For men looking to gain control of their financial future, the dual goals of building wealth and crushing debt can seem daunting. Many strategies exist, from aggressive budgeting to savvy investing, but what if there was one foundational step that could powerfully accelerate both? The answer lies in transforming your financial approach from manual to automatic.

The Unstoppable Force: Automating Your Finances

The single most effective actionable step you can take to build wealth and crush debt is to automate your financial life. This isn’t just about setting up a few recurring payments; it’s about engineering a system where your money moves where it needs to go – towards debt reduction and wealth accumulation – without requiring constant conscious effort or willpower.

Automation removes the friction, decision fatigue, and emotional impulses that often derail financial progress. When your contributions to savings, investments, and debt payments are automatically deducted from your paycheck or bank account, you dramatically increase consistency and reduce the chance of falling off track. It’s the ultimate ‘set it and forget it’ power move for your money.

Crushing Debt Through Automated Discipline

Automating your debt payments is a game-changer. Start by setting up automatic minimum payments for all your debts, ensuring you never miss a due date and incur late fees. But don’t stop there. Once your minimums are covered, identify your highest-interest debt (the avalanche method) or your smallest debt (the snowball method) and set up an additional, automatic payment specifically for that one. This extra payment, even if modest to start, compounds rapidly to reduce your principal faster.

By scheduling these additional payments to coincide with your paydays, you pay yourself first, ensuring that funds are allocated to debt reduction before you have a chance to spend them elsewhere. This systematic approach strips away the emotional weight of debt, replacing it with a predictable, relentless attack plan.

Building Wealth on Autopilot

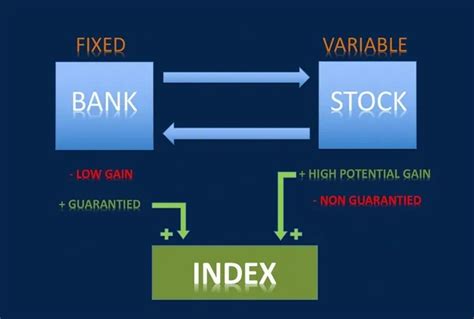

The same principle applies to wealth building. The best way to save and invest consistently is to make it automatic. Start with your employer-sponsored retirement plan (like a 401(k) or 403(b)) by setting up automatic deductions from your paycheck. Aim to contribute at least enough to get any company match, which is essentially free money. Then, gradually increase your contribution percentage over time.

Next, set up automatic transfers from your checking account to a separate high-yield savings account for your emergency fund and short-term goals. For long-term wealth beyond retirement accounts, establish automatic investments into a Roth IRA or a taxable brokerage account. Even small, consistent contributions add up significantly over years, harnessing the power of compound interest.

Your Action Plan for Automation

- Analyze Your Cash Flow: Understand exactly where your money is coming from and going. A simple budget is crucial to identify funds available for automation.

- Automate Debt Payments: Set up minimum payments for all debts and then an additional, accelerated payment for your target debt.

- Automate Savings: Schedule regular transfers to your emergency fund, then to specific short-term savings goals.

- Automate Investments: Maximize contributions to your 401(k) (at least up to the company match), then automate transfers to an IRA and/or brokerage account.

- Schedule Regular Reviews: Once a quarter, review your automated system. Are your goals still current? Can you increase your automated payments or contributions?

This systematic approach transforms financial management from a constant chore into a powerful, self-sustaining engine for progress. By removing yourself as the weakest link in the chain, you create an environment where debt is systematically attacked, and wealth is consistently built, almost effortlessly.

Embrace the Automated Advantage

Implementing a fully automated financial system is not just an actionable step; it’s a foundational shift that empowers you to achieve financial freedom. It eliminates the need for daily willpower and turns your financial goals into a relentless, self-executing process. For men serious about taking control of their money, automating your financial life is the single best step you can take to simultaneously crush debt and build lasting wealth.