The Dual Challenge: Eliminating Debt and Cultivating Wealth

High-interest debt can feel like a relentless current, pulling you further away from financial freedom. It siphons off hard-earned money that could otherwise be contributing to your future wealth. However, with a strategic approach and disciplined execution, it’s entirely possible to not only eliminate this burdensome debt but also to build a robust financial foundation that supports lasting prosperity. This article outlines actionable tactics to help you achieve both.

Phase 1: Aggressively Conquering High-Interest Debt

The first step toward financial wealth is to free yourself from the shackles of high-interest obligations, such as credit card balances, personal loans, and payday loans. These debts accumulate rapidly due to their steep interest rates, making them a priority target.

1. Understand Your Debt Landscape

- List All Debts: Compile a comprehensive list of all your debts, including the creditor, current balance, interest rate, and minimum monthly payment.

- Calculate Total Interest: See the true cost of your high-interest debts. This often provides motivation for accelerated repayment.

2. Choose a Repayment Strategy

- Debt Avalanche Method: Prioritize paying off debts with the highest interest rates first, while making minimum payments on others. Once the highest-rate debt is paid off, roll that payment amount into the next highest-rate debt. This method saves you the most money on interest over time.

- Debt Snowball Method: Focus on paying off the smallest debt balance first, while making minimum payments on others. Once paid, take the money you were paying on that debt and add it to the payment of the next smallest debt. This method provides psychological wins, keeping you motivated.

3. Explore Consolidation and Refinancing

If you have good credit, consider options like a personal loan or a balance transfer credit card with a 0% introductory APR. These can consolidate multiple high-interest debts into a single payment, often at a lower overall interest rate. Be cautious with balance transfers, ensuring you pay off the balance before the introductory period ends.

4. Boost Your Repayment Power

- Cut Expenses Ruthlessly: Temporarily reduce discretionary spending (dining out, entertainment, subscriptions) to free up more money for debt payments. Create a strict budget and stick to it.

- Increase Income: Look for opportunities to earn extra money through side hustles, freelance work, selling unused items, or negotiating a raise at your current job. Every extra dollar should go directly towards debt reduction.

Phase 2: Building Lasting Financial Wealth

Once high-interest debt is under control or eliminated, you can pivot your focus towards accumulating assets and securing your financial future. This phase requires consistency, strategic planning, and patience.

1. Establish a Robust Emergency Fund

Before significant investing, build an emergency fund covering 3-6 months of essential living expenses. This fund acts as a financial safety net, preventing new debt accumulation during unexpected events like job loss, medical emergencies, or car repairs. Keep it in an easily accessible, high-yield savings account.

2. Master Your Budget and Track Your Spending

A budget isn’t just for debt repayment; it’s a critical tool for wealth building. Understand where your money comes from and where it goes. Use budgeting apps or spreadsheets to categorize expenses, set spending limits, and identify areas where you can save more for investing.

3. Automate Savings and Investments

Adopt the ‘pay yourself first’ principle. Set up automatic transfers from your checking account to your savings and investment accounts on payday. Even small, consistent contributions add up significantly over time thanks to the power of compounding.

4. Prioritize Retirement Savings

- Employer-Sponsored Plans (401(k), 403(b)): Contribute enough to at least get any employer match – it’s free money! Maximizing these contributions offers significant tax advantages and long-term growth.

- Individual Retirement Accounts (IRAs): Explore Roth or Traditional IRAs. Roth IRAs offer tax-free withdrawals in retirement, while Traditional IRAs may provide an upfront tax deduction.

5. Diversify Your Investments

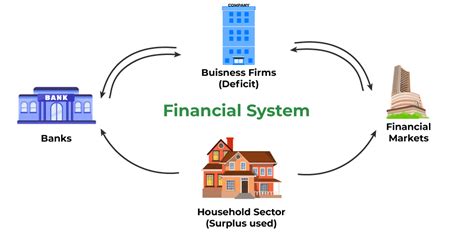

Beyond retirement accounts, consider other investment vehicles to diversify and grow your wealth:

- Index Funds and ETFs: These offer broad market exposure and diversification at a low cost.

- Stocks and Bonds: A balanced portfolio typically includes a mix of equities for growth and bonds for stability.

- Real Estate: Investing in rental properties or REITs (Real Estate Investment Trusts) can provide additional income and asset appreciation.

6. Continuous Financial Education

The financial landscape is always evolving. Commit to lifelong learning about personal finance, investing strategies, and economic trends. Read books, follow reputable financial news sources, and consider consulting with a certified financial planner as your wealth grows.

Conclusion: A Journey of Discipline and Reward

Eliminating high-interest debt and building lasting financial wealth are not overnight achievements but rather a journey that demands discipline, strategic planning, and unwavering commitment. By aggressively tackling your debt, establishing a robust emergency fund, and consistently investing in your future, you can transform your financial situation and pave the way for a life of greater security, opportunity, and freedom. Start today, stay consistent, and watch your financial future flourish.