Laying the Foundation: Before You Invest

Investing your first $5,000 is an exciting step towards financial independence and long-term wealth creation. However, before you even think about buying stocks or funds, there are crucial foundational steps that smart investors prioritize. The first is establishing an emergency fund, ideally three to six months’ worth of living expenses, in an easily accessible, high-yield savings account. This fund acts as a financial safety net, preventing you from having to tap into your investments during unforeseen circumstances like job loss or medical emergencies.

Secondly, address any high-interest debt, such as credit card balances or personal loans. The interest rates on these debts often far exceed typical investment returns, making debt repayment an immediate, guaranteed ‘return’ on your money. Once these two pillars are in place, your $5,000 is truly ready to work hard for you in the long run.

Understanding Your Investment Goals and Risk Tolerance

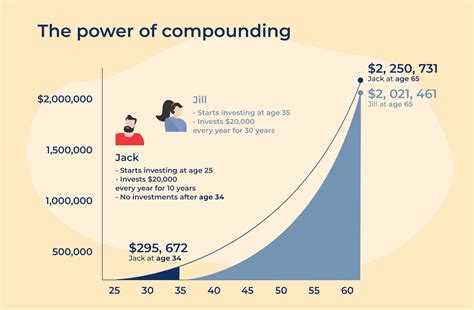

Before selecting any investment vehicle, take time to define your financial goals. Are you saving for retirement 30 years from now, a down payment on a house in 10 years, or something else? Long-term growth often implies a horizon of 10 years or more, allowing compound interest to work its magic and giving your investments time to recover from market downturns. With a long horizon, you can typically afford to take on more risk, as there’s ample time to ride out market volatility.

Equally important is understanding your personal risk tolerance. How comfortable are you with the value of your investment fluctuating, potentially seeing significant drops? While aggressive growth strategies might offer higher potential returns, they also come with higher potential losses. A balanced approach, aligned with your comfort level, is key to staying disciplined through market cycles.

The Power of Low-Cost, Diversified Investments

For a first $5,000 investment aimed at long-term growth, the smartest strategy revolves around low-cost, diversified investment vehicles. Individual stock picking is often too risky and time-consuming for new investors with limited capital. Instead, focus on options that provide instant diversification across many companies and sectors.

- Index Funds: These funds passively track a specific market index, like the S&P 500, giving you exposure to hundreds of companies with a single investment. They typically have very low expense ratios because they don’t require active management.

- Exchange-Traded Funds (ETFs): Similar to index funds, ETFs are collections of stocks or bonds that trade like individual stocks on an exchange. Many ETFs also track broad market indexes, offering diversification and low costs.

Choosing Your Investment Vehicle: Index Funds or ETFs

Why Index Funds and ETFs are the Smart Choice

Investing in a broad market index fund or ETF, such as one tracking the total U.S. stock market (e.g., VTSAX or VTI) or the S&P 500 (e.g., SPY or IVV), is often recommended for new investors. These funds offer:

- Diversification: You’re invested in hundreds or even thousands of companies, reducing the risk associated with any single company’s performance.

- Low Cost: Their passive management means lower fees compared to actively managed funds, allowing more of your money to grow.

- Simplicity: You don’t need to research individual companies; you’re betting on the overall growth of the market.

- Historical Performance: Historically, broad market indexes have delivered strong long-term returns.

Robo-Advisors vs. Self-Directed Brokerage

With your first $5,000, you have a couple of primary routes to access these funds:

- Robo-Advisors (e.g., Betterment, Wealthfront): These platforms use algorithms to build and manage a diversified portfolio for you based on your risk tolerance and goals. They’re excellent for beginners, offering automated rebalancing and tax-loss harvesting, often for a small annual fee (e.g., 0.25% – 0.50% of assets under management). They make investing incredibly simple.

- Self-Directed Brokerage Account (e.g., Fidelity, Vanguard, Charles Schwab): If you prefer more control and are comfortable choosing your own ETFs or index funds, a traditional brokerage allows you to buy them directly. Many offer commission-free trading on their own funds or selected ETFs. This option provides flexibility but requires a bit more research on your part.

For your initial $5,000, a robo-advisor offers a streamlined, hands-off approach that ensures diversification and alignment with your goals without much effort. As your portfolio grows, you might consider taking on more direct control.

The Importance of Consistency and Patience

Investing is not a sprint; it’s a marathon. The true power of long-term growth comes from two key elements: consistency and patience. After your initial $5,000, commit to regularly contributing more money, even small amounts, to your investment account. This practice, known as dollar-cost averaging, allows you to buy more shares when prices are low and fewer when prices are high, smoothing out your average purchase price over time.

Patience is equally vital. Market downturns are inevitable. The smartest investors understand this and avoid making emotional decisions. Sticking to your long-term plan, continuing to invest during dips, and resisting the urge to check your portfolio daily will allow the magic of compounding to work its full effect over decades.

Conclusion: Start Smart, Stay Consistent

Investing your first $5,000 is a significant milestone for any man looking to build lasting wealth. The smartest strategy involves first securing your financial base with an emergency fund and clearing high-interest debt. Then, define your long-term goals and risk tolerance before deploying your capital into low-cost, diversified investment vehicles like broad market index funds or ETFs. Whether you opt for the simplicity of a robo-advisor or the direct control of a brokerage account, the key to success lies in starting early, staying consistent with your contributions, and exercising patience through market fluctuations. This disciplined approach will lay a robust foundation for substantial long-term financial growth.