Laying the Groundwork: Decimating Debt

Financial independence isn’t a pipe dream; it’s a strategic destination. For men looking to build robust financial futures, the path involves a two-pronged attack: systematically eliminating debt and intelligently cultivating investments. This guide outlines actionable strategies to achieve powerful financial growth, transforming aspirations into tangible wealth.

Before significant investment can occur, crippling debt must be addressed. High-interest debts like credit cards or personal loans act as anchors, dragging down potential financial ascent. Prioritize these first.

Identify and Prioritize: List all debts, their interest rates, and minimum payments. The “debt avalanche” method (paying highest interest first) saves the most money, while the “debt snowball” (paying smallest balance first) offers psychological wins.

Aggressive Budgeting: Create a detailed budget. Track every dollar in and out. Identify non-essential expenses that can be cut or reduced. Reallocate these savings towards accelerated debt payments. Consider temporary lifestyle adjustments for quicker debt freedom.

From Debt-Free to Wealth-Bound: Strategic Investing

With debt under control, the focus shifts to wealth creation. This requires discipline, patience, and a clear understanding of investment principles.

Build Your Emergency Fund: Before anything else, establish an emergency fund covering 3-6 months of living expenses. This acts as a financial safety net, preventing new debt during unforeseen circumstances.

Understanding Investment Vehicles:

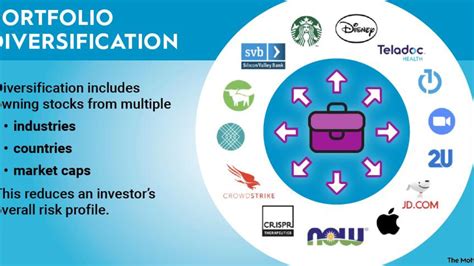

- Stocks: Ownership in companies; higher risk, higher potential return.

- Bonds: Loans to governments or corporations; lower risk, stable returns.

- ETFs/Mutual Funds: Diversified baskets of stocks/bonds, managed by professionals.

- Real Estate: Can provide rental income and appreciation, but illiquid.

Diversification is Key: Never put all your eggs in one basket. Spread investments across different asset classes, industries, and geographies to mitigate risk. A diversified portfolio is more resilient to market fluctuations.

Leverage Compounding: The most powerful force in investing. Reinvesting returns allows your money to grow exponentially over time. Start early, invest consistently, and let time do the heavy lifting.

Accelerating Growth: Advanced Tactics and Mindset

True financial growth isn’t just about what you save and invest, but also what you earn and learn.

Increase Your Income: Explore side hustles, negotiate salary raises, invest in skills development, or even consider a career change. More income means more capital available for debt repayment and investment.

Continuous Financial Education: The financial landscape is always evolving. Stay informed about market trends, tax laws, and new investment opportunities. Read books, listen to podcasts, and consult financial advisors.

Mindset and Discipline: Financial success is a marathon, not a sprint. It requires consistent effort, delayed gratification, and the discipline to stick to your plan, especially during market downturns. Avoid emotional investment decisions.

Conclusion

Crushing debt and building wealth is a journey that demands strategic planning, unwavering discipline, and a commitment to continuous learning. By systematically eliminating high-interest liabilities, establishing a robust emergency fund, and investing intelligently with a long-term perspective, men can forge a powerful path to financial independence and lasting prosperity. The time to start is now.