In today’s dynamic economic landscape, financial security and the accumulation of wealth are paramount goals for men, driven by aspirations of independence, family well-being, and a comfortable retirement. Optimizing investment strategies isn’t just about growing money; it’s about building a robust financial future efficiently and strategically. This guide delves into actionable approaches men can employ to accelerate wealth building while establishing impregnable financial security.

Understanding the “Why”: Beyond Just Accumulation

For many men, financial aspirations extend beyond personal enrichment. They often include providing for family, securing a comfortable retirement, leaving a legacy, or achieving specific life goals like homeownership or funding children’s education. A proactive, optimized investment approach directly supports these aims, transforming abstract goals into concrete realities. It’s about taking control, making informed decisions, and leveraging time and capital effectively to achieve significant financial milestones.

Laying the Foundation: Core Principles for Rapid Growth

Before diving into specific investments, establishing a strong foundational understanding is crucial. These principles serve as the bedrock for any successful wealth-building journey.

1. Define Your Financial Goals with Precision

Vague goals lead to vague outcomes. Clearly articulate what you want to achieve: a down payment in 5 years, retirement by 55, a specific net worth target, or passive income goals. Assign timelines and dollar figures. This clarity will dictate your risk tolerance, investment choices, and required savings rate.

2. Embrace Early & Consistent Investing

Time is arguably your most powerful asset in investing. Starting early allows compound interest to work its magic over a longer duration, dramatically accelerating wealth accumulation. Consistency, through regular contributions, mitigates market timing risks and ensures continuous growth regardless of market fluctuations.

3. Understand and Manage Your Risk Tolerance

Every investment carries risk. Your comfort level with potential losses (risk tolerance) should align with your investment portfolio. Younger investors with longer horizons might take on more risk for potentially higher returns, while those closer to retirement typically prefer more conservative approaches. Honesty about your risk appetite prevents panic selling and ensures a sustainable strategy.

Strategic Investment Vehicles for Accelerated Wealth

Diversification across various asset classes is key to both growth and security. Here are some optimized vehicles:

- Growth Stocks and ETFs: Focus on companies with strong growth potential in sectors like technology, renewable energy, or emerging markets. Growth ETFs offer diversified exposure to these sectors. While higher risk, they offer significant upside.

- Real Estate Investments: Beyond direct property ownership, consider Real Estate Investment Trusts (REITs) for diversified exposure to income-generating properties without the complexities of direct management. These can provide steady income and capital appreciation.

- Tax-Advantaged Retirement Accounts: Maximize contributions to 401(k)s, IRAs (Traditional or Roth), and HSAs. These accounts offer significant tax benefits (tax-deductible contributions, tax-free growth, or tax-free withdrawals) that greatly enhance long-term compounding.

- Index Funds and Low-Cost ETFs: For broad market exposure, these funds offer diversification across hundreds or thousands of companies at very low expense ratios. They are excellent core holdings for any portfolio, providing consistent, market-matching returns.

Optimizing for Growth: Advanced Strategies

Beyond asset selection, certain strategies can further optimize your wealth-building trajectory.

Harnessing Compound Interest Relentlessly

Reinvest all dividends and capital gains. This ensures that your earnings also start earning, creating an exponential growth curve over time. Automating this process removes the temptation to spend these returns.

Automate Your Savings and Investments

Set up automatic transfers from your checking account to your investment accounts. This “pay yourself first” approach ensures consistency, removes decision fatigue, and builds discipline. Treat these contributions as non-negotiable expenses.

Regular Portfolio Rebalancing

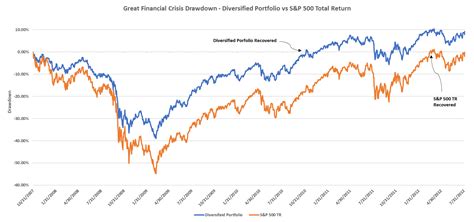

Over time, market movements can shift your portfolio’s asset allocation away from your target. Regular rebalancing (e.g., annually) involves selling assets that have performed well and buying those that have lagged to restore your desired risk profile and maintain diversification.

Building a Fortress: Financial Security Beyond Investments

Rapid wealth building shouldn’t come at the expense of financial security. A truly optimized plan integrates robust safeguards.

- Establish a Robust Emergency Fund: Before significant investing, ensure you have 3-6 months (or more) of living expenses saved in an easily accessible, liquid account. This prevents having to sell investments at a loss during unforeseen circumstances.

- Adequate Insurance Coverage: Life, disability, health, and property insurance are non-negotiable. They protect your assets and income-earning ability from catastrophic events, safeguarding your family and your financial plan.

- Proactive Debt Management: High-interest debt (e.g., credit card debt) can erode investment returns. Prioritize paying off consumer debt before aggressively investing. Strategic use of low-interest debt (like a mortgage) can, however, be part of a broader wealth strategy.

Continuous Learning and Adaptation

The financial world is constantly evolving. Successful investors commit to continuous learning, staying informed about market trends, economic shifts, and new investment opportunities. Be prepared to adapt your strategy as your life circumstances change or as market conditions dictate, always keeping your long-term goals in sight.

Conclusion: A Proactive Path to Prosperity

Optimizing investments for rapid wealth building and financial security for men involves a combination of strategic planning, disciplined execution, and continuous learning. By setting clear goals, starting early, diversifying wisely, leveraging tax advantages, and protecting against unforeseen risks, men can create a powerful trajectory toward financial independence and lasting prosperity. The journey requires patience and resilience, but the rewards of a well-orchestrated financial future are immeasurable.