For young men just starting their careers, making smart financial decisions today can have an immense impact on their future wealth and retirement security. Among the most critical choices is selecting the right retirement savings vehicle: a 401k or a Roth IRA. While both are powerful tools for building long-term wealth, their fundamental differences in tax treatment, contribution limits, and flexibility make one potentially more suitable than the other depending on individual circumstances and career trajectory.

Understanding the Core Differences

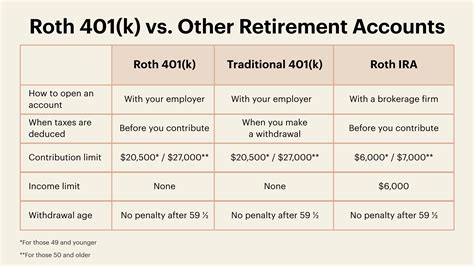

To determine which option might be better, it’s essential to grasp the basic mechanics of each.

The 401k: Employer-Sponsored and Pre-Tax

A 401k is typically offered through an employer and allows you to contribute pre-tax dollars directly from your paycheck. This means your taxable income is reduced by the amount you contribute, leading to immediate tax savings. Your investments grow tax-deferred, and you only pay taxes when you withdraw the money in retirement. A major advantage of a 401k is the potential for an employer match, where your company contributes additional money to your account, essentially providing free money for your retirement.

The Roth IRA: Post-Tax Contributions, Tax-Free Withdrawals

A Roth IRA, on the other hand, is an individual retirement account where you contribute after-tax dollars. This means there’s no immediate tax deduction for your contributions. However, the significant benefit of a Roth IRA is that your investments grow tax-free, and all qualified withdrawals in retirement are also tax-free. This can be incredibly powerful, especially if you anticipate being in a higher tax bracket during retirement than you are today.

Why Age and Income Bracket Matter for Young Men

For young men in the early stages of their careers, their income is often lower than it will be in their peak earning years. This is a crucial factor when choosing between a 401k and a Roth IRA.

The Roth IRA Advantage for Lower Earners

If you’re currently in a lower tax bracket, the immediate tax deduction offered by a traditional 401k might not be as impactful. Instead, contributing to a Roth IRA allows you to pay taxes now while your income is relatively low. The idea is that your money will grow for decades, and by the time you retire and start withdrawing, those tax-free distributions will be far more valuable than the modest tax deduction you’d get today from a 401k.

The Power of Compounding with Tax-Free Growth

Young men have the longest investment horizon, allowing the magic of compound interest to work for decades. When that compounding growth is completely tax-free, as with a Roth IRA, the long-term benefit can be staggering. Imagine decades of growth on hundreds of thousands or even millions of dollars, all accessible without a single tax payment in retirement.

The Importance of Employer Match: Don’t Leave Free Money on the Table

While the Roth IRA offers compelling benefits for young, lower-income individuals, it’s vital not to overlook the employer match often associated with a 401k. An employer match is essentially a 100% return on your investment, making it an unparalleled opportunity. If your employer offers a 401k match, the standard advice is to contribute at least enough to your 401k to receive the full match, regardless of your other retirement strategies. This free money is a guaranteed boost to your savings that cannot be ignored.

Flexibility and Access Considerations

Another aspect to consider is the flexibility of accessing your funds. While both are designed for retirement, Roth IRAs offer a unique advantage:

- Roth IRA: You can withdraw your contributions (not earnings) at any time, for any reason, tax-free and penalty-free. This offers a level of liquidity not found in traditional 401ks, which typically impose penalties for early withdrawals before age 59½, with few exceptions.

- 401k: Withdrawals are generally taxed and penalized before 59½, though some plans allow for hardship withdrawals or loans, which should be approached with caution.

![[100+] Retirement Backgrounds | Wallpapers.com](/images/aHR0cHM6Ly90czMubW0uYmluZy5uZXQvdGg/aWQ9T0lQLnJkRXBvVjNjdDNTZ3dhazVKUTRNcEFIYUZuJnBpZD0xNS4x.webp)

The Hybrid Approach: A Balanced Strategy

For most young men, the optimal strategy might not be an either/or choice but rather a hybrid approach that leverages the best of both worlds:

- Contribute to your 401k up to the employer match: This is non-negotiable free money that provides an immediate, risk-free return on your investment.

- Max out your Roth IRA contributions: Once you’ve secured the employer match, focus on contributing the maximum allowable to a Roth IRA each year. This capitalizes on your lower current tax bracket and sets you up for tax-free growth and withdrawals in retirement.

- If possible, contribute more to your 401k: If you still have money to save after maximizing your Roth IRA, go back to your 401k and contribute more. You can choose between traditional (pre-tax) or Roth 401k options if available.

Conclusion

For young men, a Roth IRA often presents a more compelling long-term advantage due to their typically lower current income and the unparalleled benefit of tax-free growth and withdrawals in retirement. However, neglecting an employer’s 401k match would be a significant financial misstep. A strategic combination of securing your 401k match and then maximizing Roth IRA contributions often provides the most robust and flexible foundation for a prosperous retirement. The key is to start early, stay consistent, and regularly review your financial plan as your income and goals evolve.