Achieving financial freedom is a dream for many, but it’s a goal that is attainable with the right strategies and a long-term perspective. Optimizing your investments is not just about picking the right stocks; it’s about building a robust framework that allows your money to grow steadily over decades. This guide will walk you through the essential steps to cultivate long-term wealth and secure your financial future.

The Foundation: Setting Clear Financial Goals

Before you even think about investment vehicles, you must define what financial freedom means to you. Is it early retirement, funding a child’s education, buying a dream home, or simply having enough passive income to cover your living expenses? Clear, quantifiable goals provide the necessary motivation and direction for your investment journey.

Break down your major aspirations into specific, measurable, achievable, relevant, and time-bound (SMART) objectives. Knowing your timeline and the amount of capital required for each goal will dictate your investment strategy and risk tolerance.

Understanding Investment Vehicles

The financial world offers a plethora of investment options, each with its own risk and reward profile. Common choices include stocks, bonds, mutual funds, Exchange Traded Funds (ETFs), and real estate. Stocks offer the potential for high growth but come with volatility, while bonds typically provide lower, more stable returns.

Mutual funds and ETFs offer diversification by pooling money from multiple investors to buy a basket of securities, often managed by professionals or tracking an index. Real estate can provide both income and appreciation, but typically requires a larger upfront capital investment and involves less liquidity. Understanding these vehicles and how they align with your risk tolerance and time horizon is crucial for effective portfolio construction.

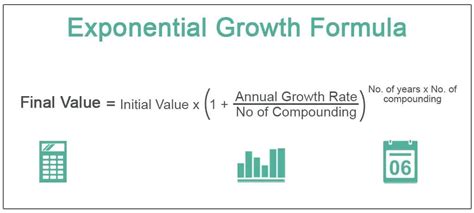

The Power of Compounding and Regular Contributions

One of the most potent forces in wealth building is compound interest. This ‘interest on interest’ effect allows your earnings to generate further earnings, creating exponential growth over time. The earlier you start investing, the more time compounding has to work its magic.

Coupled with compounding, regular and consistent contributions are vital. Strategies like dollar-cost averaging, where you invest a fixed amount at regular intervals, can mitigate the impact of market volatility. By investing consistently, you buy more shares when prices are low and fewer when prices are high, averaging out your purchase cost over time.

Diversification and Risk Management

Putting all your eggs in one basket is a risky endeavor. Diversification, the practice of spreading investments across various asset classes, industries, and geographies, is fundamental to managing risk. It helps cushion your portfolio against significant downturns in any single investment.

Asset allocation — deciding how much to invest in stocks, bonds, real estate, etc. — should be tailored to your age, financial goals, and risk tolerance. A younger investor with a longer time horizon might allocate more to growth-oriented assets like stocks, while someone nearing retirement might favor more conservative, income-generating investments.

Minimizing Costs and Staying Disciplined

Investment fees, though seemingly small, can significantly erode your long-term returns. Opt for low-cost index funds or ETFs whenever possible, as their expense ratios are typically much lower than actively managed funds. Be mindful of trading fees, advisory fees, and other hidden costs.

Perhaps the hardest part of long-term investing is staying disciplined. Market fluctuations can be unsettling, tempting investors to make rash decisions based on fear or greed. Resist the urge to time the market. Stick to your investment plan, rebalance your portfolio periodically to maintain your desired asset allocation, and remember that long-term wealth is built through patience and consistency, not speculative bets.

Automate Your Savings and Investments

Make saving and investing an effortless part of your financial routine. Set up automatic transfers from your checking account to your investment accounts (e.g., 401k, IRA, brokerage account) on your payday. This ‘pay yourself first’ approach ensures that your wealth-building efforts are prioritized and consistent, eliminating the temptation to spend the money elsewhere.

Conclusion: Your Path to Financial Freedom

Building long-term wealth and achieving financial freedom is a marathon, not a sprint. It demands careful planning, consistent execution, and unwavering discipline. By setting clear goals, understanding diverse investment vehicles, harnessing the power of compounding, diversifying wisely, minimizing costs, and automating your contributions, you lay a solid foundation for a financially secure future. Start today, stay committed, and watch your wealth grow over time, paving your way to the financial independence you desire.