For many men, financial security isn’t just a goal; it’s often tied to identity, responsibility, and the ability to provide. Yet, the path to a robust net worth can be fraught with uncertainty, leading to significant financial stress. This article offers a clear, actionable roadmap to navigate these challenges, build lasting wealth, and cultivate a sense of financial peace.

Understand Your Financial Starting Line

Before you can accelerate, you need to know your current position. This involves a comprehensive assessment of your net worth – the total value of your assets (what you own) minus your liabilities (what you owe). List everything: cash, investments, real estate, car value, alongside all debts like mortgages, student loans, credit card balances, and personal loans.

Gaining clarity on these numbers is not about judgment, but about creating a baseline. It allows you to see where your money truly stands, identify areas of strength, and pinpoint vulnerabilities that need attention. This foundational understanding is the first critical step toward intentional financial improvement.

Build a Solid Financial Foundation

Master Your Budget and Track Expenses

Knowledge is power, especially with your cash flow. A budget isn’t a restriction; it’s a strategic plan for your money. Track every dollar coming in and going out for at least a month. Use apps, spreadsheets, or even a simple notebook. Once you see where your money goes, you can identify unnecessary spending and reallocate funds towards savings and debt repayment.

Prioritize an Emergency Fund

Life is unpredictable. Losing a job, unexpected medical bills, or car repairs can derail financial progress quickly. Build an emergency fund with 3-6 months’ worth of essential living expenses in a separate, easily accessible savings account. This fund acts as a financial shock absorber, protecting your investments and preventing new debt.

Aggressively Tackle High-Interest Debt

High-interest debt, like credit card balances, can be a wealth killer. The interest payments erode your ability to save and invest. Develop a focused plan to eliminate these debts. Consider strategies like the debt snowball (paying off smallest balances first for psychological wins) or the debt avalanche (paying off highest interest rates first for maximum financial impact).

Strategically Grow Your Income Streams

Boosting your net worth isn’t just about cutting expenses; it’s also about increasing your earning potential. Look for opportunities to:

- Negotiate Salary: Regularly assess your market value and confidently negotiate for higher pay in your current role or when seeking new opportunities.

- Upskill: Invest in courses, certifications, or workshops to develop new skills that are in demand, increasing your value to employers.

- Side Hustles: Explore part-time ventures, freelancing, or passion projects that can generate additional income outside your primary job.

Invest Smartly for Long-Term Wealth

Saving money is important, but investing is how you make your money work for you. Start early and be consistent.

- Retirement Accounts: Maximize contributions to employer-sponsored plans (401k, 403b) and individual retirement accounts (IRAs). Take advantage of any employer matching programs – it’s free money.

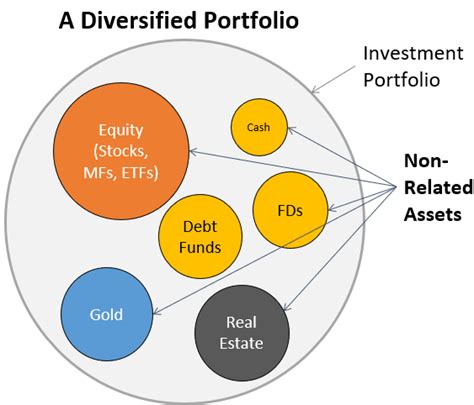

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest across various asset classes like stocks, bonds, and potentially real estate to mitigate risk.

- Financial Education: Continuously learn about investing. Understand the power of compound interest and long-term growth.

Master Your Financial Mindset & Conquer Stress

Financial stress often stems from a feeling of lack of control or societal pressures. Shifting your mindset is crucial.

- Embrace Financial Literacy: The more you understand, the less daunting it becomes. Educate yourself on personal finance topics.

- Define Your Own Success: Detach your self-worth from your net worth. Understand that true financial freedom is about security, not just accumulation.

- Seek Professional Guidance: Don’t hesitate to consult a financial advisor. They can provide personalized strategies, clarify complex topics, and offer an objective perspective.

- Practice Mindfulness: Financial worry can consume you. Incorporate stress-reduction techniques like exercise, meditation, or spending time in nature.

Regular Review and Adaptation

Your financial life isn’t static. Life events, economic changes, and personal goals evolve. Schedule regular financial reviews – at least once a year – to assess your progress, adjust your budget, rebalance your investments, and refine your long-term plans. This iterative process ensures your financial strategy remains aligned with your aspirations.

Conclusion

Boosting your net worth and conquering financial stress is a journey, not a destination. It requires discipline, continuous learning, and a proactive approach. By implementing these actionable steps – understanding your current situation, building strong foundations, tackling debt, growing income, investing wisely, and cultivating a healthy financial mindset – men can take control of their financial destiny, build substantial wealth, and achieve a profound sense of security and peace.