Achieving significant milestones in both personal fitness and financial well-being often feels like tackling two separate mountains. However, at their core, both endeavors rely on a surprisingly similar set of psychological frameworks and disciplined approaches. The journey to a healthier body and a healthier bank account isn’t just about the exercises you do or the investments you make; it’s profoundly shaped by the mindset you cultivate. By consciously shifting your perspective, you can unlock synergistic benefits that propel you forward in both areas.

The Power of Long-Term Vision

One of the most critical mindset shifts is moving from a short-term gratification focus to a long-term vision. In fitness, this means understanding that a single workout won’t transform your physique, just as one healthy meal won’t erase years of poor eating habits. Sustainable results come from consistent effort over months and years. Similarly, in finance, a long-term perspective is essential for wealth accumulation. Avoiding impulsive purchases, understanding compound interest, and consistently saving or investing requires a future-oriented outlook.

This mindset encourages patience and persistence, recognizing that small, consistent actions today build substantial results tomorrow. It’s about setting ambitious yet realistic goals for the future and crafting a roadmap to get there, whether that’s achieving a fitness milestone or reaching a specific savings target.

Embracing Discipline as a Lifestyle

Discipline isn’t a punishment; it’s the freedom to choose what you want most over what you want right now. Instead of viewing discipline as a rigid set of rules, shift your mindset to see it as a commitment to self-care and self-improvement. For fitness, this translates into showing up for your workouts even when you don’t feel like it, and making healthy food choices consistently. In financial terms, it means sticking to a budget, saving a percentage of your income, and resisting unnecessary spending.

When discipline becomes an ingrained habit, rather than an effortful chore, it integrates seamlessly into your lifestyle. It’s no longer about willpower but about automated behaviors that align with your long-term goals. This shift transforms daily routines into powerful rituals that build momentum in both your health and wealth.

The Art of Delayed Gratification

Closely linked to long-term vision and discipline is the mindset of delayed gratification. This is the ability to resist the temptation for an immediate reward in favor of a later, more substantial reward. In fitness, it means skipping the sugary snack now for better health and energy later, or pushing through a tough workout for the strength and vitality it brings.

Financially, delayed gratification is paramount. It means saving for a down payment instead of buying the latest gadget, or investing your money instead of spending it on fleeting pleasures. This mindset understands that true value often accrues over time and that patience is a virtue with tangible returns. Learning to practice this in one area often strengthens your ability to apply it in the other, creating a powerful positive feedback loop.

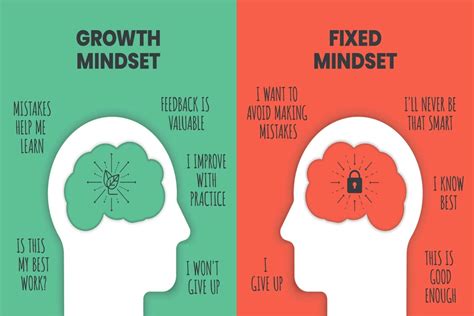

Cultivating a Growth Mindset and Resilience

Challenges and setbacks are inevitable in both fitness and finance. A growth mindset, characterized by the belief that your abilities can be developed through dedication and hard work, is crucial. Instead of seeing a missed workout or a financial misstep as a failure, view it as a learning opportunity. This resilience allows you to bounce back stronger, adjust your strategy, and continue moving forward.

Whether it’s hitting a plateau in your strength training or experiencing an unexpected expense, the growth mindset encourages analysis over despair. It asks, ‘What can I learn from this?’ and ‘How can I improve next time?’ This proactive approach to obstacles fosters continuous improvement and prevents discouragement from derailing your progress.

Prioritizing Self-Investment and Accountability

A fundamental mindset shift is recognizing that investing in yourself, whether it’s your health or your knowledge, is the best investment you can make. This means allocating resources – time, money, and energy – to activities that enhance your physical, mental, and financial well-being. For fitness, this might be investing in quality food, gym memberships, or professional coaching. Financially, it could be further education, skill development, or sound financial advice.

Coupled with self-investment is accountability. Take full ownership of your choices and their outcomes. Set clear goals, track your progress, and be honest with yourself about where you stand. Whether it’s a fitness journal or a financial spreadsheet, consistent monitoring reinforces commitment and provides the data needed to make informed adjustments.

By consciously adopting these mindset shifts – embracing a long-term vision, practicing consistent discipline, mastering delayed gratification, fostering a growth mindset, and prioritizing self-investment and accountability – you create a powerful synergy. The mental muscles you build in pursuit of fitness discipline will serve you equally well in achieving financial growth, and vice versa. It’s not about working harder, but about thinking smarter and aligning your internal compass with your deepest desires for a healthy, prosperous life.