Decoding the Debt for Master’s-Educated Men in Their Thirties

The pursuit of a Master’s degree often comes with the promise of enhanced career prospects and higher earning potential. However, it also frequently entails a significant financial investment, primarily through student loans. Pinpointing the exact average student loan debt for a very specific demographic – men aged 30-40 holding a Master’s degree – presents a complex challenge due to the granularity of available data. While broad statistics exist for graduate student debt, isolating this particular segment requires careful interpretation of various contributing factors.

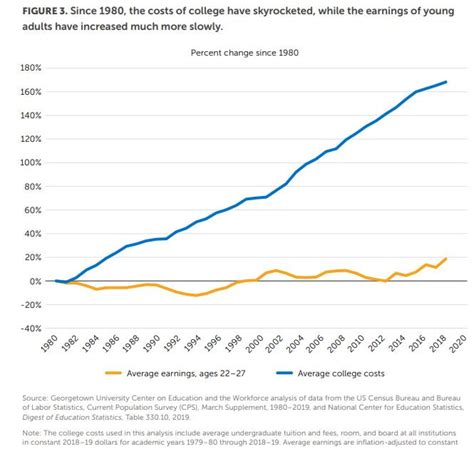

The Broader Picture: Graduate Student Debt Trends

Before diving into the specifics of men aged 30-40, it’s crucial to understand the overall landscape of graduate student debt. Individuals pursuing master’s degrees typically accrue more debt than those with only undergraduate degrees. The National Center for Education Statistics (NCES) and other reputable sources often report that graduate students can accumulate tens of thousands of dollars in debt, sometimes exceeding $50,000 to $100,000, depending on the program, institution type (public vs. private), and field of study. This higher debt load reflects the increased tuition costs of advanced degrees and often the need for students to borrow more for living expenses during their studies.

Age and Gender Nuances: 30-40 Year Old Men

When we narrow the focus to men aged 30-40, several factors come into play. This age bracket often includes individuals who may have completed their Master’s degree more recently, or perhaps returned to school after gaining some professional experience. Their debt burden might be influenced by whether they carried undergraduate debt into their graduate studies, the time elapsed since graduation, and their current repayment status. While general statistics on graduate debt don’t always differentiate precisely by gender and specific age groups, available data suggests that men often borrow for advanced degrees at similar rates to women, though the fields of study chosen can sometimes lead to different debt averages.

For example, men are disproportionately represented in fields like engineering and business, which can have varying tuition costs. While some studies indicate that women, on average, hold slightly more student loan debt due to a longer time to degree completion or lower earning potential post-graduation, these differences are often minor when looking purely at graduate degrees.

Key Factors Influencing Debt Levels

Several variables significantly impact the total student loan debt for any individual, including men aged 30-40 with a Master’s degree:

- Field of Study: Programs like Law (JD), Medicine (MD, though technically not a Master’s, it’s a professional graduate degree), or MBA programs at top-tier private universities often carry the highest tuition costs and, consequently, the highest debt. Conversely, some Master’s in humanities or public education might be more affordable.

- Type of Institution: Private universities generally have higher tuition rates than public in-state institutions, leading to larger loan amounts.

- Undergraduate Debt: Many graduate students enter Master’s programs already carrying undergraduate student loan debt, which compounds their overall financial burden.

- Cost of Living: Borrowing for living expenses, especially in high-cost-of-living areas, significantly adds to the principal loan amount.

- Financial Aid & Scholarships: The availability and receipt of grants, scholarships, or employer tuition assistance can substantially reduce the need for loans.

Estimating the Average Burden

Given the complexities, a precise, universally agreed-upon average for men aged 30-40 with Master’s degrees is elusive. However, drawing from broader data, individuals with Master’s degrees often graduate with an average debt ranging from $50,000 to $75,000 or more. For those in particularly expensive professional programs or who also carried significant undergraduate debt, this figure can easily exceed $100,000. For men in their 30s and 40s, depending on how long they’ve been in repayment, their *outstanding* debt might be lower than their *original* debt. Conversely, interest accrual and deferments could mean their balance has grown if they haven’t been making aggressive payments.

Managing the Debt Burden

For men in this demographic facing substantial student loan debt, several strategies can help manage the burden:

- Income-Driven Repayment (IDR) Plans: Federal student loan borrowers can enroll in IDR plans that cap monthly payments based on income and family size.

- Refinancing: Private refinancing can lead to lower interest rates or different payment terms, especially for borrowers with strong credit and stable income. However, this often means sacrificing federal loan benefits like IDR and forbearance.

- Public Service Loan Forgiveness (PSLF): For those working in qualifying public service jobs, PSLF can forgive the remaining balance of federal direct loans after 120 qualifying payments.

- Aggressive Repayment: If financially feasible, making extra payments or increasing monthly contributions can significantly reduce the total interest paid and shorten the repayment period.

Conclusion

While a definitive, single average student loan debt figure for men aged 30-40 with a Master’s degree remains difficult to pinpoint precisely, the evidence suggests that it is substantial. This demographic likely carries an average outstanding balance that could range from $50,000 to well over $100,000, depending on their specific educational and financial journey. Understanding the myriad factors that influence this debt – from field of study to institution type and personal financial choices – is crucial for both prospective graduate students and those currently navigating their repayment paths. Effective debt management strategies are essential for turning a Master’s degree into a financial asset rather than a long-term liability.