Conquering Debt: The First Battle for Financial Freedom

For many men, the journey to financial freedom often begins with a formidable opponent: debt. Whether it’s student loans, credit card balances, car payments, or mortgages, debt can feel like a heavy anchor, preventing true wealth accumulation. The ‘smart play’ isn’t just about earning more; it’s about strategizing to eliminate debt efficiently and then redirecting those funds into wealth-building vehicles. This requires discipline, a clear plan, and a willingness to make tough choices today for a more secure tomorrow.

The first step is to get brutally honest about your current financial situation. List all your debts, including the creditor, interest rate, minimum payment, and total outstanding balance. This clarity is crucial for developing an effective attack plan.

Strategic Debt Elimination Methods

1. The Debt Snowball Method

Popularized by financial experts, the debt snowball method focuses on psychological wins. Here’s how it works:

- List all your debts from the smallest balance to the largest, regardless of interest rate.

- Make minimum payments on all debts except the smallest.

- Throw every extra dollar you can at the smallest debt until it’s paid off.

- Once the smallest debt is gone, take the money you were paying on it (minimum payment + extra payment) and apply it to the next smallest debt.

This method builds momentum and provides quick wins, which can be incredibly motivating for staying on track.

2. The Debt Avalanche Method

For those who prioritize mathematical efficiency, the debt avalanche method is often superior. It works as follows:

- List all your debts from the highest interest rate to the lowest, regardless of balance.

- Make minimum payments on all debts except the one with the highest interest rate.

- Direct all extra funds towards the debt with the highest interest rate until it’s paid off.

- Once that debt is eliminated, roll the payment amount into the next highest interest rate debt.

This method saves you the most money in interest over time, although it might take longer to see the first debt completely eliminated, potentially testing your resolve.

Pillars of Lasting Wealth Building

Once debt is under control, the focus shifts from defense to offense – building lasting wealth. This isn’t a get-rich-quick scheme; it’s a marathon requiring consistent effort and smart decisions.

1. Automate Savings and Investments

Pay yourself first. Set up automatic transfers from your checking account to your savings and investment accounts on payday. This removes the temptation to spend the money and ensures consistent contributions. Aim to save at least 15-20% of your income, or more if possible.

2. Diversify Your Investments

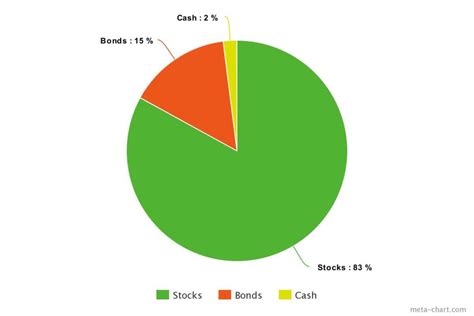

Don’t put all your eggs in one basket. Invest in a diversified portfolio that aligns with your risk tolerance and financial goals. This typically includes a mix of stocks, bonds, and potentially real estate or other assets. Consider low-cost index funds or ETFs for broad market exposure and professional advice if you’re unsure.

3. Increase Your Income Streams

While cutting expenses is vital, increasing your earning potential is equally powerful. This could involve:

- Negotiating raises or seeking promotions at your current job.

- Acquiring new skills or certifications that command higher pay.

- Starting a side hustle or freelance work.

- Investing in yourself through education or skill development.

More income provides more capital to accelerate debt repayment and boost investments.

The Long Game: Mindset and Maintenance

Building wealth is as much about mindset as it is about mechanics. It requires patience, resilience, and a long-term perspective. Resist the urge for instant gratification and understand that market fluctuations are normal. Stay informed, review your financial plan regularly, and adjust as life circumstances change.

Regularly reassess your budget, track your net worth, and celebrate milestones. Financial freedom is not a destination but an ongoing journey of smart decisions and continuous learning. By systematically crushing debt and diligently building diversified assets, men can lay a solid foundation for enduring prosperity and peace of mind.