Building Financial Freedom: A Roadmap for Men

Building financial wealth from scratch might seem like an insurmountable challenge, especially in today’s economic climate. However, with discipline, strategic planning, and consistent effort, any man can lay a solid foundation for financial independence and prosperity. It’s not about complex algorithms or insider secrets; it’s about mastering fundamental principles and executing them relentlessly. Here are the top three actionable steps for men ready to transform their financial future.

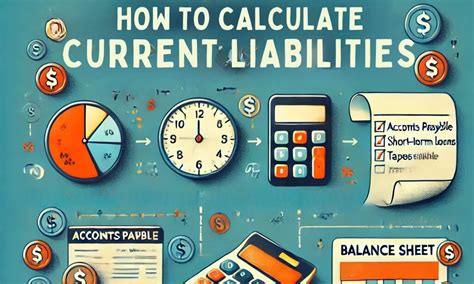

Step 1: Master Your Cash Flow and Eradicate High-Interest Debt

The bedrock of all wealth building is a thorough understanding and control of your cash flow. You cannot grow what you don’t manage. This step involves two critical components: meticulous budgeting and aggressive debt elimination.

First, meticulously track every dollar in and every dollar out for at least a month. Use an app, a spreadsheet, or even pen and paper. Categorize your expenses to identify where your money is actually going. This awareness is often the most shocking and illuminating part of the process. Once you have this data, create a realistic budget that prioritizes essential needs, allocates funds for savings and investments, and ruthlessly cuts unnecessary expenditures. Think of your budget as a spending plan, not a restrictive cage.

Second, aggressively tackle high-interest debt, such as credit card balances or personal loans. The interest rates on these debts can quickly erode any savings or investment gains. Prioritize paying off the debt with the highest interest rate first (often referred to as the ‘debt avalanche’ method) or focusing on the smallest balance first for motivational wins (‘debt snowball’). Freeing yourself from this financial burden will liberate significant cash flow that can then be redirected towards wealth-building assets.

Step 2: Invest in Yourself and Maximize Earning Potential

While managing expenses is crucial, there’s a limit to how much you can save by cutting costs. True wealth acceleration often comes from increasing your income. This step focuses on investing in your most valuable asset: yourself.

Identify skills that are in high demand in your current industry or in emerging fields. Take courses, earn certifications, or pursue higher education. Continuously learning and upskilling makes you more valuable to employers and opens doors to higher-paying roles. Don’t shy away from negotiating your salary or seeking promotions. Your career is a primary vehicle for income generation, so treat it with the strategic importance it deserves.

Beyond your primary job, explore opportunities for side hustles or starting a small business. Whether it’s freelancing, consulting, creating digital products, or even a service-based business, a secondary income stream can dramatically accelerate your ability to save and invest. This diversifies your income and reduces reliance on a single source, adding a layer of financial security.

![[100+] Career Wallpapers | Wallpapers.com](/images/aHR0cHM6Ly90czIubW0uYmluZy5uZXQvdGg/aWQ9T0lQLk5tMWtIQ0tCX0x1dFMtQVRXeUpJY0FIYUVLJnBpZD0xNS4x.webp)

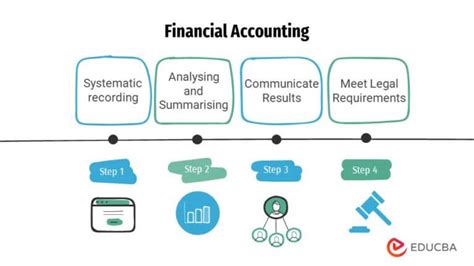

Step 3: Implement Systematic Saving and Intelligent Investing

With your cash flow under control and your earning potential growing, the final step is to put your money to work through systematic saving and intelligent investing. Consistency is key here.

Automate your savings. Set up automatic transfers from your checking account to a dedicated savings or investment account immediately after you get paid. Even a small amount consistently saved will compound over time. Aim to build an emergency fund covering 3-6 months of living expenses before delving into riskier investments.

Once your emergency fund is solid, begin investing. Start simple: consider low-cost index funds or Exchange Traded Funds (ETFs) that track broad market indices like the S&P 500. These offer diversification and tend to perform well over the long term without requiring extensive market knowledge. Contribute regularly, regardless of market fluctuations. Time in the market, not timing the market, is what builds significant wealth. Understand the power of compound interest – your money earning money – and let it work its magic over decades. As you gain more knowledge and experience, you might explore other avenues like real estate, individual stocks, or entrepreneurial ventures, but the core principle remains: consistent, diversified investment over the long haul.

The Path to Financial Prosperity

Building financial wealth from scratch is a journey, not a sprint. It requires discipline, patience, and a willingness to learn and adapt. By mastering your cash flow, relentlessly pursuing opportunities to increase your income, and consistently investing for the long term, any man can move from financial uncertainty to a position of strength and prosperity. Start today, take these actionable steps, and commit to the process for a richer, more secure future.