Unleashing Growth Potential in Your Roth IRA

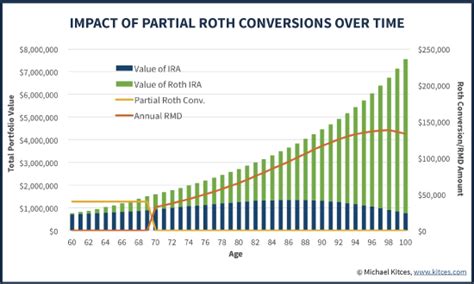

A Roth IRA is more than just a retirement account; it’s a powerful wealth-building tool, particularly for those with a long investment horizon. Its defining feature – tax-free withdrawals in retirement – makes it an ideal vehicle for aggressive growth strategies. By allowing your investments to compound over decades without future tax liabilities on gains, you can maximize your potential returns significantly. But what exactly constitutes an aggressive growth strategy within a Roth IRA, and how should you allocate your assets to achieve it?

The essence of aggressive growth lies in seeking higher returns, which inherently comes with higher risk. This approach is typically best suited for younger investors who have many years until retirement, allowing them to ride out market volatility and benefit from long-term compounding.

Core Principles for Aggressive Roth IRA Allocation

1. Maximize Equity Exposure

For aggressive growth, a significant portion, often 80-100%, of your Roth IRA should be allocated to equities. Stocks historically offer the highest returns over the long term, outperforming bonds and cash. Within equities, focus on growth-oriented sectors and companies.

2. Embrace Growth Stocks and Small-Cap Companies

- Growth Stocks: These are companies expected to grow sales and earnings at a faster rate than the overall market. Often found in technology, biotechnology, and renewable energy sectors, they can offer substantial capital appreciation.

- Small-Cap Companies: Smaller companies have a greater potential for explosive growth as they scale. While more volatile, they can deliver outsized returns if successful.

- Emerging Markets: Investing in developing economies can provide exposure to higher growth rates compared to established markets, though with increased geopolitical and currency risks.

Consider using ETFs (Exchange Traded Funds) or mutual funds that specialize in these areas to achieve diversification without picking individual stocks, which requires significant research.

Strategic Asset Allocation Breakdown

An aggressive portfolio might look something like this, though individual allocations should be tailored to personal risk tolerance:

- 60-70% U.S. Growth Stocks/ETFs: Focus on large-cap and mid-cap growth funds (e.g., S&P 500 growth index, QQQ-like funds).

- 15-20% Small-Cap Growth Stocks/ETFs: Provides exposure to high-potential smaller companies.

- 10-15% International Developed/Emerging Market Growth Stocks/ETFs: Diversifies geographically and taps into global growth engines.

- 0-5% Bonds/Cash: Minimal allocation, primarily for liquidity or if market conditions dictate a very short-term defensive play, though for pure aggressive growth, this can be zero.

This breakdown emphasizes strong equity exposure with a tilt towards growth-oriented and international opportunities. Remember, aggressive means higher volatility, so be prepared for market swings.

Managing Risk and Volatility

While the goal is aggressive growth, intelligent risk management is paramount. Diversification across different growth sectors and geographies helps mitigate company-specific or single-country risks. Avoid putting all your eggs in one basket, even if that basket looks incredibly promising.

Long-Term Mindset: The most crucial aspect of aggressive investing is a long-term perspective. Short-term market corrections or even bear markets are inevitable. An aggressive investor holds through these periods, trusting in the long-term upward trajectory of the market and the compounding power of their tax-advantaged Roth IRA.

Monitoring and Rebalancing Your Portfolio

Even an aggressively allocated Roth IRA requires periodic review and adjustment. Market movements can shift your portfolio’s original asset allocation. For instance, if growth stocks significantly outperform, they might grow to represent a larger percentage of your portfolio than you initially intended. Rebalancing involves selling a portion of your overperforming assets and buying more of your underperforming ones to bring your portfolio back to your target allocation.

Typically, rebalancing is done annually or bi-annually. This discipline ensures you’re consistently aligned with your aggressive growth strategy and helps you ‘buy low and sell high’ in a systematic way. As you approach retirement, you may gradually want to shift towards a more conservative allocation, but for aggressive growth, maintaining your chosen equity focus is key.

Conclusion

Maximizing your Roth IRA for aggressive growth means embracing a high-equity, growth-oriented investment strategy with a strong emphasis on long-term compounding. By focusing on growth stocks, small-caps, and international markets, while diligently managing risk through diversification and periodic rebalancing, you can unlock the full potential of your tax-free retirement account. Always align your strategy with your personal risk tolerance and time horizon, but for those with decades to invest, an aggressive Roth IRA can be a powerful engine for significant wealth accumulation.