The Dual Pillars: Finance & Fitness as Foundations for Men

For many men, the pursuit of success often centers around professional achievements or physical prowess. However, true long-term well-being and a sense of control stem from an unshakable mindset that integrates both financial acumen and fitness discipline. These aren’t separate battles; they are interconnected pillars that support a robust, resilient, and fulfilling life. Building this mindset isn’t about short-term fixes, but about cultivating deep-rooted habits and mental fortitude that can withstand challenges.

Understanding the Unshakable Mindset

An unshakable mindset is one characterized by resilience, clarity, and unwavering commitment to long-term goals, even in the face of adversity. It’s the ability to stay the course when motivation wanes, when the market dips, or when the gym feels too far away. This isn’t innate; it’s developed through intentional practice, self-awareness, and a strong ‘why’. For finance, it means adhering to a budget, saving consistently, and investing wisely. For fitness, it means regular exercise, proper nutrition, and prioritizing rest. Both require foresight, sacrifice, and the mental strength to delay gratification.

Strategies for Financial Discipline

1. Define Your ‘Why’ and Set Clear Goals

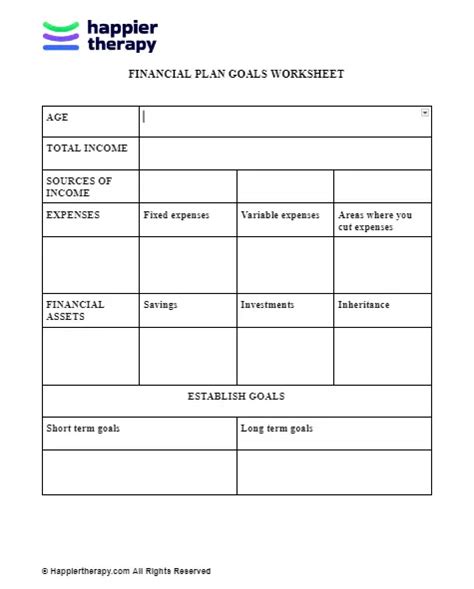

Why do you want financial stability? Is it for early retirement, a secure family future, or the freedom to pursue passions? Clearly define these long-term financial goals and then break them down into smaller, actionable steps. Use the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) for each goal.

2. Master Your Budget and Track Everything

Ignorance is not bliss in finance. Create a detailed budget that outlines your income and expenses. Utilize apps or spreadsheets to track every dollar. Understanding where your money goes is the first step to taking control. Regularly review and adjust your budget as needed.

3. Automate Savings and Investments

Remove the decision-making by automating transfers to savings and investment accounts immediately after payday. Treat savings as a non-negotiable expense. This ensures consistency and leverages compound interest over time.

4. Practice Delayed Gratification

Resist the urge for impulse purchases. Before buying, ask yourself if it aligns with your long-term financial goals. This mental muscle, strengthened in finance, has spillover benefits into all areas of life, including fitness.

Strategies for Fitness Discipline

1. Set Realistic and Progressive Goals

Similar to finance, fitness goals need to be clear. Do you want to run a 5K, lift a certain weight, or improve your overall health markers? Start small, be consistent, and progressively challenge yourself. Celebrate small victories to build momentum.

2. Find Your Movement and Make it Non-Negotiable

Not every man enjoys the gym. Find an activity you genuinely enjoy – hiking, cycling, team sports, martial arts. Whatever it is, schedule it into your week like an important meeting and stick to it. Consistency trumps intensity.

3. Fuel Your Body with Intentional Nutrition

Discipline isn’t just about exercise; it’s about what you put into your body. Focus on whole, unprocessed foods. Learn basic nutrition principles and plan your meals. Understand that food is fuel for both your body and your mind, impacting energy levels and cognitive function.

4. Prioritize Recovery and Sleep

An often-overlooked aspect of fitness discipline is recovery. Adequate sleep (7-9 hours) and rest days are crucial for muscle repair, hormone regulation, and mental clarity. Pushing too hard without recovery leads to burnout and injury.

Overcoming Obstacles and Maintaining Momentum

1. Embrace Setbacks as Learning Opportunities

You will miss a workout, or you will overspend. It’s inevitable. The unshakable mindset doesn’t dwell on failures; it learns from them and refocuses. Don’t let a slip become a fall. Get back on track immediately.

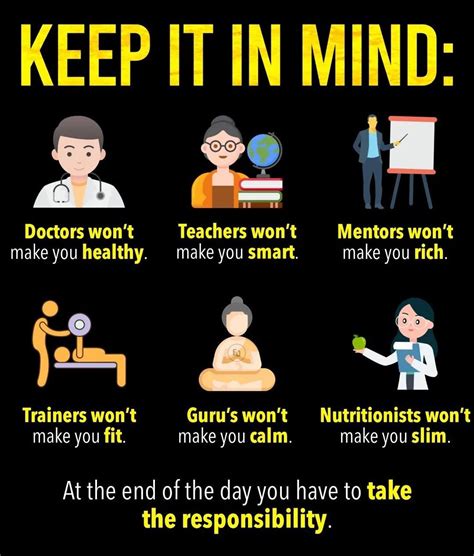

2. Build Habits, Not Just Motivation

Motivation is fleeting. Habits are robust. Use habit-stacking (e.g., go for a run after your morning coffee) and environmental cues to make desired actions easier and automatic. Track your habits to see your progress and reinforce positive behaviors.

3. Seek Accountability and Community

Share your goals with a trusted friend, partner, or mentor. Join a fitness group or an online financial forum. External accountability can provide the extra push you need when your internal drive wavers. A supportive community offers encouragement and shared wisdom.

4. Cultivate Mindfulness and Resilience

Practices like meditation or journaling can enhance self-awareness, help manage stress, and improve your ability to cope with challenges in both finance and fitness. A resilient mind is better equipped to handle the inevitable ups and downs.

The Synergy of an Unshakable Mindset

Developing discipline in one area often strengthens it in another. The self-control required to stick to a workout plan builds the muscle needed to stick to a budget. The foresight applied to financial planning can be transferred to planning healthy meals. By actively nurturing an unshakable mindset in both finance and fitness, men empower themselves not just for isolated successes, but for a holistic and enduring sense of well-being, freedom, and personal mastery. Start small, stay consistent, and commit to the journey. Your future self will thank you.