The Modern Financial Tightrope for Men Aged 30-40

For many men navigating their 30s, the dream of financial stability often clashes with the reality of competing priorities. Faced with student loan debt accrued from higher education and the pressing need to save for retirement, a limited budget forces a critical decision: prioritize immediate debt relief or invest in long-term financial security through a 401k? While precise statistics on this specific demographic’s prioritization are challenging to pinpoint, understanding the factors influencing this choice illuminates a common dilemma for a generation shouldering significant educational debt.

Understanding the Competing Priorities

Student loan debt, often with interest rates ranging from moderate to high, can feel like a heavy anchor. For some, the psychological burden of debt freedom outweighs the allure of future gains. Every dollar paid towards a loan reduces the principal and the interest accrued, offering a tangible, immediate return on investment in the form of avoided interest and a clear path to being debt-free.

On the other hand, a 401k contribution represents an investment in the future, benefiting from compound interest over decades. Employer matching contributions, a common feature of many 401k plans, act as an immediate, guaranteed return on investment, often ranging from 50% to 100% of an employee’s contribution up to a certain percentage of their salary. Missing out on this ‘free money’ can be a significant opportunity cost.

Key Factors Influencing the Decision

Several variables typically weigh on a man’s decision:

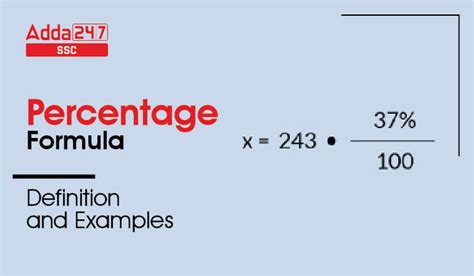

- Interest Rates: High-interest student loans (e.g., over 6-7%) often make aggressive repayment more appealing, as the guaranteed return of avoiding that interest can outperform the historical average returns of a diversified investment portfolio.

- Employer Match: Many financial advisors universally recommend contributing at least enough to a 401k to receive the full employer match. This is often seen as the absolute minimum, as it’s an immediate 50-100% return on investment.

- Debt-to-Income Ratio: A high debt-to-income ratio can make it difficult to qualify for other loans (like a mortgage) and can create significant financial stress, pushing individuals to prioritize debt elimination.

- Job Security and Career Trajectory: Those in stable, high-growth careers might feel more comfortable splitting their focus, while those with less stability might prioritize debt freedom as a safeguard.

- Personal Risk Tolerance: Some individuals are more risk-averse and prefer the guaranteed ‘return’ of debt repayment, while others are comfortable with market fluctuations for long-term growth.

Common Approaches and Real-World Behavior

While definitive percentages are scarce, surveys and anecdotal evidence suggest a mix of strategies. Many prioritize getting the full employer match for their 401k and then direct any remaining discretionary funds towards high-interest student loans. This hybrid approach seeks to capture the ‘free money’ for retirement while aggressively tackling debt.

Another segment might prioritize debt elimination entirely, especially if their loans carry high interest or if the psychological burden of debt is significant. They might contribute only the minimum to their 401k (or even nothing beyond the employer match) until student loans are cleared. Conversely, some, particularly those with lower interest federal loans, might opt for income-driven repayment plans and maximize 401k contributions, betting on long-term market growth to outpace their loan interest.

The decision is deeply personal and often influenced by factors beyond pure mathematics, including a desire for financial freedom, the pursuit of other goals (like homeownership), and the perceived stability of one’s career.

The Elusive Percentage and Psychological Impact

It’s challenging to quantify an exact percentage because financial decisions are fluid and deeply personal. However, broader trends suggest that a significant portion of millennials, which includes men aged 30-40, feel the weight of student loan debt impacting their ability to save for retirement, buy homes, or start families. The drive for debt freedom can be powerful, often leading individuals to prioritize it even over optimal investment strategies.

For men in this age group, the perceived pressure to establish financial independence and security can be immense. The relief of shedding student loan debt can provide a psychological boost and free up cash flow for other financial goals, even if it means potentially missing out on some early retirement savings growth.

Seeking Professional Guidance

Given the complexity, many men aged 30-40 benefit from consulting a fee-only financial advisor. A professional can analyze individual circumstances—loan interest rates, income, career stability, risk tolerance, and employer benefits—to develop a tailored strategy. They can help quantify the long-term impact of each decision and provide a clear roadmap.

Ultimately, while there isn’t a single universal answer or a precise percentage, the prevailing advice often emphasizes securing any available employer 401k match as a priority, then strategically tackling student loan debt based on interest rates and personal financial goals. It’s a balancing act, and the “right” answer depends entirely on individual circumstances.