Unlocking Early Wealth: Why Aggressive Investing Makes Sense for Young Men

For young men embarking on their wealth-building journey, time is arguably their most valuable asset. With decades until retirement, there’s a unique opportunity to embrace higher risk in pursuit of outsized returns. An aggressive investment strategy isn’t about recklessness; it’s about strategically leveraging a long time horizon and a greater capacity to recover from market downturns. The goal is to accelerate wealth accumulation, setting the stage for financial independence much sooner.

The Young Investor’s Edge: Time and Risk Tolerance

Youth provides two critical advantages: a long runway for compounding and a higher tolerance for risk. Compounding interest, often called the “eighth wonder of the world,” works exponentially over decades, turning modest initial investments into substantial fortunes. Furthermore, younger investors can afford to invest in more volatile assets because they have ample time to recover from potential losses. This allows for a portfolio allocation heavily weighted towards growth-oriented investments.

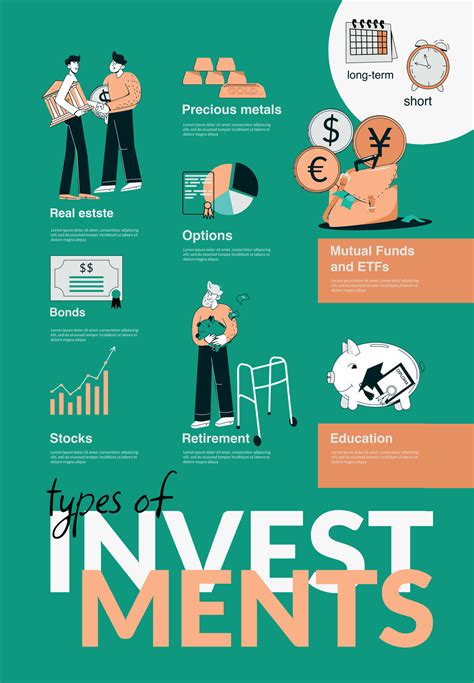

Pillars of an Aggressive Portfolio

An aggressive strategy typically involves a significant allocation to assets with high growth potential, even if they come with increased volatility. Here are some core components:

Growth Stocks and Thematic ETFs

Focus on companies demonstrating rapid earnings and revenue growth, often in disruptive industries like technology, biotech, or renewable energy. These are typically businesses reinvesting profits into expansion rather than paying large dividends. Thematic Exchange Traded Funds (ETFs) can offer diversified exposure to these high-growth sectors, allowing investors to bet on an entire industry trend rather than just a single company.

Strategic Allocation to Cryptocurrencies

While highly volatile, cryptocurrencies like Bitcoin and Ethereum have demonstrated immense growth potential. For a young investor, a small, carefully considered allocation (e.g., 5-10% of the portfolio) can act as a high-risk, high-reward “satellite” investment. Emphasize thorough research and understanding the underlying technology before investing.

Venture Capital or Private Equity (Accredited Only, or via Funds)

For those with a higher net worth or access to specialized funds, investing in venture capital or private equity can offer exposure to early-stage companies with explosive growth potential before they hit public markets. This is typically illiquid and very high risk, but can yield substantial returns.

Leveraged Real Estate (Indirectly or Directly)

While often seen as a stable asset, real estate can be an aggressive play through strategic leverage. This could involve investing in Real Estate Investment Trusts (REITs) focused on high-growth sectors or, for those with significant capital, direct investment in properties with high appreciation potential, using mortgages to amplify returns (and risks).

Smart Risk Management in an Aggressive Strategy

Aggressive doesn’t mean reckless. Effective risk management is crucial to ensure potential gains aren’t wiped out by avoidable losses.

- Diversification: Even within aggressive assets, spread your investments across different sectors and asset classes. Don’t put all your capital into a single stock or cryptocurrency.

- Position Sizing: Allocate smaller percentages to highly speculative investments. Your “core” aggressive holdings might be larger than your “satellite”, extremely high-risk ones.

- Due Diligence: Never invest in something you don’t understand. Research companies, market trends, and underlying technologies thoroughly.

- Emotional Discipline: Avoid making impulsive decisions based on market hype or fear. Stick to your predetermined investment plan and rebalance periodically.

The Long Game: Patience and Consistent Contribution

An aggressive strategy is still a long-term strategy. It’s not about getting rich overnight, but about maximizing returns over decades. Consistent contributions to your investment accounts, regardless of market conditions, are vital. This practice, known as dollar-cost averaging, smooths out market volatility and helps accumulate more assets over time.

Patience is also key. Market downturns are inevitable. A young aggressive investor understands these are opportunities to buy more assets at a discount, rather than reasons to panic and sell.

Conclusion: Harnessing Youth for Financial Prosperity

For young men aiming to build substantial wealth, an aggressive investment strategy, when executed with research and discipline, can be incredibly powerful. By leveraging time, embracing calculated risks in high-growth assets, and maintaining a diversified approach, it’s possible to significantly accelerate the journey towards financial independence. Remember, the journey is long, but the rewards of early, aggressive investing can be truly transformative.