Navigating the Unpredictable Journey of Career and Finance

Life is full of twists and turns, and the paths of our careers and financial aspirations are rarely straight. Setbacks, whether a job loss, a failed project, unexpected market downturns, or personal financial emergencies, are an inevitable part of the journey. What distinguishes those who thrive from those who falter is often their capacity for resilience – the ability to bounce back, adapt, and grow stronger from adversity.

A resilient mindset isn’t about avoiding obstacles; it’s about developing the mental fortitude and emotional intelligence to confront them head-on, learn from them, and continue moving towards your goals with renewed determination. This article explores practical strategies to cultivate such a mindset for both career setbacks and financial aspirations.

Understanding and Cultivating Resilience

Resilience is the ability to adapt successfully to stress and adversity. It’s not a trait you either have or don’t; it’s a skill set that can be developed and strengthened over time. For career and financial success, resilience involves several key components:

- Self-Awareness: Understanding your emotions, strengths, and weaknesses.

- Emotional Regulation: Managing your reactions to stress and disappointment.

- Optimism: Maintaining a positive outlook, even in difficult situations.

- Problem-Solving: Actively seeking solutions rather than dwelling on problems.

- Support Networks: Leaning on friends, family, and mentors.

Strategies for Building Resilience in Career Setbacks

Career challenges can be devastating, impacting self-worth and future prospects. A resilient mindset helps mitigate these impacts and transforms setbacks into stepping stones.

1. Reframe Challenges as Opportunities

View job loss, project failures, or professional criticisms not as end-points but as detours or learning experiences. Ask yourself: What can I learn from this? How can this experience make me better prepared for the future? This shift in perspective is fundamental to resilience.

2. Learn and Adapt

Every setback offers a lesson. Analyze what went wrong, identify areas for improvement, and adapt your approach. This might mean acquiring new skills, rethinking your career path, or adjusting your communication style. Flexibility and a growth mindset are paramount.

3. Build a Robust Support Network

Connect with mentors, peers, and industry contacts who can offer advice, encouragement, and potentially new opportunities. Sharing your experiences and seeking different perspectives can provide clarity and motivation during tough times.

Achieving Financial Goals with a Resilient Mindset

Financial stability is a cornerstone of overall well-being, and a resilient mindset is critical when facing economic uncertainties or striving for ambitious financial goals.

1. Financial Literacy and Proactive Planning

Understand budgeting, saving, investing, and debt management. The more informed you are, the better equipped you are to make sound decisions and anticipate potential challenges. Create clear, achievable financial goals and a realistic plan to reach them.

2. Build and Maintain an Emergency Fund

A robust emergency fund (3-6 months of living expenses) is your financial safety net. It provides a buffer against unexpected expenses like medical bills, car repairs, or job loss, preventing minor crises from escalating into major financial disasters. Knowing it’s there significantly reduces stress and enhances your ability to weather financial storms.

3. Long-Term Vision, Short-Term Discipline

Keep your ultimate financial goals (retirement, homeownership, education) in mind, but focus on the consistent, disciplined actions required today. Small, consistent steps accumulate over time. When market volatility hits or an unexpected expense arises, your long-term vision helps you stay calm and avoid impulsive, detrimental decisions.

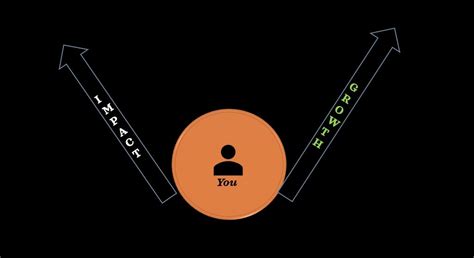

The Synergy Between Career and Financial Resilience

These two pillars of life are deeply interconnected. A resilient career trajectory often leads to greater financial stability, while a strong financial foundation provides the security to take career risks, pursue passions, or recover from professional setbacks more easily.

For instance, having an emergency fund allows you to leave a toxic job, pursue further education, or start a business, which can lead to greater career satisfaction and long-term financial gains. Conversely, a resilient approach to career development, which includes continuous learning and networking, can open doors to higher-paying opportunities and career security, bolstering your financial goals.

Practical Steps to Cultivate Daily Resilience

- Practice Self-Compassion: Be kind to yourself, especially during difficult times. Acknowledge your feelings without judgment.

- Set Realistic Expectations: Understand that progress isn’t always linear. Celebrate small victories and don’t be overly critical of minor setbacks.

- Embrace Mindfulness and Meditation: These practices can help you stay present, reduce stress, and improve emotional regulation.

- Maintain Physical Well-being: Regular exercise, adequate sleep, and a healthy diet significantly impact your mental and emotional resilience.

- Focus on What You Can Control: Redirect your energy towards actionable steps rather than worrying about circumstances beyond your influence.

Conclusion: Your Path to Lasting Resilience

Building a resilient mindset is an ongoing journey, not a destination. It requires consistent effort, self-awareness, and a commitment to personal growth. By consciously adopting strategies for reframing challenges, learning from experiences, building strong support systems, and maintaining financial discipline, you equip yourself with the tools to navigate the inevitable ups and downs of both your career and financial life.

Embrace the process, trust in your ability to adapt, and remember that every setback is an opportunity to forge a stronger, more resilient version of yourself, ready to achieve your most ambitious goals.