Taking Control: The First Steps to Financial Freedom

For many men, the path to financial freedom often feels like an uphill battle, especially when burdened by credit card debt. However, with a strategic approach to budgeting and a commitment to disciplined spending, it’s entirely possible to not only conquer debt but also build substantial wealth. This guide will provide a clear, actionable roadmap, focusing on practical steps that empower men to take charge of their financial destinies.

The journey begins with a clear understanding of your current financial landscape. This means knowing precisely what’s coming in, what’s going out, and where your money is truly going. Without this foundational knowledge, any attempt at budgeting or debt repayment will be like shooting in the dark.

Unmasking Your Money Habits: The Budgeting Blueprint

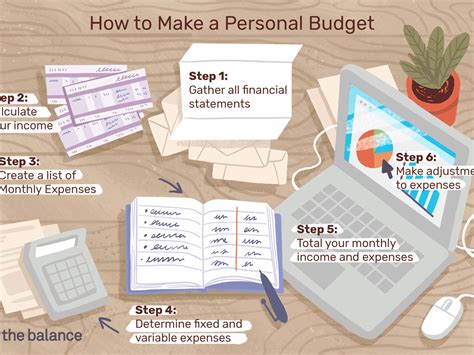

A budget isn’t about restriction; it’s about empowerment and intentional spending. Here’s how to create one that works:

- Track Everything: For one month, meticulously track every dollar you spend. Use a spreadsheet, a budgeting app, or even a simple notebook. Categorize expenses (e.g., housing, food, transportation, entertainment). This step is crucial for identifying ‘money leaks’.

- Calculate Your Net Income: Determine your take-home pay after taxes and deductions. This is the realistic amount you have to work with each month.

- Categorize and Allocate: Based on your tracking, create clear categories for your spending. Popular methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt) or zero-based budgeting (every dollar has a job). Adapt a method that resonates with you.

- Set Realistic Limits: Assign a specific dollar amount to each spending category. Be honest with yourself about what you can cut back on. This is where you identify areas to reduce spending to free up cash for debt repayment.

Crushing Credit Card Debt: Strategic Attack Plans

Once you have a budget in place, the real work of attacking debt begins. Consistency and a clear strategy are key:

- Prioritize High-Interest Debt: Credit card debt typically carries very high-interest rates, making it an urgent priority. Focus your extra payments here first.

- Choose a Repayment Method:

- Debt Snowball: Pay the minimum on all debts except the smallest one. Attack the smallest debt with all extra funds until it’s gone. Then, take the payment you were making on that debt and add it to the next smallest, creating a ‘snowball’ effect. This method is great for psychological wins.

- Debt Avalanche: Pay the minimum on all debts except the one with the highest interest rate. Focus all extra funds on this debt first. Once it’s paid off, move to the next highest interest rate. This method saves you the most money in interest.

- Cut Unnecessary Spending: Review your ‘wants’ categories in your budget. Can you temporarily cut back on dining out, subscriptions, or entertainment to free up more money for debt repayment? Every extra dollar makes a difference.

- Consider Debt Consolidation: If you have multiple high-interest cards, a personal loan with a lower interest rate or a balance transfer card (if you can pay it off before the promotional period ends) might be options. Be cautious, as these only work if you stop accumulating new debt.

Beyond Debt: Building a Robust Financial Future

While crushing debt is critical, it’s equally important to simultaneously build a foundation for wealth. Here’s how:

- Build an Emergency Fund: Before aggressively investing, aim for a small emergency fund of $1,000-$2,000. This prevents you from relying on credit cards for unexpected expenses, halting your debt repayment progress. Once debt is gone, expand this to 3-6 months of living expenses.

- Invest Early and Consistently: Even small, consistent contributions can grow significantly over time due to compounding. Start with a workplace retirement plan (like a 401k) especially if there’s an employer match – it’s free money! Consider Roth IRAs or traditional IRAs next.

- Diversify Investments: Don’t put all your eggs in one basket. Learn about different investment vehicles like index funds, ETFs, and mutual funds. Start with broad market index funds for simplicity and diversification.

- Set Clear Financial Goals: Define what wealth means to you. Is it early retirement, a down payment on a house, funding a child’s education, or starting a business? Specific goals provide motivation and direction.

Sustaining Momentum: Long-Term Habits for Wealth

Financial success isn’t a one-time event; it’s a marathon. Maintaining your progress requires consistent effort and smart habits:

- Review Your Budget Regularly: Life changes, and so should your budget. Revisit it monthly or quarterly to ensure it still aligns with your income, expenses, and goals.

- Avoid New Debt: Once you’ve crushed credit card debt, make it a priority to stay out of it. If you need something, save for it rather than charging it.

- Increase Income: Look for opportunities to earn more – ask for a raise, start a side hustle, or invest in new skills. Increased income accelerates both debt repayment and wealth building.

- Educate Yourself: Continuously learn about personal finance, investing, and wealth management. The more you know, the better decisions you’ll make.

Conclusion

Crushing credit card debt and building wealth is an achievable goal for any man committed to the process. It demands discipline, a clear budget, and strategic action, but the rewards—financial freedom, reduced stress, and the ability to pursue your life goals—are immeasurable. Start today by understanding your money, making a plan, and consistently executing it. Your future self will thank you for taking control.