Understanding the Financial Split

Understanding how men divide their disposable income between building wealth and immediate consumption is a fascinating and crucial aspect of personal finance. While specific, universally applicable percentages are elusive due to individual variation, examining the factors that influence these choices can provide valuable insights into financial behavior and planning.

Defining Key Terms

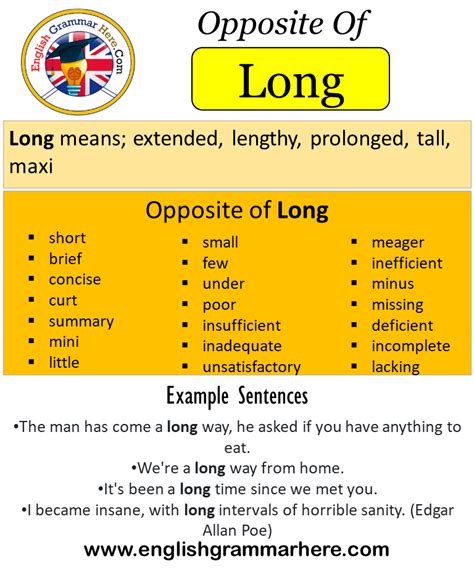

Before diving into allocation, it’s essential to clarify what we mean by the terms. Disposable income refers to the money left after taxes and essential expenses (like housing, utilities, and groceries) have been paid. It’s the portion of income available for either saving/investing or non-essential spending. Investments involve allocating funds to assets like stocks, bonds, real estate, or retirement accounts with the expectation of future growth. Discretionary spending, conversely, covers non-essential purchases and activities, ranging from dining out and entertainment to travel and luxury goods.

The Nuance of Allocation

There isn’t a “one-size-fits-all” answer to how men, on average, allocate this income. Financial decisions are deeply personal and influenced by a myriad of factors. However, general trends and financial wisdom suggest a mindful balance is key to achieving long-term financial security while also enjoying life’s pleasures.

Factors Shaping Financial Choices

Several significant factors influence how men distribute their disposable income:

- Age and Life Stage: Younger men might prioritize saving for a down payment on a home, career development, or paying off student loans, potentially limiting early investment. Middle-aged men often focus on retirement savings and family financial goals, while older men might shift towards preserving capital and legacy planning.

- Income Level: Naturally, higher disposable income often provides more flexibility for both significant investments and substantial discretionary spending. Lower income levels might necessitate a larger proportion of disposable income going towards essential savings buffers or more modest investments.

- Financial Literacy and Goals: An understanding of compound interest and long-term financial benefits often encourages greater investment. Clear goals, such as early retirement, purchasing a large asset, or starting a business, can also heavily skew allocation towards investments.

- Risk Tolerance: Men’s approaches to risk can vary significantly. Some might be inclined towards higher-risk, higher-reward investments, while others prefer more conservative options. This impacts both the type and amount invested.

- Societal and Peer Influence: The desire to maintain a certain lifestyle, keep up with peers, or acquire status symbols can sometimes lead to an overemphasis on discretionary spending at the expense of investment.

Finding the Balance: Investment vs. Spending

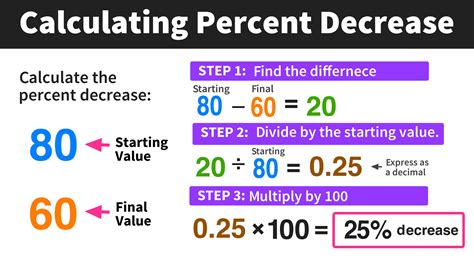

While specific, definitive data on male-specific allocation is often aggregated or varies wildly by study, general financial advice encourages a significant portion of disposable income to be directed towards investments. Many financial experts recommend a variant of the 50/30/20 rule, where 20% (or more) of net income goes towards savings and debt repayment, which for most people should include investments. For disposable income specifically, aiming for 50% or more towards investments is often ideal, especially for those with long-term wealth accumulation goals, after essential needs are met.

Optimizing Your Allocation Strategy

For men looking to optimize their financial allocation, several strategies can prove beneficial:

- Budgeting and Tracking: Understanding exactly where your money goes is the first step. Detailed budgeting helps identify areas where spending can be trimmed to free up funds for investment.

- Setting Clear Goals: Define what you’re saving and investing for. Whether it’s retirement, a home, or a child’s education, clear goals provide motivation and direction for your financial decisions.

- Automate Investments: Set up automatic transfers to investment accounts. This ensures consistency and makes investing a non-negotiable part of your financial routine.

- Prioritize High-Interest Debt: Before heavy investing, paying down high-interest debt (like credit card debt) can often be a more effective financial move, as the guaranteed return of avoiding interest often outweighs potential investment gains.

- Regular Review: Financial situations change. Regularly reviewing and adjusting your budget and investment allocation is crucial to ensure it aligns with your current income, goals, and market conditions.

Conclusion

The exact percentage of disposable income men allocate to investments versus discretionary spending is a highly individualized figure, shaped by personal circumstances, financial goals, and external influences. While there’s no universal average, the principle remains constant: a conscious and strategic balance between enjoying the present and securing the future is paramount for long-term financial well-being. By understanding the factors at play and implementing sound financial practices, men can optimize their allocation to build significant wealth while still experiencing life to the fullest.