Navigating the Dual Challenge: Debt Reduction and Credit Enhancement

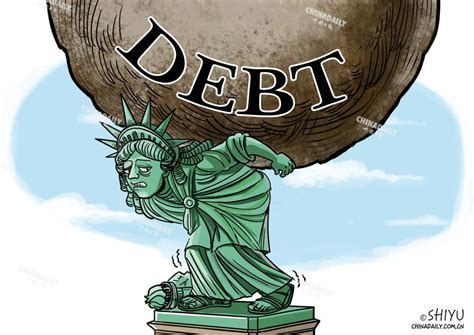

Credit card debt can feel like a heavy anchor, dragging down your financial aspirations while simultaneously damaging your credit score. Many individuals find themselves caught in this challenging cycle, unsure where to begin their journey toward financial freedom. The good news is that tackling credit card debt and improving your credit score are not separate battles; they are interconnected goals that, when approached strategically, can lead to powerful and lasting results. This article will outline an ultimate strategy to help you crush your credit card debt and build a robust credit profile.

Phase 1: Assessing Your Debt Landscape

Before you can conquer your debt, you need to understand its full scope. Gather all your credit card statements. Note down the outstanding balance, interest rate (APR), and minimum monthly payment for each card. This inventory is crucial for deciding which repayment strategy will be most effective for your situation. Knowing your total debt burden and the cost of that debt (interest) empowers you to make informed decisions.

Phase 2: Choosing Your Debt Repayment Strategy

There are two primary methods for aggressive debt repayment, each with its own psychological and financial benefits:

The Debt Snowball Method

This strategy focuses on psychological wins. You list your debts from smallest balance to largest. Pay the minimum on all cards except the smallest one, on which you throw every extra dollar you can. Once the smallest debt is paid off, you take the money you were paying on it and add it to the payment of the next smallest debt. This creates a “snowball” of increasing payments and motivation as you clear off accounts one by one.

The Debt Avalanche Method

This strategy is financially optimized. You list your debts from highest interest rate to lowest. Pay the minimum on all cards except the one with the highest interest rate, dedicating all extra funds to it. Once that debt is cleared, move to the next highest interest rate. This method saves you the most money in interest charges over time, although it might take longer to see the first debt completely disappear.

Phase 3: Supercharging Your Credit Score During Repayment

As you actively pay down debt, your credit score will naturally improve, but you can accelerate this process by focusing on key credit factors:

- Payment History (35% of score): This is the most critical factor. Make all your payments on time, every time. Set up auto-payments or reminders if necessary. A single missed payment can significantly hurt your score.

- Credit Utilization (30% of score): This refers to the amount of credit you’re using compared to your total available credit. Aim to keep your utilization below 30% on each card and overall. As you pay down balances, your utilization ratio will decrease, positively impacting your score.

- Length of Credit History (15% of score): The longer you’ve had credit accounts open and in good standing, the better. Avoid closing old, paid-off accounts, especially if they are your oldest.

- Credit Mix (10% of score): Having a healthy mix of credit types (e.g., credit cards, installment loans) can be beneficial, but don’t open new accounts just for this purpose.

- New Credit (10% of score): Avoid opening many new credit accounts in a short period, as this can signal risk to lenders and result in hard inquiries that temporarily ding your score.

Phase 4: Advanced Tactics and Long-Term Habits

Consider a Balance Transfer (With Caution)

If you have good credit, you might qualify for a balance transfer card with a 0% APR promotional period. This can give you breathing room to pay down high-interest debt without accumulating more interest. However, be extremely careful: understand the transfer fees, and ensure you can pay off the balance before the promotional period ends, as regular APRs can be very high.

Debt Consolidation (If Appropriate)

A personal loan for debt consolidation can simplify multiple payments into one, often with a lower fixed interest rate. This can be helpful but ensure the new interest rate is genuinely lower and that you don’t then rack up new debt on the old cards.

Build an Emergency Fund

Once you start making progress on debt, prioritize building a small emergency fund (e.g., $1,000). This prevents you from relying on credit cards for unexpected expenses, halting the debt cycle.

Budgeting is Non-Negotiable

Create and stick to a realistic budget. Know exactly where your money is going and identify areas where you can cut back to free up more funds for debt repayment. Tools and apps can make this process easier.

The Ultimate Strategy: Consistency and Discipline

The ultimate strategy for crushing credit card debt and boosting your credit score isn’t a single trick, but rather a combination of informed choices, consistent effort, and unwavering discipline. It involves a systematic approach to debt repayment, a keen eye on credit-building habits, and the adoption of sound financial principles for the long haul. Celebrate small victories, stay focused on your goals, and remember that every payment, no matter how small, moves you closer to financial freedom.