Taking Charge: Your Financial Power Play

For many men, taking control of personal finances can feel like a daunting task, a mountain to climb. But it doesn’t have to be. With the right strategies and a determined mindset, you can not only crush debt but also build substantial savings at an accelerated pace. This guide is designed to equip you with practical, no-nonsense tips to get your finances in prime shape, fast.

The First Strike: Understanding Your Financial Battlefield

Before you can win the war, you need to understand the terrain. The first step to crushing debt and boosting savings is a brutal, honest assessment of your current financial standing. Gather all your bank statements, credit card bills, loan documents, and investment portfolios.

- Calculate Your Net Worth: Subtract your total liabilities (debts) from your total assets (savings, investments, property). This number is your baseline.

- Track Every Dollar: For at least a month, meticulously track every single dollar you spend. Use an app, a spreadsheet, or even a notebook. This will reveal where your money is actually going versus where you think it’s going.

- Set Clear, Ambitious Goals: Don’t just say, “I want to save more.” Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. E.g., “Pay off $5,000 of credit card debt by end of year” or “Save $10,000 for a down payment in 18 months.”

Crushing Debt: Aggressive Strategies for a Debt-Free Future

Debt is like a financial anchor, dragging down your progress. To boost savings fast, you must first lighten this load.

Prioritize High-Interest Debt

Focus your efforts on the debt that costs you the most. This usually means credit cards, personal loans, or other high-interest consumer debt.

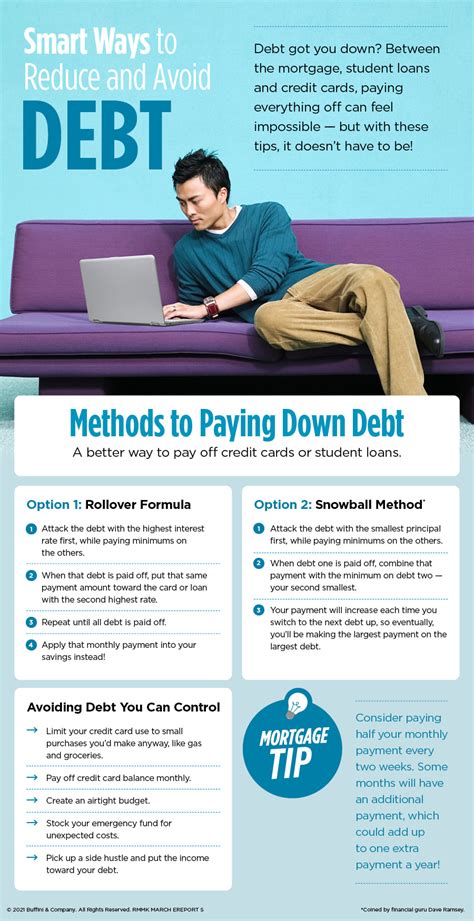

- Debt Avalanche Method: List all your debts from highest interest rate to lowest. Pay the minimum on all but the highest-interest debt, and throw every extra dollar you have at that one. Once it’s paid off, roll that payment amount into the next highest-interest debt. This saves you the most money in interest.

- Debt Snowball Method: List your debts from smallest balance to largest. Pay the minimum on all but the smallest debt, and aggressively pay that one off. The psychological wins can keep you motivated.

Drastic Expense Reduction

Look for areas to cut back, even if it feels uncomfortable at first. These cuts don’t have to be permanent, just while you’re in aggressive debt-crushing mode.

- Review Subscriptions: Cancel unused gym memberships, streaming services, or apps.

- Eat At Home: Dining out and daily coffees add up quickly. Pack your lunch and brew your own coffee.

- Reduce & Reuse: Can you carpool, use public transport, or delay that new gadget purchase?

Boost Your Income Streams

Sometimes, cutting expenses isn’t enough. Look for ways to earn more. Even an extra few hundred dollars a month can significantly accelerate your debt payoff.

- Side Hustles: Freelance in your area of expertise, drive for a ride-share service, deliver food, or offer handyman services.

- Sell Unused Items: Clear out your garage, attic, or closet. Sell clothes, electronics, furniture, or collectibles on online marketplaces.

- Negotiate a Raise: If you’re a valuable employee, make a case for a raise at your current job.

Boosting Savings: Building Your Financial Fortress

Once you’ve started to dismantle your debt, pivot that momentum directly into building your savings. Think of it as a financial fortress protecting your future.

Automate Your Savings

The easiest way to save is to make it automatic. Set up automatic transfers from your checking to your savings account immediately after you get paid. “Pay yourself first” is a mantra for a reason.

- Emergency Fund First: Before investing heavily, build an emergency fund of 3-6 months’ worth of living expenses. This protects you from unexpected job loss, medical emergencies, or car repairs without going back into debt.

- Retirement Accounts: Max out your employer-sponsored 401(k) (especially if there’s a match – that’s free money!), then consider Roth IRAs or traditional IRAs. The power of compounding interest over decades is immense.

Invest Smartly for Growth

Beyond basic savings, smart investments can significantly boost your wealth over time.

- Diversify: Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds, real estate) and industries.

- Low-Cost Index Funds/ETFs: For most investors, these are an excellent, low-maintenance way to get broad market exposure and good returns.

- Educate Yourself: Learn about different investment vehicles. Understanding what you’re investing in is crucial.

Track Progress and Stay Motivated

Regularly review your financial progress. Seeing your debt diminish and savings grow will provide powerful motivation to stick to your plan. Celebrate milestones, no matter how small, to reinforce positive habits.

Conclusion: Your Path to Financial Freedom

Crushing debt and boosting savings fast isn’t about magic; it’s about discipline, strategic planning, and consistent action. By understanding your finances, aggressively tackling debt, and systematically building your savings, you’re not just improving your bank account – you’re building a foundation for a more secure, flexible, and prosperous future. Take these tips, implement them with conviction, and watch your financial landscape transform.