Unlocking Your Potential: Overcoming Fitness and Finance Procrastination

Procrastination is a silent saboteur, often lurking in the shadows of our most important life domains: our health and our wealth. We know we should exercise, eat well, save money, and plan for the future, yet a powerful inertia keeps us tethered to inaction. The good news? The battle against this inertia isn’t fought with brute force, but with a strategic shift in mindset. By understanding the psychological underpinnings of procrastination and reframing our approach, we can unlock consistent progress in both fitness and finance.

The Common Threads: Why We Procrastinate on Health and Wealth

While seemingly disparate, fitness and finance share profound similarities in how they invite procrastination. Both often involve:

- Delayed Gratification: The rewards are not immediate, making it harder for our brains to prioritize long-term gain over short-term comfort or pleasure.

- Perceived Overwhelm: The sheer scope of ‘getting fit’ or ‘getting rich’ can feel immense, leading to paralysis.

- Fear of Failure/Success: Sometimes, the fear of not meeting expectations, or even the anxiety of success and its implications, can cause us to delay.

- Lack of Clarity: Vague goals (“I want to get fit,” “I need to save more”) are easily postponed because there’s no clear first step.

Mindset Shift #1: From Overwhelm to Micro-Commitments

The biggest hurdle isn’t often the task itself, but the perceived magnitude of it. Instead of committing to an hour at the gym or saving $1,000, commit to something ridiculously small. This isn’t about achieving the goal in one go; it’s about building momentum and reducing resistance.

- Fitness: “I will do 5 push-ups.” “I will walk for 10 minutes.”

- Finance: “I will check my bank balance.” “I will set aside $5 today.”

The goal is to make the start so easy that you can’t say no. Once you start, the inertia often shifts, and you might do more than you initially intended.

Mindset Shift #2: Embrace Imperfection and Consistency Over Perfection

Many of us fall into the trap of all-or-nothing thinking. If we can’t do a perfect workout or save a significant sum, we do nothing at all. This perfectionist mindset is a primary driver of procrastination. The shift lies in understanding that consistent, imperfect action beats sporadic, perfect effort every single time.

- Fitness: A 20-minute walk every day is infinitely better than an intense hour-long gym session once a month.

- Finance: Saving $10 every week is far more effective than waiting until you can save $500, which might never happen.

Let go of the ideal and embrace the real. Focus on showing up, even if it’s just for a small, imperfect contribution.

Mindset Shift #3: Future Self vs. Present Self — Bridging the Gap

Procrastination often arises from a disconnect between our present self (seeking comfort) and our future self (who benefits from current actions). To bridge this gap, visualize your future self. What does healthy you look like? What does financially secure you feel like? Make the benefits tangible and emotional.

- Fitness: Imagine the energy, confidence, and longevity you’ll have.

- Finance: Envision the freedom, reduced stress, and opportunities that financial stability provides.

Connect today’s small action to that powerful future vision. Your future self will thank your present self.

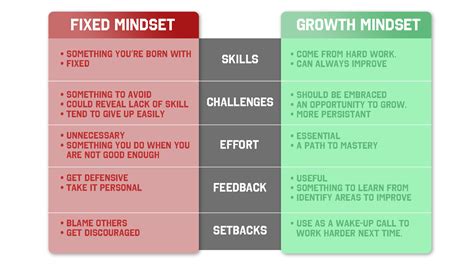

Mindset Shift #4: Identity-Based Habits – Become the Person Who Does

Instead of focusing on what you want to achieve, focus on who you want to become. This is an identity shift. When you adopt the identity of a ‘healthy person’ or a ‘financially responsible person,’ your actions naturally align with that identity.

- Fitness: “I am a person who prioritizes movement daily.” (Rather than “I need to go for a run.”)

- Finance: “I am a person who manages their money wisely.” (Rather than “I need to budget.”)

Your actions become a reflection of your identity, reinforcing it with every step you take.

Actionable Strategies for Immediate Implementation

Beyond mindset, practical tools can solidify your new approach:

- The 2-Minute Rule: If a task takes less than two minutes, do it immediately. This applies to laying out gym clothes, checking a finance app, or tidying a small area.

- Habit Stacking: Pair a new habit with an existing one. “After I brush my teeth, I will do 10 squats.” “After I get my morning coffee, I will review my budget for 5 minutes.”

- Accountability Partners: Share your goals with a friend, family member, or join a group. Knowing someone is checking in can be a powerful motivator.

- Pre-Commitment: Make decisions in advance. Pack your gym bag the night before, set up automated savings transfers, or schedule specific times for financial review.

- Reward Systems: Acknowledge small wins. A non-food reward for sticking to your workout routine, or a small treat after hitting a savings milestone.

Conclusion: The Power of Persistent, Mindful Action

Beating procrastination in fitness and finance isn’t about waiting for motivation to strike; it’s about cultivating a mindset that empowers consistent, deliberate action. By breaking down daunting tasks, embracing imperfection, connecting with your future self, and shaping your identity, you transform potential into reality. Start small, stay consistent, and watch as the cumulative power of these mindset shifts revolutionizes your health and wealth.