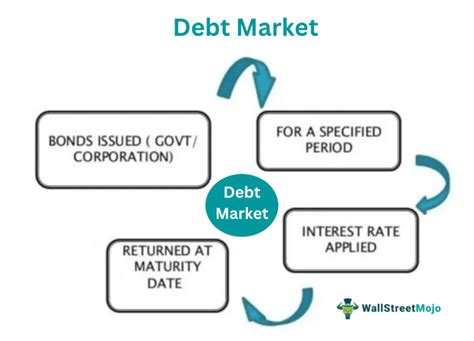

In today’s fast-paced world, many men find themselves navigating the challenging waters of personal debt. Whether it’s credit card balances, student loans, or car payments, debt can feel like a heavy anchor, preventing you from achieving your financial goals. But it doesn’t have to be a permanent fixture. This article provides straightforward, actionable strategies to help you not just manage, but aggressively eliminate debt, putting you firmly on the path to financial freedom.

Understand Your Debt Landscape

Before you can conquer debt, you need to fully understand it. This isn’t just about knowing how much you owe, but getting into the nitty-gritty details. Compile a comprehensive list of all your debts:

- Creditor: Who do you owe money to?

- Outstanding Balance: The total amount remaining.

- Interest Rate (APR): This is crucial as higher rates cost you more over time.

- Minimum Payment: What you’re required to pay each month.

- Due Date: When each payment is expected.

Seeing all your debt laid out clearly can be a wake-up call, but it’s the essential first step to formulating an effective attack plan. Knowledge is power, and in this case, it’s the power to prioritize and strategize.

Master the Art of Budgeting

A budget isn’t about restricting yourself; it’s about gaining control over your money. For men looking to eliminate debt faster, a strict, realistic budget is non-negotiable. Start by tracking every dollar you earn and every dollar you spend for a month or two. Use apps, spreadsheets, or even a pen and paper – whatever works for you.

Once you see where your money is going, identify areas where you can cut back. Are there subscriptions you don’t use? Can you cook more meals at home instead of eating out? Every dollar saved is a dollar that can be redirected towards debt repayment. The goal is to create a surplus each month that can be aggressively applied to your outstanding balances.

Choose Your Debt Elimination Strategy

There are two primary strategies for paying down debt, each with its own benefits:

Debt Snowball Method

This method focuses on psychological wins. List your debts from smallest balance to largest. Pay the minimum on all debts except the smallest one, which you attack with every extra dollar you have. Once that smallest debt is paid off, take the money you were paying on it (minimum payment + extra payment) and apply it to the next smallest debt. This creates a ‘snowball’ effect, building momentum and motivation as you eliminate debts one by one.

Debt Avalanche Method

This method is mathematically more efficient. List your debts from highest interest rate to lowest. Pay the minimum on all debts except the one with the highest interest rate, which you attack with all your extra funds. Once that debt is paid off, move to the next highest interest rate. This method saves you the most money in interest charges over time.

Choose the method that resonates most with your personality. Consistency is key, regardless of which path you take.

Boost Your Income, Attack Your Debt

While cutting expenses is vital, increasing your income can significantly accelerate your debt elimination journey. Consider these options:

- Side Hustles: Explore opportunities like freelancing, consulting, ride-sharing, or selling crafts. Even a few hundred extra dollars a month can make a big difference.

- Negotiate a Raise: If you’ve been excelling at work, build a case for a salary increase.

- Sell Unused Items: Declutter your home and sell items you no longer need on online marketplaces.

- Overtime: If available at your current job, picking up extra hours can directly contribute to your debt fund.

The key is to dedicate any additional income directly to your debt payments, rather than letting it inflate your lifestyle. Think of it as a temporary mission with a clear objective.

Build an Emergency Fund (Even While in Debt)

It might seem counterintuitive to save money while trying to eliminate debt, but a small emergency fund (e.g., $1,000-$2,000) is crucial. This fund acts as a buffer against unexpected expenses like car repairs or medical bills, preventing you from falling back into debt or adding to existing balances when life inevitably throws a curveball. Once this initial fund is established, you can then funnel all extra cash towards debt repayment.

Automate Your Payments and Stay Consistent

Life gets busy, and it’s easy to miss a payment, which can lead to late fees and credit score damage. Automate your minimum payments to ensure they’re always made on time. Then, manually make additional payments as frequently as possible. Even bi-weekly extra payments can make a significant impact over time by reducing the principal faster and therefore, the interest accrued.

Eliminating debt is a marathon, not a sprint. There will be days when it feels slow, but consistency and discipline will get you across the finish line. Celebrate small victories along the way, stay focused on your long-term goal of financial freedom, and don’t be afraid to seek advice from financial professionals if you feel overwhelmed.

Conclusion

Taking control of your finances and actively working to eliminate debt is one of the most empowering steps a man can take towards securing his future. By understanding your debt, budgeting rigorously, choosing a smart repayment strategy, boosting your income, and building robust financial habits, you can accelerate your journey to debt freedom. The road may require discipline and sacrifice, but the destination—a life free from the burden of debt and full of financial possibilities—is well worth the effort.