Starting Your Wealth Building Journey: A Beginner’s Guide

For many, the world of investing can seem intimidating, filled with jargon and complex strategies. However, building wealth is an achievable goal for anyone willing to learn the ropes and take consistent action. It’s not about getting rich quick, but rather about laying a solid foundation and making smart, informed decisions over time. If you’re new to investing, understanding the essential first steps can demystify the process and set you on a clear path towards financial prosperity.

1. Understand Your Current Financial Situation

Before you can invest, you need a clear picture of where you stand financially. This means understanding your income, expenses, assets, and liabilities. Creating a detailed budget is the cornerstone of this step. Track every dollar coming in and going out for a month or two. This exercise will reveal your spending habits and identify areas where you can save more.

Knowing your net worth (assets minus liabilities) also provides a crucial baseline. Tools like spreadsheets or budgeting apps can help you organize this information, giving you the clarity needed to make future financial decisions.

2. Set Clear Financial Goals

Why do you want to invest? Is it for a down payment on a house, your child’s education, retirement, or simply financial independence? Defining your financial goals, both short-term (1-5 years) and long-term (5+ years), will provide direction and motivation. Ensure your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Having clear objectives helps you choose appropriate investment vehicles and understand the risk levels you’re comfortable with. For instance, funds for a short-term goal might require less volatile investments than those for retirement decades away.

3. Build a Robust Emergency Fund

This step is non-negotiable before you even think about investing. An emergency fund is a stash of readily accessible cash, typically held in a high-yield savings account, to cover unexpected expenses like job loss, medical emergencies, or car repairs. Financial experts generally recommend having 3-6 months’ worth of essential living expenses saved.

Without an emergency fund, you might be forced to sell investments at an inopportune time or go into debt when an unforeseen event occurs, derailing your wealth-building efforts.

4. Tackle High-Interest Debt

High-interest debt, such as credit card balances or personal loans, can be a major impediment to building wealth. The interest rates on these debts often outpace potential investment returns, meaning you’re effectively losing money by holding onto them. Prioritize paying off these debts before allocating significant funds to investments.

Strategies like the ‘debt snowball’ (paying smallest balance first) or ‘debt avalanche’ (paying highest interest rate first) can help you systematically eliminate these financial burdens and free up more capital for investing.

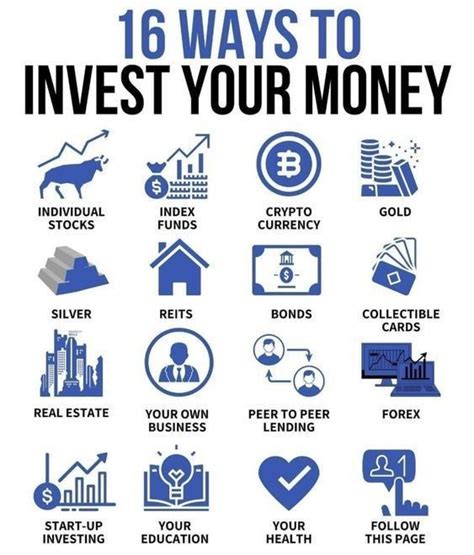

5. Learn the Basics of Investing

You don’t need to become a market expert overnight, but understanding fundamental investment concepts is crucial. Familiarize yourself with different asset classes, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Learn about diversification – spreading your investments across various asset types and industries to reduce risk.

Resources like reputable financial blogs, books, podcasts, and online courses can provide a solid educational foundation. Focus on long-term investing principles rather than trying to time the market.

6. Start Small and Automate Your Investments

The best time to start investing is now, even if you can only afford a small amount. Consistency is far more important than the initial sum. Many brokerage firms allow you to start with minimal amounts, sometimes as little as $50 or $100 per month.

Set up automatic transfers from your checking account to your investment account. This ‘set it and forget it’ approach ensures you’re consistently contributing, taking advantage of dollar-cost averaging (investing a fixed amount regularly, regardless of market fluctuations) and the power of compounding.

7. Consider Seeking Professional Advice

While self-education is powerful, sometimes professional guidance can be invaluable, especially as your financial situation becomes more complex. A qualified financial advisor can help you create a personalized investment plan, understand tax implications, and navigate market volatility. Look for fiduciaries who are legally obligated to act in your best interest.

Conclusion

Building wealth is a marathon, not a sprint. It requires discipline, patience, and continuous learning. By systematically addressing these essential first steps – understanding your finances, setting clear goals, building an emergency fund, eliminating high-interest debt, educating yourself, and starting to invest consistently – you’ll establish a robust framework for long-term financial success. Remember, every great financial journey begins with a single, well-planned step.