Laying the Groundwork: Why and How to Start Investing

Embarking on the wealth journey can seem daunting, especially with a myriad of options and financial jargon. However, for men just starting out, the most effective strategies are often the simplest. The key is to establish solid financial habits early and leverage the power of time.

Before diving into specific investments, it’s crucial to understand your personal financial landscape. This means creating a budget, tracking expenses, and ensuring you have an emergency fund covering 3-6 months of living expenses. This foundation prevents you from needing to liquidate investments prematurely during unexpected events.

Defining Your Goals and Risk Tolerance

What are you investing for? Retirement, a down payment on a house, your children’s education, or simply long-term wealth growth? Defining your goals will help shape your investment strategy and timeline. Equally important is understanding your risk tolerance – how comfortable you are with the potential fluctuation in your investment’s value.

- Long-term Goals: Generally allow for more aggressive, growth-oriented investments due to a longer time horizon to recover from market downturns.

- Short-term Goals: Require more conservative investments to preserve capital.

Most beginners, especially those with decades until retirement, benefit from a growth-oriented approach, focusing on long-term accumulation rather than short-term gains.

Simple and Effective Investment Vehicles for Beginners

Forget complex derivatives or individual stock picking initially. For men starting their wealth journey, simplicity and broad market exposure are paramount.

1. Low-Cost Index Funds and ETFs

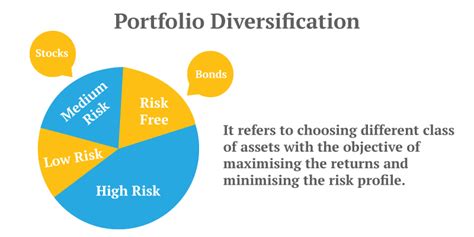

These are often the bedrock of a beginner’s portfolio. An index fund (or its exchange-traded counterpart, an ETF) holds a basket of stocks or bonds designed to mimic the performance of a specific market index, like the S&P 500. They offer instant diversification, low fees, and require minimal active management.

- Advantages: Diversification, low cost, easy to understand, excellent long-term performance.

- Action: Look for total market index funds or S&P 500 index funds from reputable providers like Vanguard, Fidelity, or Schwab.

2. Robo-Advisors

If you prefer a hands-off approach, a robo-advisor service (e.g., Betterment, Wealthfront) can be an excellent choice. These platforms use algorithms to build and manage a diversified portfolio based on your risk tolerance and goals, often utilizing ETFs. They handle rebalancing and tax-loss harvesting, all for a low annual fee.

- Advantages: Automated, diversified, low fees, ideal for passive investors.

- Action: Research different robo-advisor platforms and compare their fees and features.

Harnessing Compound Interest and Consistency

The true magic of long-term investing lies in compound interest – earning returns on your initial investment *and* on the accumulated interest from previous periods. The earlier you start and the more consistently you contribute, the greater this effect becomes.

Dollar-Cost Averaging (DCA)

Instead of trying to “time the market,” implement dollar-cost averaging. This means investing a fixed amount of money at regular intervals (e.g., every paycheck), regardless of market fluctuations. When prices are high, you buy fewer shares; when prices are low, you buy more. Over time, this strategy smooths out your average purchase price and reduces risk.

Building a Resilient Portfolio: Diversification and Long-Term Vision

While index funds already offer diversification within their specific market, a truly resilient portfolio often includes exposure to different asset classes. For beginners, this might mean a mix of stock-based index funds (for growth) and bond-based index funds (for stability, especially as you approach retirement).

Resist the urge to panic during market downturns. History shows that markets tend to recover and reach new highs over the long term. Patience and a steadfast commitment to your long-term plan are invaluable.

Beyond the Basics: Continuous Learning and Adjusting

While simplicity is key for starting, your wealth journey is dynamic. As you gain experience and your financial situation changes, continue to educate yourself. Read financial books, reputable articles, and consider consulting a financial advisor as your portfolio grows more complex.

Review your portfolio annually to ensure it still aligns with your goals and risk tolerance. Small adjustments over time are far more effective than drastic, emotional changes.

Conclusion: Start Small, Stay Consistent, Think Long-Term

For men embarking on their wealth journey, the most effective investment strategies are straightforward: establish a strong financial foundation, leverage simple investment vehicles like low-cost index funds or robo-advisors, commit to consistent contributions through dollar-cost averaging, and maintain a long-term perspective. The journey of building wealth is a marathon, not a sprint, and consistency will always outperform complexity.