be adept at managing finances and making sound investment decisions. This can prevent some from seeking professional financial advice, feeling they should already possess the necessary knowledge or that admitting a lack of understanding would be a sign of weakness. This self-reliance, while sometimes beneficial, can also lead to missed opportunities or suboptimal investment choices due to insufficient research or emotional biases.

Evolving Expectations and the Modern Investor

The landscape of societal expectations is continually shifting. With more dual-income households and a greater emphasis on shared responsibilities, the sole burden of financial provision is often distributed. This evolution offers men an opportunity to redefine their investment strategies, potentially reducing the pressure and allowing for more collaborative and diversified financial planning. It encourages a move from a traditional “provider” mindset to a “partner” mindset in financial stewardship.

Navigating Expectations for Optimal Outcomes

To navigate these complex expectations effectively, men can benefit from several strategies:

- Self-Awareness: Recognize how societal pressures might be influencing investment decisions.

- Open Communication: Discuss financial roles and goals openly with partners and family members.

- Financial Education: Continuously learn about investing, regardless of perceived expertise.

- Professional Advice: Overcome the stigma and seek guidance from qualified financial advisors who can offer objective perspectives tailored to individual and family goals.

- Balanced Perspective: Understand that true provision is about security, not just accumulation, and that a balanced approach to risk and return is often most effective long-term.

Conclusion

Societal expectations regarding men’s financial provision play a substantial, often subconscious, role in shaping their long-term investment strategies. From influencing risk tolerance and specific investment goals to affecting the willingness to seek advice, these pressures are a significant factor. As these expectations evolve, understanding their impact becomes crucial for men to make informed, less-pressured, and ultimately more effective investment decisions that truly align with their personal values and family aspirations for long-term financial well-being.