Optimizing Your Life: The Best Tech for Men

In today’s fast-paced world, staying on top of both physical health and financial stability is crucial. For men looking to enhance their daily lives, technology offers powerful tools to track fitness progress, manage budgets, and make informed decisions. This guide explores the essential tech that can help you achieve a balanced, healthier, and wealthier lifestyle.

Mastering Your Health: Top Fitness Tracking Gear

Gone are the days of manual logging and guesswork. Modern fitness tech provides real-time data and actionable insights to keep you motivated and on track with your health goals.

- Smartwatches (Apple Watch, Garmin Fenix, Samsung Galaxy Watch): These versatile devices are at the forefront of fitness tracking. They monitor heart rate, track GPS for runs, count steps, analyze sleep patterns, and even offer advanced features like ECG, blood oxygen monitoring, and stress tracking. Many also provide guided workouts and recovery insights.

- Fitness Trackers (Fitbit Charge, Whoop Strap): For those who prefer a more streamlined experience, dedicated fitness trackers offer excellent accuracy for activity, sleep, and heart rate monitoring without the full functionality of a smartwatch.

- Smart Scales (Withings Body+, Garmin Index S2): Beyond just weight, smart scales measure body fat percentage, muscle mass, bone mass, and even body water. They often sync wirelessly with your fitness apps, providing a comprehensive view of your body composition trends.

- Smart Home Gym Equipment (Peloton, Tonal): For the ultimate home workout experience, connected gym equipment offers guided classes, personalized training plans, and performance tracking directly from your living room.

Integrating these devices with companion apps creates a holistic view of your physical well-being, helping you set realistic goals and celebrate achievements.

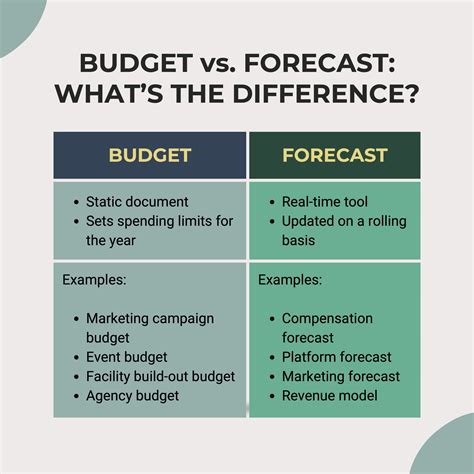

Streamlining Your Wealth: Essential Financial Management Tools

Managing money doesn’t have to be a chore. The right tech can demystify personal finance, automate savings, and help you build wealth efficiently.

- Budgeting & Expense Tracking Apps (Mint, YNAB, Personal Capital): These powerful apps connect to your bank accounts, credit cards, and investments to give you a consolidated view of your finances. They categorize transactions, help you create budgets, track spending habits, and identify areas for savings. Personal Capital also offers robust investment tracking.

- Investment Platforms & Robo-Advisors (Fidelity, Vanguard, Betterment, Wealthfront): Whether you’re a seasoned investor or just starting, these platforms make investing accessible. Traditional brokerages offer a wide range of options, while robo-advisors provide automated, diversified portfolios based on your risk tolerance, making wealth building hands-off.

- Digital Wallets (Apple Pay, Google Pay, Samsung Pay): Beyond convenience, digital wallets offer enhanced security for transactions by tokenizing your card information. They streamline payments online and in-store, and some even integrate loyalty programs.

- Bill Management Apps (Prism, Truebill): These apps help you keep track of upcoming bills, manage subscriptions, and often negotiate better rates for services, preventing late fees and unnecessary expenditures.

These financial tools offer insights, automate savings, and simplify transactions, providing a clear picture of your financial health.

The Synergy: How Tech Bridges Fitness & Finance

While often treated as separate domains, health and wealth are deeply interconnected. Some tech solutions even bridge the gap, offering integrated benefits.

For instance, some health insurance providers offer discounts or rewards for achieving fitness goals tracked by smartwatches. Conversely, strong financial health can reduce stress, directly impacting your physical and mental well-being. Tools like Personal Capital not only manage your investments but also offer a retirement planner, helping you ensure financial security for a long, healthy life. The data from your fitness tracker might even inform life insurance premiums or provide incentives in wellness programs offered by employers.

Making the Right Choice: Factors to Consider

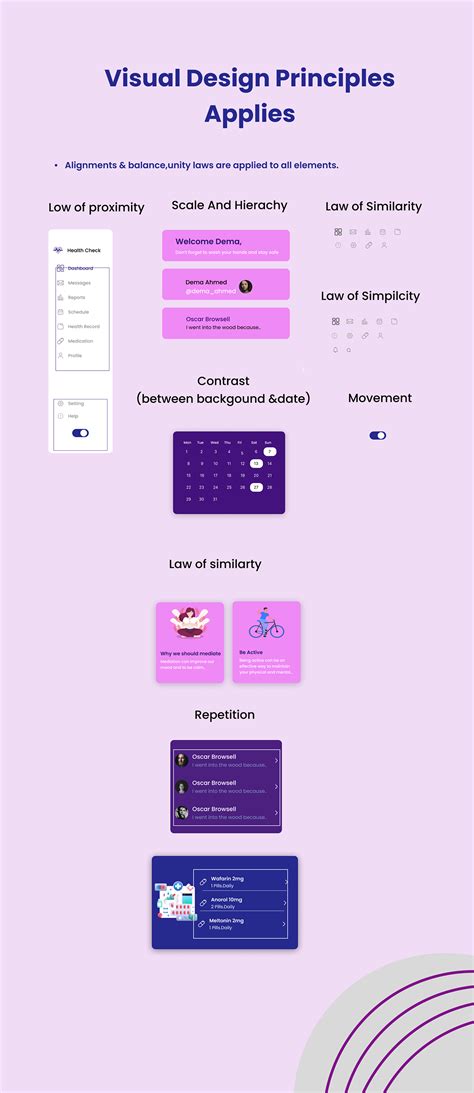

With a plethora of options available, selecting the best tech for your needs requires careful consideration:

- Compatibility: Ensure devices and apps work seamlessly with your existing smartphone and operating system (iOS, Android).

- Battery Life: Crucial for fitness trackers, especially if you want to track sleep without constant recharging.

- Ecosystem: Do you prefer to stick within a specific brand’s ecosystem (e.g., Apple, Garmin) for better integration, or do you need cross-platform flexibility?

- Security & Privacy: Absolutely vital for financial apps. Look for strong encryption, two-factor authentication, and transparent privacy policies.

- User Interface: An intuitive and easy-to-navigate interface will ensure you actually use the tech consistently.

- Cost: Consider initial purchase costs, subscription fees for premium features, and potential in-app purchases.

- Your Goals: Align the tech with your specific fitness and financial aspirations. Do you need in-depth analytics or just basic tracking?

Conclusion: Empowering Your Journey

Investing in the right tech for fitness and finance isn’t just about gadgets and apps; it’s about investing in a more organized, healthier, and financially secure future. By leveraging these powerful tools, men can take charge of their well-being and wealth, achieving a truly balanced and optimized lifestyle. Start by identifying your biggest needs, research the best-suited solutions, and embrace the power of technology to empower your journey towards a better you.