Laying the Foundation: More Than Just Money

For many men, the idea of investing that first $1,000 can feel daunting, or conversely, insignificant. However, this initial sum is a powerful starting point—a gateway to understanding financial markets, building discipline, and setting the stage for long-term wealth creation. The smartest way to approach this isn’t just about picking a stock; it’s about establishing a robust financial foundation that maximizes the impact of every dollar.

Prioritize Your Financial Health: The Non-Negotiables

Before any investment in the market, ensure these critical elements are in place:

- Emergency Fund: This is paramount. At least 3-6 months of living expenses should be secured in an easily accessible savings account. If you don’t have this, your first $1,000 might be best allocated here, protecting you from unforeseen financial setbacks and preventing you from having to sell investments at a loss.

- High-Interest Debt: Credit card debt, payday loans, or any personal loans with interest rates above 7-8% should be addressed with extreme prejudice. The guaranteed return from eliminating 18% credit card debt far outweighs the potential, but uncertain, returns from market investments. Think of paying off high-interest debt as an immediate, risk-free investment.

Smart Investment Avenues for Your First $1,000

Once your financial foundation is solid, your $1,000 can begin its journey into the investment world. Here are the most effective strategies for a beginner:

1. Low-Cost Index Funds or ETFs

This is arguably the gold standard for beginner investors. Instead of trying to pick individual stocks, an index fund (like an S&P 500 index fund) or an Exchange-Traded Fund (ETF) allows you to invest in a broad basket of hundreds or thousands of companies simultaneously. This provides instant diversification, significantly reducing risk compared to buying a single stock.

- Why it’s smart: Low fees, automatic diversification, and historical market returns (which average around 7-10% annually over the long term, adjusted for inflation).

- Where to invest: Brokerages like Vanguard, Fidelity, or Charles Schwab offer a wide range of low-cost index funds and ETFs, often with no minimums for buying fractional shares or specific ETFs.

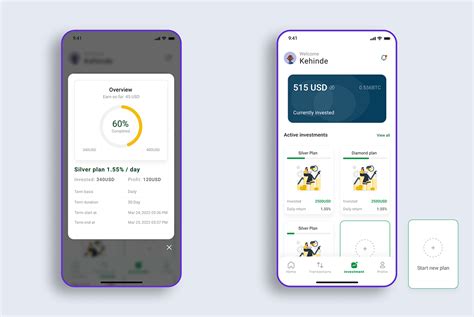

2. Robo-Advisors

Services like Betterment or Wealthfront take the guesswork out of investing. You answer a few questions about your risk tolerance and goals, and the robo-advisor automatically creates and manages a diversified portfolio of ETFs for you. They rebalance your portfolio, reinvest dividends, and offer tax-loss harvesting—all for a low annual fee (typically 0.25% to 0.50% of assets under management).

- Why it’s smart: Automated, diversified, low-cost, and perfect for those who want a hands-off approach.

3. Invest in Yourself: Skills and Knowledge

Sometimes, the best investment isn’t in the market at all, but in increasing your human capital. If your current skills or education are limiting your income potential, that $1,000 could be transformative:

- Online Courses/Certifications: Learn a new high-demand skill (coding, digital marketing, data analysis).

- Professional Development: Attend a conference, buy industry-specific books, or get a mentorship.

- Tools of the Trade: Purchase equipment or software that directly increases your productivity or earning capacity in your current field or a side hustle.

The return on investment for enhancing your skills can often be far greater and more immediate than market returns, directly increasing your future earning potential and allowing you to invest even more later.

Key Principles for Long-Term Success

Regardless of where you choose to allocate your first $1,000, remember these core tenets:

- Start Early, Stay Consistent: Time in the market beats timing the market. Even small, consistent contributions over decades can lead to substantial wealth thanks to compounding.

- Diversify: Never put all your eggs in one basket. Index funds and ETFs excel here.

- Think Long-Term: Investing is a marathon, not a sprint. Don’t panic during market downturns; view them as opportunities to buy at lower prices.

- Keep Learning: Personal finance is an ongoing journey. Continuously educate yourself about different investment strategies and economic principles.

Your first $1,000 is more than just money; it’s the start of your financial education and journey towards financial independence. By prioritizing your foundation, choosing smart investment vehicles, and committing to long-term principles, you’ll be well on your way to building lasting wealth.