Navigating the Dual Path to Financial Freedom

For many men, the quest for financial security often feels like a two-front war: on one side, the relentless pressure of debt, and on the other, the urgent need to build wealth for the future. It’s a common misconception that you must conquer one before even considering the other. However, with strategic planning and a disciplined approach, it’s entirely possible to simultaneously chip away at debt and build a robust investment portfolio.

This article will guide you through practical, actionable strategies designed to empower you to tackle your financial obligations head-on while intelligently growing your assets, setting you on a clear path to financial independence.

Understanding Your Debt Landscape

Before you can crush debt, you need to understand it. Identify all your outstanding debts – credit cards, student loans, car loans, mortgages – noting their interest rates, balances, and minimum payments. High-interest debts, particularly credit card balances, act as an anchor, significantly slowing down your wealth-building efforts. Prioritizing these is often the most impactful first step.

Debt Reduction Strategies:

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first, while making minimum payments on others. Once the highest-interest debt is gone, apply that payment amount to the next highest. This method saves you the most money in interest over time.

- Debt Snowball: Pay off the smallest debt first to gain psychological momentum, then apply that payment to the next smallest. While it might cost slightly more in interest, the quick wins can be incredibly motivating for those who need a boost.

- Consolidation/Refinancing: For eligible debts, consider consolidating high-interest debts into a lower-interest personal loan or refinancing your mortgage. This can lower your monthly payments and overall interest costs.

Building Your Investment Foundation

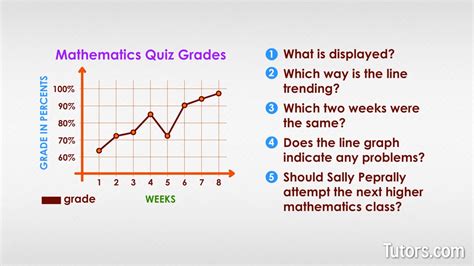

While aggressively tackling debt, you shouldn’t neglect your investment future. Smart investing doesn’t always mean large sums; consistency and time are often more crucial. The key is to start early, even with small amounts, to leverage the power of compound interest.

Key Investment Pillars:

- Emergency Fund First: Before significant investing, establish an emergency fund of 3-6 months’ living expenses in a high-yield savings account. This safety net prevents future debts when unexpected events occur.

- Employer Match (Free Money): If your company offers a 401(k) match, contribute at least enough to get the full match. This is an immediate, guaranteed return on your investment that you shouldn’t pass up.

- Diversification is Key: Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds, real estate) and geographies to mitigate risk. Low-cost index funds and ETFs are excellent tools for broad diversification.

- Long-Term Mindset: Investing is a marathon, not a sprint. Focus on long-term growth and avoid emotional decisions based on short-term market fluctuations.

The Simultaneous Attack Plan: Balancing Debt & Investment

The real challenge and opportunity lie in executing both strategies concurrently. Here’s how to create a balanced approach:

- Prioritize High-Interest Debt: Generally, if your debt has an interest rate higher than what you realistically expect to earn from a relatively safe investment (e.g., credit card debt often exceeds 15-20%), attacking that debt should be your primary focus after securing your emergency fund and employer 401(k) match.

- Allocate a Percentage: Dedicate a specific percentage of any extra income (raises, bonuses, side hustle earnings) to debt repayment and another percentage to investments. For example, an 80/20 split (80% to debt, 20% to investment) or 50/50 depending on your debt rates and risk tolerance.

- Automate Everything: Set up automatic payments for your debts and automatic contributions to your investment accounts. This “set it and forget it” approach ensures consistency and reduces the chance of impulsive spending.

- Budgeting & Tracking: Create a detailed budget to understand where your money is going. Regularly track your progress on both debt reduction and investment growth. Seeing tangible progress is a powerful motivator.

Cultivating a Winning Financial Mindset

Beyond the numbers, financial fitness is about mindset. It requires discipline, patience, and a willingness to continuously learn. Challenge common financial myths, such as “investing is only for the rich” or “debt is unavoidable.”

Educate yourself on personal finance through reputable sources, books, and courses. Consider seeking advice from a certified financial planner, especially as your financial situation becomes more complex. A professional can provide personalized strategies and help you stay on track.

Remember, financial fitness isn’t a destination but an ongoing journey. Celebrate small victories, learn from setbacks, and stay committed to your goals.

Your Path to Financial Empowerment

Crushing debt while investing smart isn’t just about accumulating wealth; it’s about gaining control, reducing stress, and building a secure future for yourself and your loved ones. By understanding your debt, strategically investing, balancing your efforts, and maintaining a positive financial mindset, you can achieve both simultaneously. Start today, stay consistent, and watch your financial fitness transform.