In today’s fast-paced world, financial stability isn’t just a goal; it’s a foundation for freedom, opportunity, and peace of mind. For many men, the drive to provide, achieve, and secure a better future is powerful. Yet, debt can feel like an insurmountable obstacle, while wealth building seems like a distant dream. The good news? It’s entirely within reach. With the right strategies and a committed mindset, you can aggressively tackle debt and forge a path to significant wealth, faster than you might think.

Phase 1: The Debt Demolition Playbook

Before you can build, you must clear the ground. Debt, especially high-interest debt, acts like a financial anchor, dragging down your progress. Here’s how to cut it loose.

1. Conduct a Brutal Financial Audit

Know your enemy. Sit down and meticulously list every single debt: credit cards, student loans, car loans, personal loans. Note the interest rate, minimum payment, and total balance for each. Simultaneously, track every dollar coming in and every dollar going out for at least a month. Use budgeting apps, spreadsheets, or even a pen and paper. This isn’t about judgment; it’s about clarity. You can’t fix what you don’t understand.

2. Choose Your Debt Slayer Strategy

Two popular methods stand out:

- Debt Snowball: Pay off your smallest debt first, then roll that payment into the next smallest. The psychological wins keep you motivated.

- Debt Avalanche: Tackle the debt with the highest interest rate first. This saves you the most money in interest over time.

Pick the method that resonates most with your personality and stick to it fiercely. The goal is to make extra payments whenever possible.

3. Slash Unnecessary Expenses Relentlessly

Every dollar saved is a dollar that can go towards debt repayment or wealth building. Go through your budget line by line. Can you cut down on dining out? Are there subscriptions you’re not using? Can you find cheaper alternatives for utilities, insurance, or even your phone plan? This isn’t about deprivation, but smart optimization. Challenge every expense and ask: “Is this essential, or can this money work harder for me?”

4. Boost Your Income Aggressively

While cutting expenses is crucial, increasing your income accelerates the process dramatically.

- Negotiate Your Salary: If you haven’t recently, research market rates and prepare a case for a raise at your current job.

- Side Hustles: Freelance, drive for a ride-sharing service, deliver food, teach a skill online, or start a small e-commerce venture. Even a few hundred extra dollars a month can make a huge difference in your debt repayment schedule.

- Monetize Hobbies: Can you turn a passion into profit? Woodworking, photography, coaching, writing – the possibilities are endless.

Direct all extra income straight towards your highest priority debt.

Phase 2: Building Your Wealth Fortress

Once debt is under control, the focus shifts to accumulating assets and making your money work for you. This is where long-term financial freedom is forged.

5. Establish Your Emergency Fund First

This is non-negotiable. Aim for 3-6 months’ worth of essential living expenses stored in a separate, easily accessible savings account. This fund acts as your financial shield against unexpected job loss, medical emergencies, or car repairs, preventing you from falling back into debt.

6. Automate Your Savings and Investments

Pay yourself first. Set up automatic transfers from your checking account to your savings, investment accounts (401k, Roth IRA, brokerage), and even your emergency fund. This removes the temptation to spend the money and ensures consistent progress. Treat these transfers like non-negotiable bills.

7. Invest Smartly for Growth

Once your emergency fund is solid and debt is managed, it’s time to put your money to work.

- Max Out Retirement Accounts: Contribute at least enough to get any employer match in your 401(k) – it’s free money! Then consider maxing out a Roth IRA or traditional IRA.

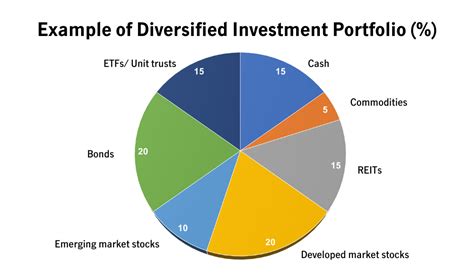

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in a mix of stocks (through low-cost index funds or ETFs), bonds, and potentially real estate.

- Long-Term Mindset: Resist the urge to chase short-term gains. Wealth building is a marathon, not a sprint. Compounding interest is your most powerful ally over decades.

Educate yourself continually about investing, but avoid speculative fads.

8. Prioritize Financial Literacy and Continuous Learning

The financial landscape is always evolving. Make it a habit to read financial books, follow reputable financial news, listen to podcasts, and understand economic principles. The more you know, the better decisions you can make. Staying informed empowers you to adapt your strategies and identify new opportunities for growth.

The Road Ahead: Consistency and Discipline

Crushing debt and building wealth isn’t a one-time event; it’s a journey that requires consistency, discipline, and regular adjustments. It means making conscious choices every day that align with your financial goals. Celebrate your small victories, learn from setbacks, and always keep your eyes on the ultimate prize: financial freedom. The power to transform your financial future is in your hands – seize it.