In a world brimming with uncertainty, two common adversaries often stand in the way of personal well-being: the gnawing anxiety of financial fear and the persistent struggle to maintain fitness discipline. While seemingly distinct, these challenges frequently share a common psychological root. The good news is that a single, powerful mindset strategy can simultaneously disarm financial dread and supercharge your commitment to health: adopting a process-oriented approach over an outcome-oriented one.

The Pitfalls of Outcome-Oriented Thinking

Many of us are hardwired to focus on end goals: a specific net worth, a certain body weight, or a dream physique. While having clear outcomes is essential for direction, an exclusive focus on them can be detrimental. When your entire motivation hinges on an outcome that isn’t yet realized, it breeds anxiety about failure and demotivation during plateaus. Financial fear often arises from worrying about future market crashes, unexpected expenses, or simply “not having enough” – all outcome-based worries. Similarly, fitness discipline crumbles when the scale doesn’t move fast enough, or the mirror doesn’t reflect desired changes instantly, leading to feelings of inadequacy and a desire to give up.

Embracing the Power of Process-Oriented Thinking

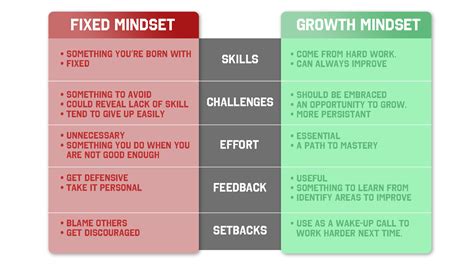

A process-oriented mindset shifts your focus from the “what” (the end goal) to the “how” (the consistent actions and habits that lead to the goal). Instead of fixating on the destination, you commit to enjoying and mastering the journey. This approach acknowledges that outcomes are often a cumulative result of small, consistent efforts rather than sudden leaps. By concentrating on what you can control – your daily actions – you reduce anxiety, build momentum, and cultivate resilience.

Defeating Financial Fear Through Process

For financial well-being, a process-oriented mindset means establishing and adhering to sound financial habits. Instead of stressing about reaching a million-dollar net worth, focus on the processes:

- Consistent Saving: Commit to saving a fixed percentage of every paycheck, regardless of market conditions.

- Diligent Budgeting: Regularly track your income and expenses, ensuring you live within or below your means.

- Educated Investing: Dedicate time each week to learning about diversified investments and sticking to a long-term strategy rather than reacting to short-term market fluctuations.

- Debt Reduction Plan: Systematically pay down high-interest debt following a structured plan (e.g., snowball or avalanche method).

By immersing yourself in these controllable processes, the fear associated with uncertain financial outcomes begins to dissipate. You build a sense of control and competence, understanding that consistent positive actions will naturally lead to improved financial security over time.

Boosting Fitness Discipline Through Process

When it comes to fitness, shifting to a process mindset transforms daunting aspirations into achievable routines. Forget the pressure of looking a certain way by a specific date, and instead, prioritize the consistent actions that contribute to health and strength:

- Regular Workouts: Commit to a specific number of workouts per week, focusing on showing up and completing the session, not just on the immediate results.

- Mindful Nutrition: Concentrate on consistently making healthy food choices, preparing balanced meals, and staying hydrated daily, rather than restricting yourself based on an ideal weight.

- Adequate Recovery: Prioritize consistent sleep patterns and active recovery, understanding these are integral parts of the fitness process.

- Skill Development: Focus on improving your form, increasing reps, or learning new exercises, which makes the journey engaging and rewarding regardless of immediate aesthetic changes.

This focus on the ‘doing’ rather than the ‘having’ makes fitness less about deprivation and more about sustainable self-care. Each completed workout, each healthy meal, is a small victory, reinforcing your discipline and building intrinsic motivation.

The Synergistic Benefits and How to Cultivate It

The beauty of the process-oriented mindset is its universality. When applied to both finance and fitness, you begin to see a powerful synergy. The discipline you build in one area often spills over into the other. Learning to consistently manage your budget can strengthen your resolve to consistently hit the gym, and vice versa. This mindset fosters patience, resilience, and a deeper appreciation for incremental progress.

To cultivate this mindset:

- Identify Your Processes: Break down your large goals into small, actionable daily or weekly tasks.

- Focus on Consistency, Not Perfection: It’s better to perform a small action consistently than to aim for perfect execution occasionally.

- Track Your Actions: Journaling or using apps to track your adherence to processes provides positive reinforcement and highlights progress.

- Celebrate Small Wins: Acknowledge and appreciate every time you successfully execute a process, no matter how minor.

- Reframe Setbacks: View missed days or financial slips as data points, not failures. Adjust your process and recommit.

Conclusion

By consciously shifting your focus from the often-daunting outcomes to the empowering, controllable processes, you can dismantle financial fear and build robust fitness discipline. This mindset isn’t just about achieving goals; it’s about transforming your relationship with effort, consistency, and self-efficacy. Embrace the journey, trust the process, and watch as both your financial landscape and physical well-being flourish.