Laying the Foundation: Why Early Financial Moves Matter

For young men on the cusp of their careers or already in the early stages, the concept of building wealth can seem daunting, yet it’s one of the most empowering pursuits. The decisions made in your 20s and 30s will profoundly shape your financial future, determining the pace at which you achieve independence and security. This isn’t just about accumulating money; it’s about gaining freedom, creating opportunities, and establishing a robust legacy.

The smartest approach combines discipline, strategic investing, and a commitment to continuous learning. Forget get-rich-quick schemes; true wealth is built through consistent, informed action over time.

Step 1: Master Your Money – The Non-Negotiable Basics

Budgeting and Tracking Expenses

Before you can invest, you need to know where your money is going. Create a budget that outlines your income and expenses. Utilize apps, spreadsheets, or even a simple notebook. The goal is to identify unnecessary spending and allocate funds towards savings and investments. Knowledge is power, and knowing your cash flow is the first step to controlling it.

Build a Robust Emergency Fund

Life is unpredictable. A fully funded emergency fund (typically 3-6 months of living expenses) in a high-yield savings account is your financial safety net. This fund prevents you from going into debt or having to liquidate investments during unexpected events like job loss, medical emergencies, or car repairs.

Eliminate High-Interest Debt

Credit card debt and personal loans can erode your financial progress faster than any investment can build it. Prioritize paying off high-interest debt aggressively. The interest rate on these debts often far exceeds any returns you might see from investing, making debt elimination a guaranteed high “return” on your money.

Step 2: Embrace the Power of Compounding and Early Investing

Start Early, Start Small, Stay Consistent

The single greatest advantage young men have is time. Compound interest, often called the eighth wonder of the world, allows your investments to grow exponentially over decades. Even starting with small, consistent contributions will yield significant results over time. Delaying even a few years can cost you hundreds of thousands of dollars in potential returns.

Automate Your Investments

Set up automatic transfers from your checking account to your investment accounts immediately after payday. This “pay yourself first” strategy ensures you’re consistently investing without having to think about it, removing the temptation to spend the money instead.

Step 3: Smart Investment Avenues for Long-Term Growth

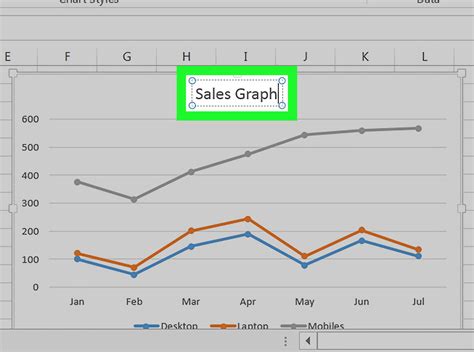

Low-Cost Index Funds and ETFs

For most young investors, broad-market index funds or Exchange-Traded Funds (ETFs) are an ideal starting point. These funds offer diversification across hundreds or thousands of companies, reducing risk, and come with very low fees. Examples include funds tracking the S&P 500 or the total stock market. They allow you to participate in the overall growth of the economy without needing to pick individual stocks.

Maximize Retirement Accounts (401k, Roth IRA)

Take full advantage of tax-advantaged retirement accounts. If your employer offers a 401(k) match, contribute enough to get the full match – it’s free money! A Roth IRA is another excellent choice, allowing your investments to grow tax-free and withdrawals in retirement to be tax-free. These accounts are powerful tools for long-term wealth accumulation.

Consider Real Estate (Long-Term Perspective)

While often requiring more capital, real estate can be a powerful wealth builder. This could involve purchasing your first home and building equity, or exploring rental properties. Real estate offers potential for appreciation, rental income, and tax benefits, but also comes with responsibilities and less liquidity.

Step 4: Accelerate Your Wealth Building

Increase Your Income

While smart investing is crucial, increasing your income significantly speeds up wealth creation. Focus on career advancement, acquire new skills, negotiate raises, or explore side hustles. The more you earn, the more you can save and invest.

Avoid Lifestyle Inflation

As your income grows, it’s natural to want to upgrade your lifestyle. However, be mindful of lifestyle inflation, where increased earnings lead to increased spending without a proportional increase in savings or investments. Maintain a disciplined approach to spending and continue to live below your means.

Continuous Learning and Adaptability

The financial landscape is constantly evolving. Stay informed about market trends, investment strategies, and economic developments. Read books, listen to podcasts, and follow reputable financial news sources. Adapt your strategies as you gain more knowledge and as your life circumstances change.

The Road to Financial Freedom Starts Now

Building wealth rapidly as a young man isn’t about luck; it’s about making conscious, strategic choices. By establishing a solid financial foundation, embracing the power of early and consistent investing, and continuously seeking ways to grow your income and knowledge, you can set yourself on an accelerated path to financial independence and a life of greater choice and security. The time to act is now – your future self will thank you.