For many men, the concept of budgeting can feel restrictive or, worse, unmasculine. However, understanding and mastering your money is one of the most powerful moves you can make for your future, your family, and your peace of mind. A killer financial growth plan isn’t about deprivation; it’s about strategic allocation, smart goals, and building a foundation for true wealth and freedom. Let’s break down how to get there.

Why Budgeting is Your Ultimate Financial Tool

Think of your finances like a high-performance machine. Without a detailed understanding of its components – how much fuel (income) comes in, where it’s being used (expenses), and what upgrades are needed (investments) – you’re driving blind. Budgeting provides the dashboard, allowing you to see exactly what’s happening, identify leaks, and optimize for maximum performance. It’s not about being cheap; it’s about being powerful and intentional with every dollar.

This systematic approach helps you move beyond living paycheck to paycheck and starts building a roadmap towards significant financial milestones, from buying a home to securing a comfortable retirement. It shifts your mindset from reacting to money to actively directing it.

Step 1: Know Your Numbers – Income and Expenses

Before you can make any plan, you need a clear snapshot of your current financial reality. This involves two critical components:

Tracking Your Income

List all sources of income you receive regularly. This might include your primary salary, freelance work, rental income, or any other consistent cash flow. Be precise about the net amount (after taxes and deductions) you actually take home.

Identifying Your Expenses

This is where the real detective work begins. Categorize your spending into two main types:

- Fixed Expenses: These are consistent payments that don’t change much month to month. Examples include rent/mortgage, car payments, insurance premiums, and subscriptions.

- Variable Expenses: These fluctuate each month and are often where you have the most control. Think groceries, dining out, entertainment, utilities, and discretionary spending.

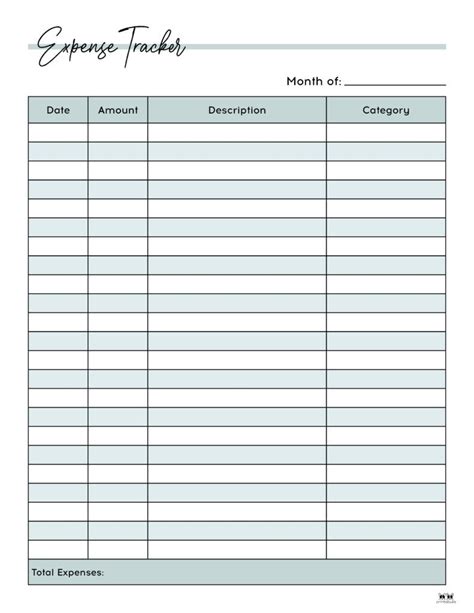

For a month or two, rigorously track every dollar you spend. Use a spreadsheet, a budgeting app, or even a simple notebook. The goal is to gain an honest understanding of where your money is actually going versus where you *think* it’s going. This step often reveals surprising insights and potential areas for optimization.

Step 2: Define Your Financial Goals

A budget without goals is like a ship without a destination. What do you want your money to do for you? Setting clear, measurable, and time-bound goals will give your budget purpose and motivation.

Short-Term Goals (1-2 years)

- Build an emergency fund (3-6 months of living expenses)

- Pay off high-interest debt (credit cards, personal loans)

- Save for a significant purchase (new gadget, vacation)

Mid-Term Goals (3-5 years)

- Save for a down payment on a house or car

- Invest in professional development or education

- Start a small business fund

Long-Term Goals (5+ years)

- Retirement planning

- Children’s education fund

- Investment portfolio growth

- Achieving financial independence

Prioritize your goals and assign a dollar amount and a timeline to each. This clarity transforms abstract desires into actionable targets.

Step 3: Choose Your Budgeting Strategy

There isn’t a one-size-fits-all approach to budgeting. Find a method that resonates with your personality and financial situation:

The 50/30/20 Rule

- 50% Needs: Housing, utilities, groceries, transportation, insurance, minimum debt payments.

- 30% Wants: Dining out, entertainment, hobbies, travel, shopping.

- 20% Savings & Debt Repayment: Emergency fund, retirement, investments, extra debt payments.

This rule is simple to implement and provides a good framework for balancing spending with saving.

Zero-Based Budgeting

Every dollar is assigned a job. At the beginning of the month, you allocate every dollar of your income to expenses, savings, or debt repayment until your income minus your expenses equals zero. This method ensures maximum intentionality with your money and is excellent for those who want tight control.

The Envelope System

Best for those who prefer a tangible approach or struggle with overspending on variable categories. You allocate cash into physical envelopes for categories like groceries, dining out, and entertainment. Once an envelope is empty, you stop spending in that category until the next budgeting cycle.

Step 4: Automate and Accelerate Your Growth

Once you have your plan, make it as effortless as possible to stick to it.

Automate Savings and Investments

Set up automatic transfers from your checking account to your savings, investment accounts, and debt repayment funds immediately after you get paid. “Pay yourself first” is a cornerstone of financial growth. Even small, consistent contributions add up significantly over time due to compound interest.

Regular Review and Adjustment

Life changes, and so should your budget. Review your budget monthly or quarterly. Are your goals still relevant? Have your income or expenses changed? Adjust your allocations as needed. This flexibility prevents your budget from becoming a rigid, frustrating document.

Seek Financial Education

Continuously educate yourself about personal finance, investing, and wealth building. Read books, listen to podcasts, and follow reputable financial advisors. The more you know, the better decisions you can make to accelerate your financial growth.

Conclusion: Your Path to Financial Mastery

Creating a killer financial growth plan is not a one-time event; it’s an ongoing journey of learning, discipline, and optimization. By understanding your money, setting clear goals, choosing a suitable budgeting strategy, and automating your process, you move from merely existing financially to actively building the life you want. Embrace the challenge, stay consistent, and watch your financial future transform from uncertain to truly powerful.