Credit card debt can feel like a heavy burden, hindering your financial progress and causing significant stress. Many find themselves trapped in a cycle of minimum payments and mounting interest, making the path to freedom seem impossible. However, with a strategic approach and consistent effort, it is entirely possible to not only eliminate this debt quickly but also to lay a robust foundation for a healthier financial future. This article will guide you through actionable steps to tackle your credit card debt head-on and empower you to rebuild your finances.

Grasping the Scope of Your Debt

Before you can crush your debt, you need to understand its full scope. Gather all your credit card statements. List out each card, its outstanding balance, and most importantly, its interest rate (APR). This clear overview will be crucial for determining the most effective repayment strategy, whether it’s focusing on high-interest cards first or tackling smaller balances for motivational wins.

Accelerating Your Debt Repayment

Once you have a clear picture, it’s time to choose a battle plan. There are several powerful strategies to help you pay down debt faster than just making minimum payments.

The Debt Snowball vs. Debt Avalanche

The two most popular methods are the debt snowball and the debt avalanche. The debt snowball method involves paying off your smallest debt first while making minimum payments on all others. Once that smallest debt is gone, you roll the payment amount you were making (plus the old minimum payment) into the next smallest debt. This method provides psychological wins early on, keeping motivation high.

The debt avalanche method focuses on paying off the debt with the highest interest rate first, while making minimum payments on the rest. Once the highest-interest debt is cleared, you move on to the next highest. This method saves you the most money in interest over time, making it mathematically superior.

Aggressive Budgeting and Expense Cutting

A tight budget is your best friend when battling debt. Scrutinize every line item of your spending. Identify non-essential expenses like dining out, subscriptions you don’t use, or impulse purchases, and drastically cut them. Redirect every extra dollar towards your credit card debt. Even small cuts can add up to significant progress over time.

Boosting Your Income

Beyond cutting expenses, look for ways to increase your income. This could involve taking on a side hustle, working overtime, selling unused items, or asking for a raise at your current job. The more money you can throw at your debt, the faster it will disappear, accelerating your journey to financial freedom.

Exploring Debt Consolidation Options

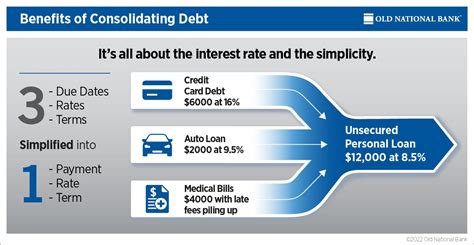

For those with multiple high-interest debts, consolidation can be a game-changer. A balance transfer credit card might offer a 0% introductory APR for a period, allowing you to pay down principal without interest. Be wary of fees and ensure you can pay off the transferred balance before the promotional period ends. Alternatively, a personal loan with a lower fixed interest rate can consolidate multiple debts into one manageable monthly payment, often at a significantly lower rate than credit cards.

Negotiating with Creditors

If you’re struggling to make payments, don’t be afraid to contact your creditors. Some may be willing to work with you by lowering your interest rate, waiving fees, or offering a temporary hardship plan. It never hurts to ask, and it can provide much-needed breathing room during difficult times.

Rebuilding Your Financial Foundation

Paying off debt is just the first step. The next crucial phase is to rebuild and strengthen your overall financial health to prevent future debt accumulation.

Establishing an Emergency Fund

Once your high-interest credit card debt is gone, your top priority should be building an emergency fund. Aim for at least 3-6 months’ worth of essential living expenses saved in an easily accessible, separate account. This fund acts as a buffer against unexpected costs, preventing you from resorting to credit cards again.

Improving Your Credit Score

As you pay down debt, your credit score will naturally improve. Continue to make all payments on time and keep your credit utilization low (ideally below 30%). A good credit score opens doors to better interest rates on future loans and mortgages, saving you money in the long run.

Building Savings and Investments

With your emergency fund in place, start allocating funds towards longer-term savings goals like retirement, a down payment on a house, or your children’s education. Automate these savings to make them consistent and effortless. Consider consulting a financial advisor to help you navigate investment options tailored to your goals and risk tolerance.

Cultivating Sustainable Financial Habits

The most important part of financial rebuilding is adopting healthy habits. Stick to your budget, live below your means, regularly review your financial situation, and avoid unnecessary debt. Financial freedom is not a destination but a continuous journey of mindful choices and disciplined actions.

The Path to Financial Freedom

Crushing credit card debt and rebuilding your finances requires discipline, patience, and a well-thought-out plan. It’s not always easy, but the relief and long-term security it brings are immeasurable. By consistently applying these strategies, you’ll not only shed the weight of debt but also empower yourself to achieve lasting financial well-being and pursue your future goals with confidence.