High-interest debt can feel like a relentless uphill battle, draining your resources and stifling your financial growth. Whether it’s credit card balances, personal loans, or payday loans, the compounding interest can quickly make even small amounts balloon into unmanageable sums. The good news is that with a strategic approach and consistent effort, you can not only crush this debt but also pave the way for a future of true financial freedom.

Understanding the Enemy: High-Interest Debt

Before you can defeat high-interest debt, you need to understand its nature. Interest rates on certain types of debt can range from 15% to over 400%, making it incredibly difficult to pay down the principal balance when a significant portion of your payment goes straight to interest. This type of debt acts as a major roadblock to wealth building, preventing you from saving, investing, or achieving other financial goals.

Identifying all your high-interest debts is the first critical step. List them out: credit cards, personal loans, medical debt, or even old student loans if their rates are high. Note down the interest rate, minimum payment, and total balance for each. This comprehensive overview will be your battle plan.

Strategic Debt Repayment: Avalanche vs. Snowball

There are two popular and highly effective methods for tackling multiple debts:

-

The Debt Avalanche Method

This method prioritizes paying off debts with the highest interest rates first, regardless of the balance. You make minimum payments on all debts except the one with the highest interest rate, to which you direct all extra funds. Once that debt is paid off, you take the money you were paying on it and apply it to the next highest interest rate debt. This method saves you the most money in interest over time.

-

The Debt Snowball Method

The snowball method focuses on psychological wins. You pay off debts with the smallest balances first, regardless of interest rates. You make minimum payments on all debts except the smallest one, throwing all extra money at it. Once it’s paid, you roll that payment amount (plus the previous minimum) into the next smallest debt. This method provides quick victories, building momentum and motivation to keep going.

Choose the method that best suits your personality. If you’re driven by logic and saving money, the avalanche is for you. If you need frequent motivation and quick wins, the snowball might be a better fit.

Mastering Your Budget and Cutting Expenses

To accelerate your debt repayment, you need to free up more cash. This starts with a meticulous budget. Track every dollar you spend for a month or two to identify where your money is actually going. You might be surprised by how much is spent on non-essentials.

Look for areas to cut expenses aggressively:

- Dining Out: Cook at home more often.

- Subscriptions: Cancel unused streaming services, gym memberships, or apps.

- Entertainment: Find free or low-cost activities.

- Transportation: Carpool, walk, or bike if possible.

- Shopping: Distinguish between wants and needs, and avoid impulse purchases.

Every dollar saved is a dollar that can be put towards your high-interest debt, significantly shortening your repayment timeline.

Boosting Your Income and Debt Consolidation

While cutting expenses is crucial, increasing your income can provide an even faster path to debt freedom. Consider:

- Side Hustles: Freelance, drive for a rideshare service, dog-walk, or sell crafts online.

- Overtime: If available at your current job, take on extra hours.

- Selling Unused Items: Declutter your home and sell items on online marketplaces.

- Negotiating Salary: If you’re due for a raise or review, prepare to negotiate for higher pay.

For some, debt consolidation or refinancing can be a viable option. This involves taking out a new loan (often with a lower interest rate) to pay off multiple high-interest debts, simplifying payments and potentially reducing total interest paid. Options include a balance transfer credit card (be wary of introductory rates expiring), a personal consolidation loan, or even a home equity loan if you have equity. Always compare interest rates, fees, and terms carefully to ensure it’s a net benefit.

Building Your Financial Freedom Foundation

Once you’ve made significant progress or completely eliminated your high-interest debt, it’s crucial to pivot towards building long-term financial freedom. This involves several key steps:

- Build an Emergency Fund: Aim for 3-6 months of living expenses in a separate, easily accessible savings account. This protects you from future debt if unexpected costs arise.

- Start Investing: Begin contributing to retirement accounts (401k, IRA) and other investment vehicles. The power of compound interest will now work for you, not against you.

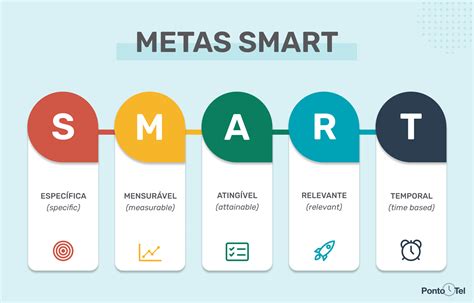

- Set New Financial Goals: Define what financial freedom means to you—perhaps it’s saving for a down payment, a child’s education, or early retirement.

- Continue Budgeting: Make budgeting a lifelong habit to maintain control over your finances and ensure you’re always living within your means and saving for the future.

Conclusion

Crushing high-interest debt and building financial freedom is an achievable goal, but it requires discipline, strategy, and perseverance. By understanding your debt, employing smart repayment methods, aggressively cutting expenses, boosting income, and then building solid financial habits, you can transform your financial life. The journey may be challenging, but the peace of mind and opportunities that financial freedom brings are immeasurably worth the effort.